Generative AI solutions, e.g., Open.AI/Microsoft’s ChatGPT, Google’s Bard, and Meta’s LLaMA are a generational leap forward from previous AI tools. While previous generations remain highly effective for their specifically trained tasks, they are otherwise limited to “one-trick-ponies.”

Generative AI tools are more versatile and adaptive and capable of performing a wide array of tasks without requiring specific training.

These developments will significantly impact private equity investment strategies, portfolio company productivity, and profitability. Stax has crafted an early view of the near-term implications of generative AI, and we will continue to closely follow these rapidly evolving developments.

The Early Positive Impacts on Organizations

Recent studies at MIT, Microsoft, GitHub, and NBIR highlight the variety of positive impacts that AI can drive on individuals and organizations. And while these cases are for homogenous environments, they demonstrate the real potential that generative AI can already produce today:

Disruptions and Impacts

Generative AI has caused significant real-world disruption as well, notably shifting consumer demand and eliminating present or planned future jobs. Goldman Sachs estimates that AI will impact ~18% of the global workforce, or ~300M jobs. As generative AI eliminates routine, repetitive work, accelerates writing/content creation, and facilitates low/no-code programming, companies will right-size high-wage labor forces and redirect efforts to leverage the efficiencies of generative AI.

In April, Meta made headlines with the announcement of ~4,000 layoffs, mainly within programmer roles. Similarly, Dropbox announced it would lay off ~16% of its workforce, citing a shift towards AI. In May, IBM unveiled a strategic initiative to leverage AI, aiming to automate 30% of back-office jobs within the next 5 years, potentially affecting around 7,800 positions. These developments highlight the growing influence of AI in shaping workforce dynamics.

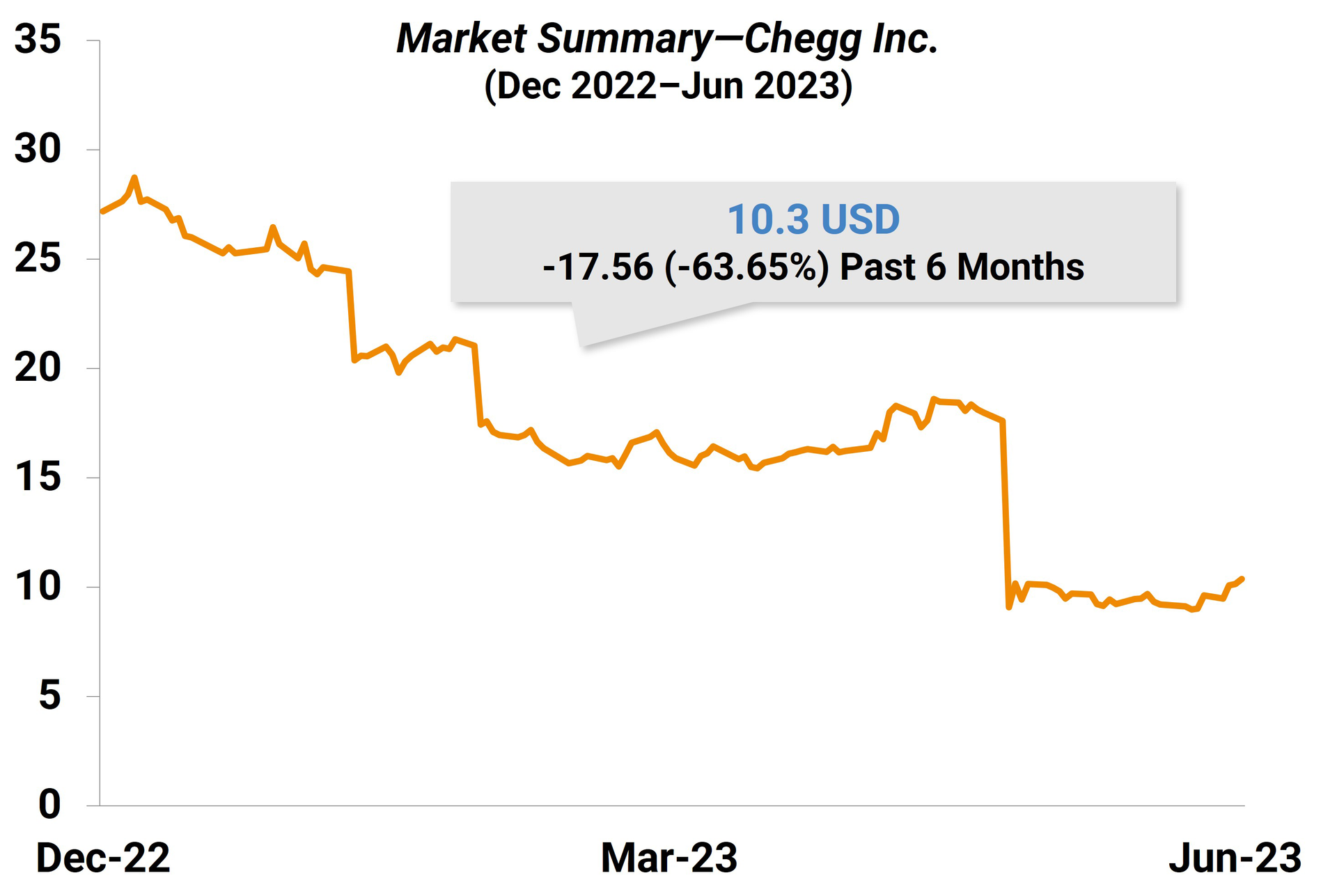

While we are still in the early innings of disruption, failure to mitigate impact (i.e., with action or a clear plan) can prove costly to company valuations, as evidenced by the precipitous fall in education company Chegg’s stock price after ChatGPT disrupted its key value proposition.

Near-Term Predictions

Generative AI’s growth and impact are increasing exponentially. What can we expect in the near future?

Generative AI Usage Will Become Ubiquitous

AI tools have quickly become the fastest-growing tech platform in history. ChatGPT reached 100 million users in just two months, compared to TikTok’s nine months and Instagram’s 2.5 years. Tech giants with extensive reach are pushing generative AI through their applications to enhance their value propositions. For instance, Microsoft’s Office Suite will soon incorporate AI in Outlook, Word, PowerPoint, and Excel.

Though concerns need to be ironed out for many organizations (e.g., legal, security), generative AI will soon become well integrated into everyday work, and its rise has profound implications for private equity. At a minimum, private equity will need to assess the potential downside risk from generative AI as a standard diligence component. Portfolio companies in at-risk sectors should also be assessed, and there are efficiency gain opportunities that can be realized across virtually all sectors.

Generative AI Vendors and Tools Will Become Fragmented

As usage increases, it will also fragment. Companies will seek out various solutions that align with high-value use cases—including foundational models, vertical, or functional-specific solutions, and those fine-tuned on proprietary company data. Generative AI’s reach is not limited to text, but extends into audio, video, music, and 3D-product design.

Ongoing fragmentation will accelerate as new ecosystems develop and more companies experiment with AI to fine-tune their proprietary data. Many companies will claim that they have achieved superior deployments of third-party applications, or that they have fine-tuned a superior version of generative AI based on their proprietary data. Private equity will need to measure and assess the veracity of these claims and the durability of any resulting differentiation.

AI will also become a key part of platform strategies, and a potential differentiator within a sector or broader portfolio. Business owners seeking private equity investment will begin to value sponsors demonstrating a successful track record and expertise in implementing generative AI solutions to help drive profitable growth and successful outcomes. Thus, success in the early innings of disruption will translate to further opportunities and investments.

A Tsunami of Content Will Be Unleashed

The proliferation of generative AI is rapidly reducing the cost of content creation and increasing the amount of content produced, from writing and blogging to YouTube video production. In a recent survey by The Conference Board, 50% of marketing leaders and 42% of communications leaders selected AI content creation as an exciting area of innovation for the next year.

However, AI-generated content is a double-edged sword, as it can lead to an influx of misinformation and disinformation. Microsoft’s 2022 Digital Defense Report identifies malign cyber influence campaigns using synthetic media as a key emerging threat. Recent viral instances of disinformation, such as fake explosions at the Pentagon and Pope Francis wearing a puffy coat, demonstrate how generative AI is already being misused.

For private equity investors, verifying the veracity of content within diligences and as inputs to support firm strategies will become increasingly difficult. Human judgement and validation will continue to prove essential, especially where work is supporting high-stakes investment decisions.

Longstanding Moats Will Evolve

As AI impact progresses, it will disrupt traditional business models and moats. While traditional moats such as scale and distribution will persist, AI’s acceleration of coding and product development will decrease the durability of technology moat-driven differentiators like streamlined workflows, superior ease-of-use, and better integration via APIs.

Newer moats will be more centred on the ability to remain agile and adapt, and to make use of extensive proprietary data. Proprietary data is becoming an invaluable asset and competitive advantage. Salesforce’s rapid development of Einstein GPT, a CRM technology trained on a company’s existing Salesforce Data Cloud data, offers a template for turning existing relationships into new AI-powered moats. For private equity, acquiring companies in part for leverageable proprietary data to fine-tune differentiated models will become a new strategic consideration.

Data Analytics Will Become Democratized

Generative AI also holds near-term potential to democratize data analytics and data science.

Less onerous tasks traditionally undertaken by data scientists (and data engineers/architects) are likely to become viable for non-specialists, leading to dramatic expansions in the capacity for data-driven decision-making across organizations. This transformation will also redefine the role of data scientists, shifting from a siloed model to more of a supporting expert and output verification role. The implication for private equity is clear: even with few data specialists, generative AI can be leveraged to make rapid, data-based decisions and drive growth across portfolios.

Key Takeaways for Private Equity

To-date impacts validate that AI-driven shifts in core value propositions have the potential to create new winners and losers across markets and verticals. Private equity investors should consider the following key factors in diligence:

The strategic advantage of agility will become even more pronounced. Portcos across verticals should evaluate high-value use cases to incorporate generative AI. Additionally, there are likely business unit-specific best practices that can be standardized or at least improved across portfolios (e.g., advertising/ marketing, sales enablement, customer service/support, product design/software coding, HR hiring and training.) PE investors have a unique opportunity to scale the impact of these solutions broadly across portfolio companies and achieve optimal outcomes.

Conclusion

Generative AI marks a paradigm shift with significant early implications for the success of ongoing and future investments. New winners and losers will be defined by their agility, foresight, and courage to seize the opportunity amidst disruption.

As we enter the generative AI era, the journey ahead demands an ally that blends existing market expertise with real-time data, actionable insights and thought partnership. Stax stands ready as a strategic partner to help you navigate disruption and identify opportunities.

“Stax Consulting is a global strategy consulting firm providing actionable, data-driven answers to clients’ critical strategic questions.”

Please visit the firm link to site