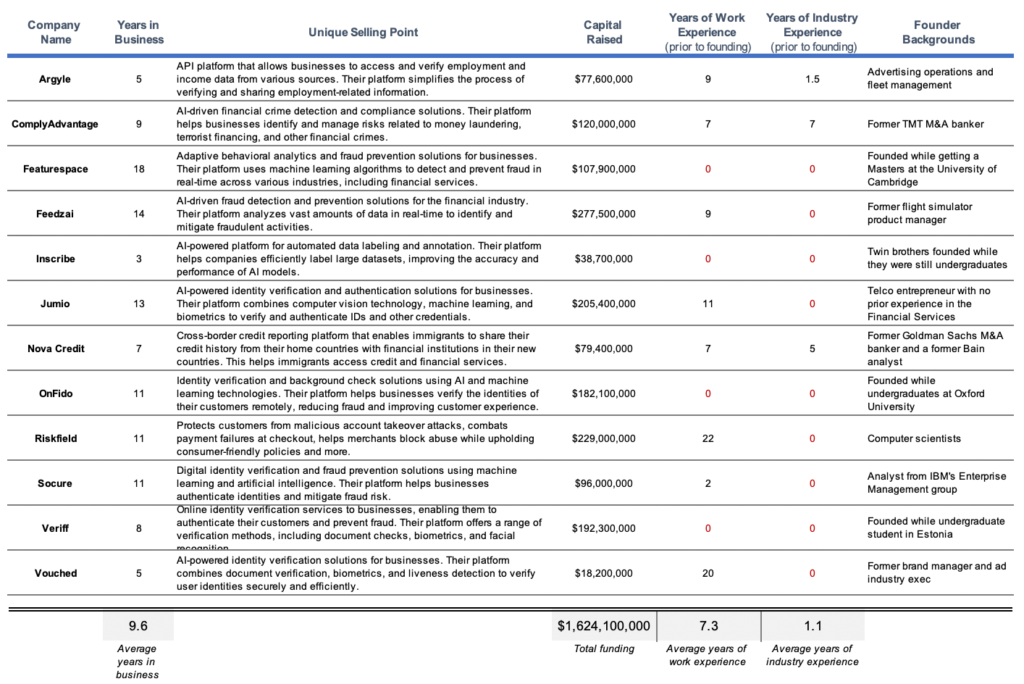

What do a flight simulator product manager, an advertising agency brand manager, a paralegal, and a bunch of undergraduate students have in common? All are founders of disruptive startups that are transforming the financial services industry. And all of them founded these startups with precisely ZERO years of experience in financial services and without any prior expertise on the highly complex and technical business issues their startups’ address.

Despite what, on paper, would appear as incompetence, these individuals have all built companies that have collectively raised over $1.5 billion in venture funding and are trusted by some of the world’s leading financial services firms such as Goldman Sachs, Citibank, HSBC, American Express, and Experian. If you open an account or use a credit card, it’s highly likely one of these startups play a role in your transaction.

Relevant experience – a help or hindrance?

Business leaders have grown accustomed to seeking expertise when hiring for key roles. Recruiters and HR departments constantly stress multiple years of relevant industry experience as the mandatory entry ticket into a high-performing organization. Yet, despite filling its ranks with very highly experienced leaders and experts, nearly every incumbent company in nearly every industry is under pressure from new entrants and startups that are filled with energetic but highly inexperienced staff. Anecdotal examples and decades of research have shown that when it comes to innovation, entrepreneurship and disruption, experience can be a hinderance. Diversity of experience and even some blissful ignorance can be an asset for organizations seeking to innovate…

“When it comes to innovation, entrepreneurship and disruption, experience can be a hinderance“.

Airbnb, founded by two industrial designers and a computer scientist, revolutionized the hospitality industry despite the founders lacking prior experience in the field. Travis Kalanic and Garret Camp had no transportation experience when they founded Uber in 2010. Michael Dubin and Mark Levine worked in marketing and operations respectively before founding Dollar Shave Club. Stephen Korey, founder of Away Luggage, previously worked at Warby Parker and Casper (also companies founded by entrepreneurs with no relevant industry experience). Most famously perhaps, Phil Knight and Bill Bowerman started Nike with zero athletic gear manufacturing experience. While Adidas and Puma were using world-class experts and physiologists to design shoes, Phil and Bill were experimenting with fish skins and pouring polyurethane onto kitchen waffle irons.

The obvious takeaway here is that while none of these founders had any experience in the industry they disrupted, they’ve all gone on to become behemoths in their respective craft, transforming entire industries and forcing the incumbents (filled with world-class experts) to scramble just to keep pace.

Diversity is a critical topic that nearly every company has started to address. However, corporate diversity efforts focus on “inherent diversity” (traits one is born with, such as race, gender, ethnicity, sexual orientation). While the impact of increasing inherent diversity has been unquestionably proven, it’s also been shown that companies that optimize for both inherent diversity AND “acquired diversity” (traits gained from personal experience) are 45% more likely to grow market share and 70% more likely to capture a new market than their peers.

Embracing the generalist mindset

Studies have shown that generalists, not specialists, are often the ones who excel in complex and unpredictable domains. Bain Chairwoman Orit Gadiesh coined the term “Expert Generalist” to speak to this phenomenon. The Expert Generalist is someone who has the ability and curiosity to master and collect expertise in many different disciplines, industries, skills, topics and capabilities. Their ability to draw from diverse experiences and perspectives can lead to breakthrough thinking and unique problem-solving approaches. Founders without industry-specific expertise are unencumbered by the shackles of conventional wisdom, allowing them to explore uncharted territories and question established norms. They bring with them a fresh set of eyes, unburdened by preconceived notions and experience-based biases, and are more likely to challenge the status quo, paving the way for true innovation.

David Epstein speaks to this broadly in his NYT best-selling book ‘Range’. From the summary (and ultimately the thesis and argument of the book):

David Epstein examined the world’s most successful athletes, artists, musicians, inventors, forecasters and scientists. He discovered that in most fields—especially those that are complex and unpredictable—generalists, not specialists, are most likely to excel and deliver greatest impact. Generalists are more creative, more agile, and able to make connections their more specialized peers can’t see. The most impactful inventors cross domains rather than deepening their knowledge in a single area. As experts silo themselves further, people who think broadly and embrace diverse experiences and perspectives will increasingly thrive.

“In most fields—especially those that are complex and unpredictable—generalists, not specialists, are most likely to excel and deliver greatest impact” (David Epstein).

Breaking free from conventional solutions

When we rely solely on experts entrenched in a particular field, we risk perpetuating the same tired solutions. In contrast, founders with limited experience have the audacity to question existing approaches and reimagine what is possible. They are free to experiment, iterate, and find unconventional ways to address complex challenges. By breaking away from the established patterns, these pioneers create space for new ideas to flourish and disrupt stagnant industries. One must not conflate inexperience with incompetence – the two are truly distinct. Inexperience is a lack of data collected that creates cognitive biases, while incompetence is the inability to execute. The founders discussed here are inexperienced but are by no means incompetent. These organizations thrived by executing their strategies with precision, raising significant funding, and developing products and/or services that deliver value to their customers.

The magic of cross-pollination

Inexperience can be a catalyst for cross-pollination of ideas and skills. Founders who hail from diverse backgrounds bring with them a wealth of knowledge and insights from other domains. They seamlessly integrate concepts from seemingly unrelated fields, igniting a spark of innovation that specialists might overlook. By bridging the gap between industries, they introduce fresh perspectives and challenge the boundaries of what is considered possible.

“Inexperience can be a catalyst for cross-pollination of ideas and skills”.

Take the FICO credit score for example. Before Americans had a credit score that determined nearly every financial aspect of their lives, creditworthiness was often determined by subjective measures which were discriminatory in nature and provided an inaccurate picture of a prospective borrower’s creditworthiness. Seeking to utilize data intelligently to develop an objective measure of a potential borrower’s ability to pay back a loan, Bill Fair and Earl Isaac created the Fair Isaac and Company (FICO) scoring system in 1958. Later, the scoring system was released to the three major credit bureaus and remains the objective measure of a person’s creditworthiness in the United States. What’s remarkable about this is that Fair and Isaac had no previous experience in financial services, credit, or any adjacent industries – they were an engineer and a mathematician respectively. They did not approach a problem from thought patterns developed by being in the industry. They were unobscured in their method for conceptualizing a problem and designing a solution – one for which they would conventionally be considered “inexperienced” and “unqualified”. 75 years later, the FICO score was invented by two individuals with no previous relevant experience is the fuel that powers every corner of the lending industry and is relied upon by every consumer and financial institution.

Agility in a dynamic landscape

While we have seen examples of this across nearly every industry, we find that it’s more prevalent in the more niche industries or topics. Looking at the credit risk, fraud and verification areas of financial services showcases this phenomenon in remarkable ways. The fast-paced nature of the industry, and the specific challenges of these highly technical areas, require founders who can quickly learn and evolve alongside rapidly changing technologies and market trends. Inexperienced founders often possess a hunger for knowledge and a willingness to embrace new ideas, unburdened by preconceived limitations. Their ability to pivot and navigate uncharted waters can be a distinct advantage, enabling them to stay ahead of the curve and respond swiftly to emerging challenges.

We looked at a dozen of the leading startups & new entrants in the credit risk space and found some noteworthy patterns:

Companies that are disrupting this space continue to do so with minimal industry and professional experience while garnering significant investment from venture capital.

Despite the lack of relevant experience, these founders have managed to raise billions in venture capital, secure partnerships with industry giants, and process millions of transactions daily for leading financial institutions. Their stories defy conventional wisdom and provide tangible proof that expertise is not always a prerequisite for success. Instead, it is their ability to think differently, be “Expert Generalists”, connect disparate dots, and challenge the status quo that sets them apart.

The virtue of consultants

To innovate and transform, companies must embrace fresh ideas, new perspectives, and cross-industry experiences that challenge the status quo. This is precisely where the virtues of hiring consultants come out. Some may argue that industry-specific expertise is essential, but research suggests that organizations seeking disruptive innovation should prioritize diversity of experience over deep industry knowledge.

When organizations bring in consultants, they introduce a fresh wave of ideas and perspectives that can invigorate stagnant processes and revitalize problem-solving. Consultants, unburdened by preconceived notions and industry-specific biases, can think beyond traditional boundaries. Their objective perspective allows the identification of opportunities and challenges that may have been overlooked by employees immersed in the day-to-day operations.

Consultants with cross-industry experience bring valuable insights from diverse sectors, enabling them to identify relevant patterns, best practices, and innovative solutions that can be adapted to a client’s specific context. By drawing on a wide range of industries, these consultants connect seemingly unrelated dots, inspiring novel approaches that drive sustainable growth.

“Consultants with cross-industry experience bring valuable insights from diverse sectors, enabling them to identify relevant patterns, best practices, and innovative solutions that can be adapted to a client’s specific context”.

Paradoxically, one of the greatest strengths a consultant brings to the table is a certain level of ignorance about an organization’s internal workings. This ignorance frees consultants from the constraints of existing systems, biases, and internal politics, allowing them to challenge established norms and propose disruptive solutions. Their outsider status empowers them to ask difficult questions, uncover hidden inefficiencies, and initiate transformative change that can revitalize organizations. Scientists refer to this as “intellectual humility” and their research shows strong correlations between intellectual humility and quality of decision making.

At Elixirr, we deliberately do not organize our teams by industry practices or functional offerings. For each client, we bring together a diverse group of talented consultants who each offer unique perspectives, original ideas, and creative approaches. Unlike other firms that rehash stale methodologies, rely on rigid frameworks, and implement tried and tested solutions that have been deployed with other similar clients, we only deliver bespoke solutions that are tailored to each client’s challenge. We challenge conventional wisdom because we view our clients’ issues through lenses that are unclouded by the fog of “this is how it’s always been done”.

Our top performers are not the ones who demonstrate mastery of a particular topic but ones who demonstrate a growth mindset. The value we bring to clients and our differentiator is not merely experience, it’s our ability to execute and produce results. This is how we deliver unmatched impact for our clients.

Key takeaways

While experience undoubtedly holds value in many contexts, credit risk, fraud, verification, KYC, and AML, is just one small area of the financial services industry that demonstrates how inexperience can be a potent catalyst for innovation. As senior executives across all industries seek to transform, they must look beyond their preconceived biases towards experience, and instead search for fresh perspectives from those whose creativity is not clouded by what they already know.

By embracing the generalist mindset, breaking free from conventional solutions, fostering cross-pollination, and leveraging agility, founders with little to no industry-specific experience have disrupted established norms and reshaped their respective domains. As we navigate an increasingly complex and rapidly evolving business and economic environment, let us remember the untapped potential that lies within inexperience and the remarkable transformations it can bring forth.

Steve Jobs, upon his return to Apple, launched the Think Different campaign in 1997, which highlighted the need for the world to embrace creativity and original thought. The TV and print ads said…

‘The ones who see things differently.

They’re not fond of rules.

And they have no respect for the status quo.

You can quote them, disagree with them, glorify or vilify them.

About the only thing you can’t do is ignore them.

Because they change things.

They push the human race forward.

While some may see them as the crazy ones, we see genius.

Because the people who are crazy enough to think

they can change the world, are the ones who do’.

To some, hiring an executive with little domain expertise into a critical role may be too risky. To others, it’s just the spark needed to drive meaningful change, bring fresh innovation, and deliver substantial growth. Innovation, disruption and transformation all require taking risks. Hiring solely based on experience may reduce some risk but it can also kill any hope for disruption.

“We help senior business leaders turn ideas into actions. Of course, it’s execution that determines success; that’s why we also make change happen, treating our clients’ business like our own.

Our people make our firm. And while our team expands across the globe, we continue to attract the best talent in the industry, building a team of high performing, like-minded individuals who share our vision of building the best consulting firm in the world.

With the launch of our ESPP scheme in 2021, we gave our entire team the opportunity to be part owners of Elixirr — and with a 74% enrolment rate for 2022, entrepreneurialism has never been more embedded into our business.”

Please visit the firm link to site