Cash savings are a simple way to hold your wealth and you can easily access the funds whenever you need them. You may also generate interest over time, and you typically don’t assume the same level of risk that you do when investing.

As such, you may think that cash savings are a “safe” and low-risk option. However, that is not necessarily the case, particularly during a period of high inflation.

Stories of rising prices and record levels of inflation continue to dominate the headlines and many people face increased living costs.

Unfortunately, inflation could affect your cash savings too because, when the interest that you generate on your savings is lower than the rate of inflation, your money loses value in real terms.

As a result, your wealth may not be as safe as you think if you leave it in a cash savings account.

Recent figures from Standard Life show just how significant the effect of inflation on your savings could be, and why you may want to consider ways to protect your wealth.

Inflation was 8.7% in the 12 months to May 2023

According to the Office for National Statistics (ONS), inflation was 8.7% in the 12 months to May 2023.

Over the last few years, rising energy, food and travel costs may have put more pressure on your regular income, and high inflation could be eroding the value of your cash savings too.

This is because savings account interest rates are not keeping up with inflation. For instance, the best easy-access savings interest rate, according to Moneyfacts is currently 4.35%.

Effectively, this means that your savings grow slower than the cost of goods and services, so the purchasing power of your savings is reduced.

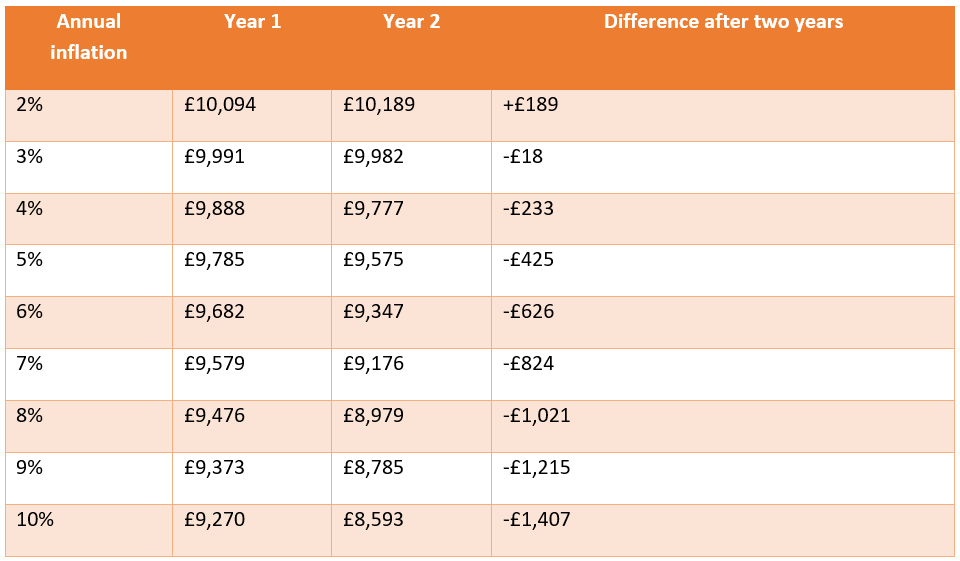

The purchasing power of £10,000 could drop to £8,593 after 2 years of inflation

The new study from Standard Life demonstrates what can happen to the purchasing power of your wealth if the rate of inflation is significantly higher than the interest rate on your savings account.

According to their calculations, £10,000 earning 3% interest would effectively be worth £8,593 after two years, assuming that inflation was 10%.

Conversely, if inflation was 2% – the Bank of England’s current target for inflation – that same £10,000 would be worth £10,189 in real terms, after two years.

The following table demonstrates how different levels of inflation could affect the real value of your cash savings – based on £10,000 in a savings account with an interest rate of 3%.

Source: Standard Life

As you can see, when inflation is high, it only takes a few years before your savings begin to significantly drop in real-terms value. Consequently, cash savings may be useful for short- to medium-term goals but you may want to avoid holding cash for extended periods of time.

Additionally, it could be useful to consider ways to counteract the effects of inflation and protect your wealth.

3 ways to tackle the effect of sustained inflation on cash savings

1. Consider investing

If you want to give your wealth the best chance of maintaining its real-terms value, you need it to grow in line with, or faster, than the rate of inflation.

Currently, savings accounts may not help you achieve this because the interest rates are too low. Investments, on the other hand, typically perform better than cash savings and provide the potential for growth that beats inflation.

Indeed, historical data reported by IG shows that the annualised returns on UK stocks were 4.9% higher than the rate of inflation in the last 119 years.

So, even though the returns on investments fluctuate year on year, and there are no guarantees about performance, there is a good chance that your returns could be higher than the interest on a cash savings account and the rate of inflation.

That said, it is important to consider your own attitude to risk and do due diligence on any investments before making a decision.

2. Make sure your savings are tax-efficient

Finding ways to make your savings more tax-efficient could help you retain more of your wealth and counteract the effects of inflation, to some extent.

Luckily, there are several ways you can potentially do this.

Increasing your pension contributions, for example, may be more useful than paying into a savings account as you benefit from tax relief at your marginal rate. In practice, as a basic-rate taxpayer you only pay £80 for a £100 contribution, for instance.

Additionally, your employer may match your increased contributions and your pension provider will likely invest the funds, so they could grow faster than the rate of inflation.

Paying into an ISA is another way to potentially reduce your tax burden as you do not pay Capital Gains Tax (CGT) or Income Tax on any interest or investment returns.

You can pay up to £20,000 into an ISA each year (in the 2023/2024 tax year), so you may want to consider making use of the full allowance where possible.

3. Revisit your financial plan

When prices are rising, it is likely that your outgoings will increase. The real-terms value of your cash savings may drop too, meaning that it could be more difficult to reach your financial goals.

As a result, now may be a good time to speak with your financial planner and revisit your plan.

You may want to consider your short- to medium-term goals and how much wealth you realistically need to hold in cash savings. If you can reduce the amount of cash you have and invest some of those funds, while still meeting short-term goals, you may not feel the effects of inflation quite so much.

Moreover, you may need to rethink some of your long-term savings and investment goals as they could take longer to reach when your living expenses are higher.

Fortunately, if you discuss this with your financial planner you can adjust your plan, so you are able to continue working towards your goals even during times of turmoil.

Get in touch

If you are concerned about how high inflation could affect your wealth, we are here to help.

Email enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100 for more information today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

The post 3 ways to tackle the effect of sustained inflation on cash savings appeared first on Black Swan Financial Planning.

“Black Swan Financial Planning was established in 2000, and since then became one of the top independent financial adviser firms in the UK.”

Please visit the firm link to site