With rising geopolitical tensions and urgent global challenges such as the climate and digital transitions, Europe needs to bolster its resilience to shocks and invest strategically. In order to achieve this, we need to work together, as a more integrated Europe is better positioned to realize shared goals in a fragmented global economy.

Central to this strategy is the creation of an integrated European capital market — a vision set out by the European Commission in 2015, and commonly known as the capital markets union (CMU).

A fully functioning CMU would both enhance Europe’s economic structure and benefit the euro area. It would do this in three main ways:

It would allow us to reap the benefits of euro area-wide capital markets, and facilitate greater risk-sharing across member countries. At present, barriers between national markets are deterring cross-border investment, leaving European firms and households largely reliant on national funding, as well as overly exposed to domestic economic shocks. By eliminating these barriers, the CMU would help investment flow across the euro area, which would diversify risk and mitigate the effects of local shocks.

There is also a pressing need for the CMU to complement traditional banking channels in financing the innovation vital for Europe’s future growth — notably in the energy and technology sectors. Equity funding and specialized forms of investment, such as venture capital, are typically more suitable than debt funding for the financing of innovation, since such projects often involve high levels of risk and uncertain returns, making it difficult to commit to regular debt repayments.

Finally, a fully functioning CMU would be beneficial for the implementation of the European Central Bank’s (ECB) monetary policy. By fostering deep, liquid and integrated capital markets, the CMU would support the timely, smooth and even transmission of monetary policy to firms and households.

Since the Commission launched its CMU action plan in 2015, progress has been made. For example, the European Union has adopted legislation to develop EU securitization markets, and thereby enhance firms’ access to funding. It has also further harmonized prudential rules for investment firms, and eased investment conditions for European venture capital to promote risk capital funding.

Additional steps are also being taken under the 2020 CMU action plan to simplify the rules for the public listing of EU companies, harmonize national insolvency regimes and address issues related to the taxation of financial instruments, which hamper cross-border investment and make equity funding less attractive than debt financing.

But despite this progress, the results are not yet satisfactory. Europe’s capital market remains fragmented across national borders, and ECB analysis shows that financial integration in Europe is still much lower than before the global financial crisis.

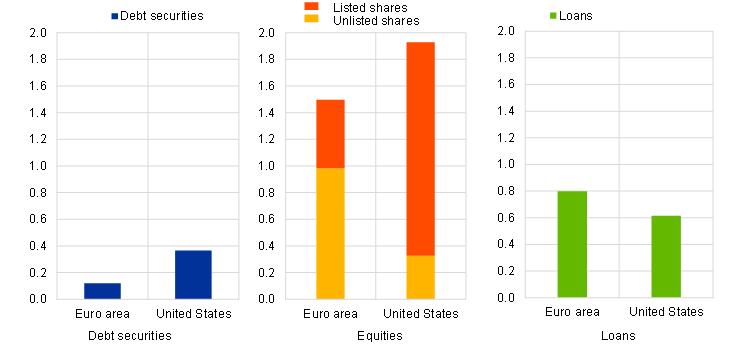

Moreover, Europe’s capital markets are less developed than those of other advanced economies. In the euro area, bond markets as a percentage of GDP are three times smaller than in the United States. And although equity represents firms’ main source of funding in both jurisdictions, in the euro area it is mainly unlisted, while in the U.S. most equity is listed, opening firms up to a greater pool of potential investors.

Chart 1

Sources of external financing of non-financial corporations in the euro area and the United States

(2022; ratio to GDP)

Sources: ECB (euro area accounts); OECD and ECB calculations.

Still, Europe does have a prominent role in certain market segments, such as the green bond sector. But the market for green bonds remains niche, representing less than 3 percent of the global bond market. Moreover, as the green transition accelerates, Europe’s “green advantage” might fade if we don’t make progress with the CMU. For example, venture capital activity, shown to be pivotal for funding green innovation and decarbonization, remains limited in the euro area. And there are signs that Europe’s green bond market is becoming increasingly fragmented, pointing to a lack of common standards and obstacles to cross-border investment.

All of this suggests that simply addressing specific barriers to market integration may not be sufficient to establish a genuine CMU. We must keep our eyes on the broader picture, and there are two critical blind spots in the development of a genuine CMU.

The first is the lack of a permanent European safe asset.

Historically, mature capital markets have been built around a public safe asset. In the U.S., for example, capital markets developed alongside the issuance of federal bonds.

A risk-free benchmark is necessary for critical financial activities. It would enable better pricing of risky financial products, such as corporate bonds or derivatives, encouraging the development of such products. It would provide a common form of collateral that would promote centralized clearing activity and cross-border collateralized trading in interbank markets. It would also help diversify bank and non-bank exposure. And it would support the euro’s international role, helping to attract foreign investors.

Establishing such a permanent European safe asset would be a game changer, but it hinges on Europe having a standing fiscal capacity with a borrowing function. Without that, building a deep and competitive CMU will prove much more difficult.

The second blind spot is the lack of a complete banking union, which restricts European banks to operating in one or just a few national markets.

Banks play a crucial role in the functioning of all major capital markets. They operate — and often have a leading role — in crucial segments like asset management, bond underwriting and trading, initial public offerings and financial advice. They are active traders in securities markets and often provide market-making services. Thus, it is difficult to envisage a genuine CMU without the key players being able to operate throughout the euro area.

The global landscape is evolving rapidly, and Europe must keep pace, if not lead, that change. To be successful, it needs a genuine — and complete — CMU.

“The European Central Bank is the prime component of the Eurosystem and the European System of Central Banks as well as one of seven institutions of the European Union. It is one of the world’s most important central banks.”

Please visit the firm link to site