In private, talent operating partners are frustrated with investment teams lack of understanding about organizations. Likewise, investment managers are frustrated that they can’t find the right executive talent fast enough. Frictions have spiked with economic headwinds increasing pressure to deliver operational improvements.

These tensions are an inevitable aspect of the “Third Wave” in private equity, as the focus shifts from leverage and simple operational improvements to complex organisational drivers of value growth. Mutual understanding is the foundation for effective collaboration. And, understanding the root cause of the friction between deal and talent operating teams is a first step.

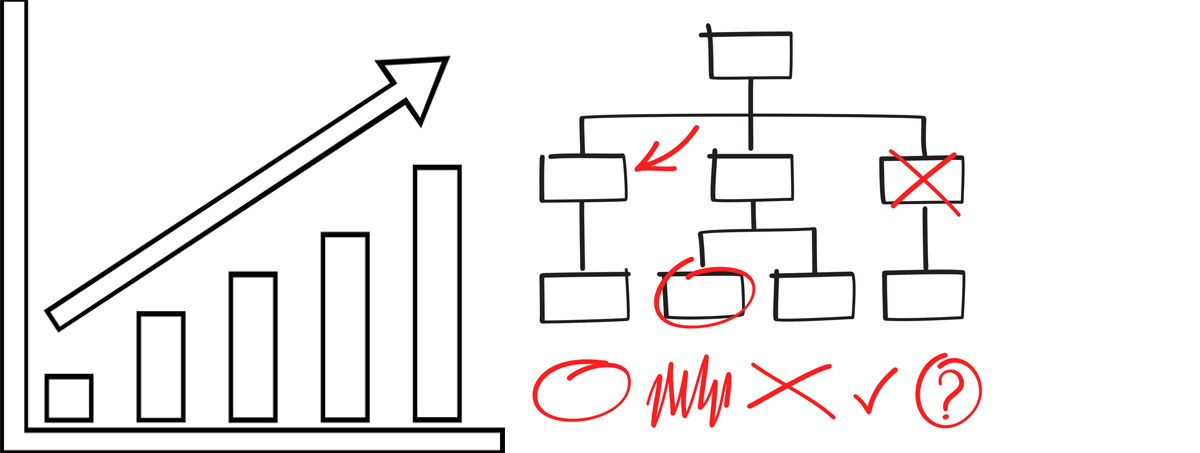

Deal makers are conditioned to analyse financially relevant hard-facts including revenues, costs and profit – making assumptions about these factors which are modelled in a discounted cash flow estimate of value. Although markets can achieve break-out growth, modelling financial performance is pretty simple. Cost-volume-profit models are inherently “linear” approximations, with fixed and variable costs driving profits based on sales volume. There are only few variables, and the relationships between them are linear.

The performance of organizational systems and people is NOT linear. The collective ability to make and execute the right decisions enables realization of the value creation plan. However, this process can be severely impaired by subtle organizational derailers that are impossible to pin-point from the board, or even by senior management. There are a vast number of diverse enabling/disabling factors. And, organisations are only as good as their weakest link. So, a missing vision, poor CEO communications, micro-management in a key function, a lack of a CRM or thousands of other potential issues can cripple organisational performance and delay full-potential plan implementation. The relationship between org derailers (drivers) and performance is anything but linear.

We rely on CEO’s and leadership teams to manage their organizational systems, identify, and improve the weakest links. So it’s logical that when implementation starts to wobble, management is thrown out and new managers are brought in. But this is often “throwing the baby out with the bath water”. New management may not bring the competencies to resolve specific bottlenecks. And, there is always a delay and loss of knowledge when making a management change. It’s far less risky and faster to pin-point the specific derailers and help the existing management to resolve them.

Embracing organizational effectiveness as a value driver has great potential for private equity. However, realizing it will demand greater mutual understanding between deal teams and talent operating partners. Deal partners need to learn that organizational systems are far more complex than financial models a short check list. And talent operating partners have to learn how to empirically connect diverse organizational performance drivers to valuation models.

Humatica

Please visit the firm link to site