Long-term financial services solutions for a pervasive financial problem

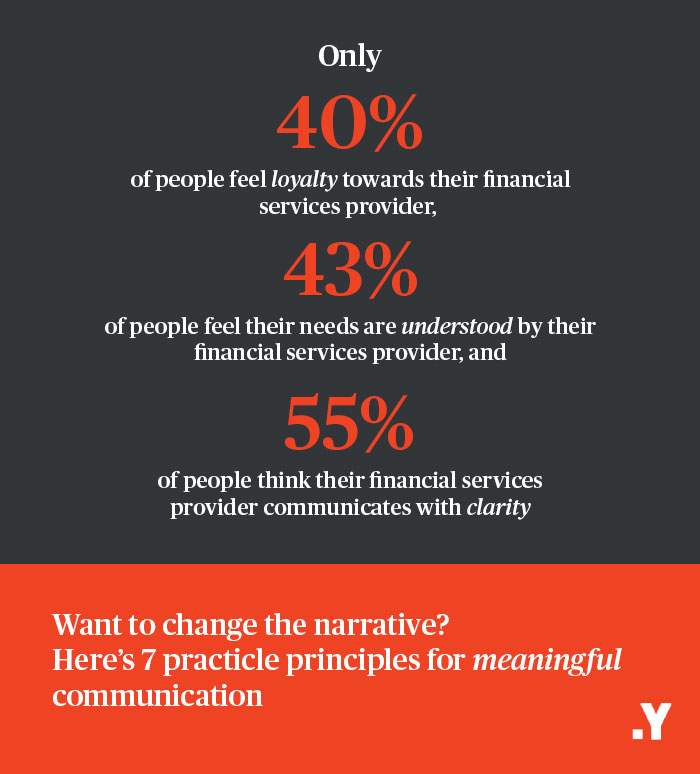

With money talk at the top of the agenda, striking the right tone is paramount to the financial future of businesses – as well as their customers. With just over half of customers (52%) believing their financial provider hits the mark when communicating with them, plus the many people now experiencing increasing degrees of financial strife, the way financial services providers engage with audiences can be the make or break in more ways than one. Effective customer communication is essentially a legislative and moral obligation that should increase both loyalty and trust. Here’s how.

Empathy now essential to FCA compliance

Good communication should “focus on supporting and empowering customers to make good financial decisions” – a requirement outlined by the Financial Conduct Authority (FCA) in a new Consumer Duty that came into force in July 2023. The FCA Consumer Duty outlines clear need for higher standards of consumer protection through a fairer and more transparent approach, especially when catering for the growing number of vulnerable audiences.

With less than half of people (43%*) believing their needs are truly understood by their financial services provider and only 51% citing their provider is transparent, the need for a shift in service provision and communication has never been more prevalent. With this in mind, what tangible steps can your business take to strike the right tone?

Seven practical principles for meaningful communication

Finding the right words is just one piece of the puzzle when it comes to getting money talk right. More is needed to support financial services providers if they are to truly support their customers. The following principles can guide tangible action.

- Put people before products. With 57% of people saying their needs are not met by their financial services providers, it’s worth considering if your products and services actually align what customers truly need or want from you. Let their feedback, struggles and aspirations guide your offering so you can deliver meaningful services.

- Be transparent. Cut the jargon. Only 55% of customers believe their financial services providers communicate with clarity so talk to yours as real people dealing with real issues. Where possible, strike a balance between approachable and authoritative – they want to understand you and trust you with their money.

- Trust and transparency go hand in hand. When talking about products and services, do your research to understand what your customers want to know the most, and how they’re likely to feel when you talk about it. This goes a long way to building trust, which isn’t to be taken for granted when you consider that only 40% of people feel a sense of loyalty towards their financial services provider – with an even lower 37% citing the same in the 45-54 age band.

- Carefully consider your point of view. Around a third of people (32%) say their financial services provider should have a point of view on socioeconomic issues. So should you be speaking out about certain issues? Or using social media to reach out to customers? Whichever approach you choose, make sure your positioning is authentic and not overstepping. Too much controversy or intrusion can break trust.

- Practice empathy. Get insight into customers’ day-to-day money management. Speak to those real-life experiences in language they can understand and relate to. Communicate in ways that are sensitive to the delicacy of their situation.

- Be inclusive. Do you have clear sight of your audience demographic? Are you tracking the ways market segments are changing as a result of the cost of living crisis? With just under half of those surveyed (49%) saying they feel protected by their financial services provider, it’s worth considering that more of your audience may be more vulnerable than you realise.

- Stay current with market trends. Especially those that impact your audience. Consider how your customers might be feeling as a result of high interest rates, for example, and adapt your tone accordingly.

Impactful customer engagement delivers competitive advantage

Putting your business at the heart of your customers’ lives is pivotal to the long-term growth and success of your business. Applying the above principles effectively requires a three-pronged approach that allows you to fully respond and adapt to a challenged and ever-changing customer landscape.

- Understanding the customer. Deep customer insight and comms testing clarifies what audiences what to hear, what’s working and what’s not, which also ensures FCA compliance.

- Understand the market. Research provides an understanding of how competitors are communicating so you can identify emergent opportunities and white space.

- Understanding where your business fits. Customers often can’t tell you specifically what they want, which means they can’t tell you what to do about it. That’s why it’s so important to understand where they are in their lives, what they’re struggling with and striving for – so you can situate your business right at the heart of their day-to-day and let them decide what you should do next.

Driven by customers, not just centred around them

A ‘customer-centric’ approach has value, but that value is limited. When you approach customers to test a new product or get feedback on an existing service, you could be missing a trick. Why? Because this approach is fundamentally driven by business agenda.

Conversely, if you go out to customers with the sole intent of getting to know them as people, you have an opportunity to understand where you fit into the picture of their lives. They may not be able to articulate a specific need for a specific product, yet could talk to you about budgeting struggles, which could inform your next product launch.

For your communications strategy to be meaningful and impactful, it needs to be two-way. Make sure it is driven by the true needs, desires and lifestyles of your audience – then respond to these with goal-oriented communication that makes it easy for them to understand how they can reach their desired outcomes.

In turn, this informs a business strategy that paves the way for your future, not to mention delivering solutions customers didn’t even know they needed to secure their own financial future. This customer-driven approach is what’s needed now, more than ever. It allows you to be proactive rather than reactive in the way you continuously evolve and transform your business. So, where do you begin? Find out makes your audience tick – and let us help you.

“Yonder is a consulting firm that helps clients to unlock opportunity and deliver business impact.”

Please visit the firm link to site