Banks are talking more about the environment. But does such talk go hand in hand with greener lending? The ECB Blog finds a disconnect: banks talking more about their environmental policies and goals tend to lend more to brown industries.

Banks have a crucial role to play in financing the transition to a greener economy. In light of increased concerns about sustainable finance, supervisory authorities and investors closely monitor banks’ environmental disclosures.[1] This blog zooms in on a critical question: do banks that seemingly put more emphasis on the environment engage in greener lending? Not so much, our research suggests.[2] Even more, the findings shine a light on a serious disconnect: banks which portray themselves as more environmentally conscious lend more than others to brown industries.

By Mariassunta Giannetti, Martina Jasova, Maria Loumioti, Caterina Mendicino

What banks say vs. how they act

Banks commonly convey information on their environmental initiatives and policies to stakeholders using investor reports.[3] For our findings we use granular loan data from the Anacredit database and combine it with textual analysis of those reports. Our research digs into environmental disclosures of the Eurozone’s 101 systemically relevant banking groups[4]: 1,397 investor reports and releases from banks’ websites for the years 2014 to 2020. We identified repeating patterns in the words and phrases that banks commonly use to portray their environmental profile and built a dictionary of keywords. We find banks typically discuss their climate footprint in the context of “finance” activities and “loan” decisions to portray their active contribution to a sustainable economy. Occasionally, banks also discuss other aspects of their environmental activities, for instance their direct emissions. Chart 1 reports the words that banks employ most frequently in sentences with at least one environmental disclosure keyword.

Chart 1

Word Cloud of Environmental Disclosure Content

The figure presents the cloud of words identified in sentences with at least one environmental disclosure keyword of our dictionary in banks’ reports over the 2014-2020 period. Terms are assigned a font size proportional to their frequency in the corpus of reports.

Source: Giannetti, Jasova, Loumioti, Mendicino (2023)

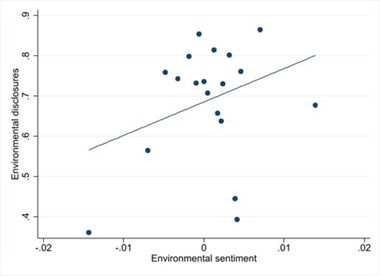

We find that our measure of banks’ environmental disclosures increases over the sample period by about 27%. This is in line with the increasing focus on climate topics. Banks with more extensive environmental disclosures tend to discuss environmental issues with positive sentiment or tone (Chart 2). The tone of disclosures reveals banks’ attitude towards the environment. If, for instance, banks are optimistic about the impact they have on the environment or the importance of financing the transition to a greener economy, their disclosures would tend to have positive sentiment. In contrast, discussions about negative financial and environmental consequences of climate risks, would have negative sentiment. Our keywords thus mainly capture the extent to which banks showcase their environmental consciousness and to a lesser extent discussions about climate risk.

Chart 2

Environmental Disclosures Volume and Sentiment

The figure presents the scatter plot depicting the relationship between the baseline measure of banks’ environmental disclosures and our measure of the environmental disclosures’ sentiment.

Sources: Giannetti, Jasova, Loumioti, Mendicino (2023)

Note: Results are based on Eurozone 101 systemically important banking groups.

Environmental disclosures (vertical axis) are defined as the ratio of environmental-information related keywords in a bank’s documents reported over a year to the total number of words in these documents. The number of observations of Environmental disclosures is 3,365 and the mean value is about 1.12%, i.e. a small value by construction because banks use disclosures to report about many topics, including financial performance.

Environmental sentiment (horizontal axis) is constructed conditioning on proximity of our environmental keywords to positive and negative words, identified using Loughran and McDonald’s (2011) dictionary of words related to sentiment in financial texts. More positive values mean more positive tone.

The scatter plot presents averages for the data sorted into 20 bins based on environmental sentiment.

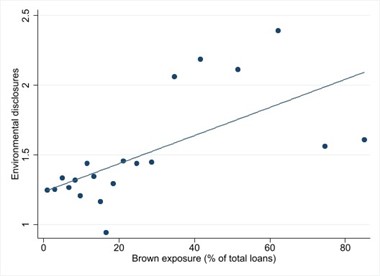

Which banks put more emphasis on their environmental goals? To address this question, we link the volume of environmental disclosures to granular bank loan data and other financial information.[5] We find that banks with more extensive environmental disclosures are also more likely to adopt sustainability reporting standards. Looking at the loan data we find that these same banks tend to be specialised in extending loans to brown industries (Chart 3). This is consistent with the hypothesis that banks with greater exposure to brown industries are under greater pressure to disclose their environmental strategies and plans for decarbonisation. The amount of environmental disclosure correlates also with higher environmental ratings, provided by external rating agencies. This observation supports the conclusion that our measure capture banks’ attempt to portray themselves as environmentally conscious.

Chart 3

Environmental Disclosures and Banks’Exposure to Brown Industries

The figure presents the relationship between banks’ environmental disclosures and their ex-ante exposure to brown borrowers.

Sources: Giannetti, Jasova, Loumioti, Mendicino (2023)

Note: Note: The scatter plot displays a bin scatter plot for the lagged share of the bank’s lending to brown borrowers as a proportion of total credit outstanding (Brown exposure) and the continuous variable of the bank’s environmental exposure. It presents averages for the data sorted into 20 bins based brown exposures.

Note: Results are based on Eurozone 101 systemically important banking groups.

Environmental disclosures (vertical axis) are defined as the ratio of environmental-information related keywords in a bank’s documents reported over a year to the total number of words in these documents. The number of observations of Environmental disclosures is 3,365 and the mean value is about 1.12%, i.e. a small value by construction because banks use disclosures to report about many topics including financial performance.

Brown exposure (horizontal axis) is constructed as the lagged share of the bank’s lending to brown borrowers as a proportion of total credit outstanding (Brown exposure). More positive values mean larger share of loans in the past.

The scatter plot present averages for the data sorted into 20 bins based on brown exposures.

Are banks helping brown industries get greener?

High environmental-disclosure banks extend more credit to brown industries. On average, these banks extend about 4% more (new) loans to firms in brown industries compared to other banks.[6] This effect is stronger after the Paris Agreement, when pressure for environmental stewardship increased. This is especially true for new lending to smaller borrowers, which is not observable to investors and stakeholders. The lending policies of banks with more environmental disclosures would not indicate greenwashing if these banks financed the transition of brown borrowers to lower emission technologies. But we find that firms with a larger carbon footprint that obtain loans from banks with more extensive environmental disclosures do not end up decreasing their emissions or commit to voluntary emission targets. Strikingly, these banks also show a reluctance to lend to young firms in brown industries – firms that could potentially drive innovation in cleaner technologies. And, more broadly, these banks hesitate to lend to high-emission firms which can support green innovation through research and development spending. In essence, the stark revelation of our research lies in the discrepancy about how banks talk about environmental intentions and how they lend.

Our research suggests that the discrepancies between banks’ environmental disclosures and their lending practices arise because banks are reluctant to disrupt established lending relationships with larger carbon footprint borrowers. If borrowers in brown industries are unprofitable and lack alternative financing options, banks may prefer to renew their loans to keep the borrowers in business and to avoid realizing losses on their balance sheets. Banks with high environmental disclosure, indeed, tend to lend not only to brown borrowers with whom they have exclusive relationships, but also to those with limited financing options and who would be in distress if their banking relationship were terminated. The latter are also unlikely to have the operational and financial capacity to switch to greener technologies.

European leaders are increasingly recognizing that climate change is a major and urgent threat to our economies. The green transition of our economies is an answer to this and banks could be playing a crucial role. Currently banks do not have incentives to report their environmental policies in a way that reflects their lending policies because their disclosures have little or no effect on their reputation Greater transparency and standardisation of sustainability disclosures would decrease the disconnect we highlight in this blog. In this respect, the ECB’s effort in improving the quality of information of banks’ environmental disclosures is vital.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

“The European Central Bank is the prime component of the Eurosystem and the European System of Central Banks as well as one of seven institutions of the European Union. It is one of the world’s most important central banks.”

Please visit the firm link to site