It has been an exciting year for Europe’s banking industry. Major central banks such as the ECB and the Bank of England continued to hike interest rates rapidly, to levels not seen since at least the financial crisis. This has led to wider interest margins and boosted the sector’s most important source of revenue, net interest income, by a staggering 26% yoy in the first three quarters of the year (using the 20 leading institutions as a proxy). It is unlikely that this picture changes materially when banks report full-year results in the next weeks and months. However, this success comes after a double-digit decline in net interest income during the previous decade, which had weighed heavily on the banking system. It also outshines a relatively feeble performance in fees and commissions, which only stagnated yoy. Part of the reason was the continued slowdown in capital market activity where momentum faded further after two very strong years during the pandemic. Globally within core investment banking, M&A and syndicated lending were especially weak in 2023, whereas equity and bond issuance edged up slightly but remained on a low level. Trading volumes were down yoy in equities and broadly stable in fixed income. Nevertheless, large European banks’ trading income, the smallest of the major revenue components, rose 30% in the first nine months of 2023. Bottom line, total income jumped by 13%.

But this is only part of the story. Cost management remained in focus, despite administrative expenses up by 8%. Of course, inflation played a role for banks as well, as did the merger of the two largest Swiss institutions. Nevertheless, there were a handful of banks which even achieved nominal cost reductions compared to the prior-year period. As a consequence, the cost-income ratio fell further, to just 53% on average (-6 pp yoy), with the median (49%) below the symbolically important 50% mark.

Furthermore, asset quality stayed more robust than could have been expected given the weak macroeconomic performance not just in 2023, but also the years before. There were a lot of headwinds for borrowers, i.e. companies and private households: the pandemic, the energy crisis, inflation and essential economic stagnation in Europe over the past year – with the surge in financing costs coming on top. Still, non-performing loan ratios in all the major markets (France, Germany, UK, Italy and Spain) have barely ticked up. Ranging between below 1% and less than 4%, they remain essentially at the lowest level since at least before the financial crisis. The impressive resilience of the real economy has allowed banks to keep loan loss provisions fairly limited. They grew in 2022 from record lows, but in the first nine months of 2023 declined again by 5% yoy.

All in all, banks’ profitability has surged. Net income jumped 52% yoy and in the full year will probably have reached the highest figure ever, at least in absolute, not inflation-adjusted terms. This even excludes one-off book gains due to the Swiss bank merger (whose distortionary effects have been eliminated elsewhere, too). The average, unweighted post-tax return on equity climbed 5 pp to 13% and thus comfortably exceeds banks’ cost of capital. It is also on eye level with the US banking system.

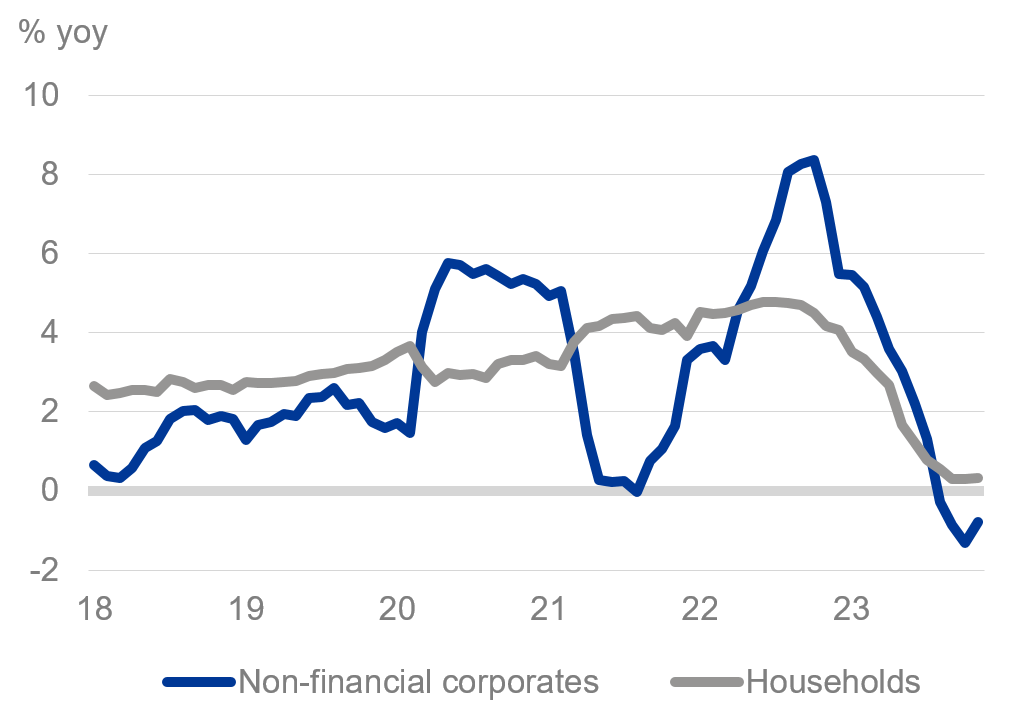

The current strength comes in spite of not only weakness in the investment banking business, but also a collapse in loan growth with the private sector. In the euro area, the slowdown looks dramatic: on a yoy basis, loans to non-financial firms were expanding by more than 8% about a year ago and are now contracting by 0.8%. Similarly, outstanding loans to households were up 4 ½% back then and are currently almost flat (+0.3%). The meagre state of the real economy and, above all, the interest rate burden have diminished the appetite for credit. However, volumes are not really declining. Instead, they have essentially plateaued and are meandering around their peak level. This follows a major increase in recent years. Since the start of 2018, both corporate and retail loans have grown by 19% in total. Hence, taking a breather does not need to sound the alarm bells yet.

Balance sheets on aggregate have shrunk by 6% over the past 12 months for the major banks. By contrast, total equity rose by 5%, even though banks have returned exceptionally large sums of money to their owners, via both dividends and share buybacks. Likewise, capital ratios rebounded after they had dipped a year ago. The CET1 ratio reached 14.5% (+1 pp yoy) on average, also because of a 2% decrease in risk-weighted assets. The leverage ratio climbed to 5.1% (+0.5 pp). Both figures are close to an all-time high. The LCR slipped a moderate 4 pp to 155% as banks repaid TLTRO funds to the ECB.

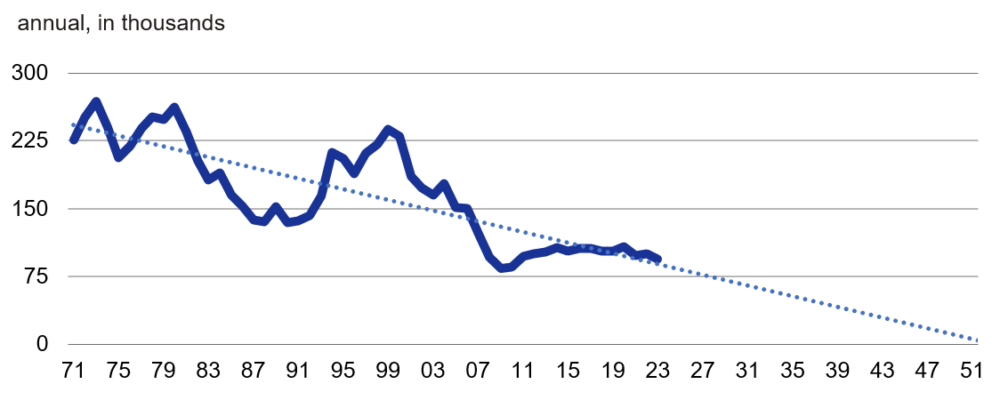

What’s next? First, this remarkable set of results is awaiting confirmation for the full year 2023. Second, base effects will make it much more difficult for banks to beat those numbers in 2024. Third, headwinds are likely to gain strength and the tailwind from recent rate hikes may wane. Loan losses could still increase, given the EMU economy should continue to stagnate this year (GDP: +0.2% expected) and the elevated funding costs keep creeping into borrowers’ calculations. For the same reasons, lending will probably stay anaemic. Upside could come if capital markets regain momentum after the cyclical downturn over the past two years. Finally, central banks could start cutting interest rates from spring onwards. Timing and extent of this are uncertain, which is all the more true for the combined impact on banks’ interest margin, customer demand for credit, and asset quality. Overall, the revenue environment and sector profitability may remain strong although further improvements will become more challenging.

Deutsche Bank AG

Please visit the firm link to site