Though many customers value paying only for what they consume in usage-based pricing, that flexibility also makes it very difficult to predict how much of your product they’ll use. Accurately predicting usage—and therefore cost—is a major sticking point for buyers of usage-based software. We’ve heard from plenty of leaders who opt to build instead of buy because it makes it significantly easier to forecast their costs.

The good news is that, as a vendor, there are measures you can take to help your customers predict their usage. But as your company scales and you revise your pricing structures—when you introduce new products, for instance, or enter a new market—those measures will likely need to shift.

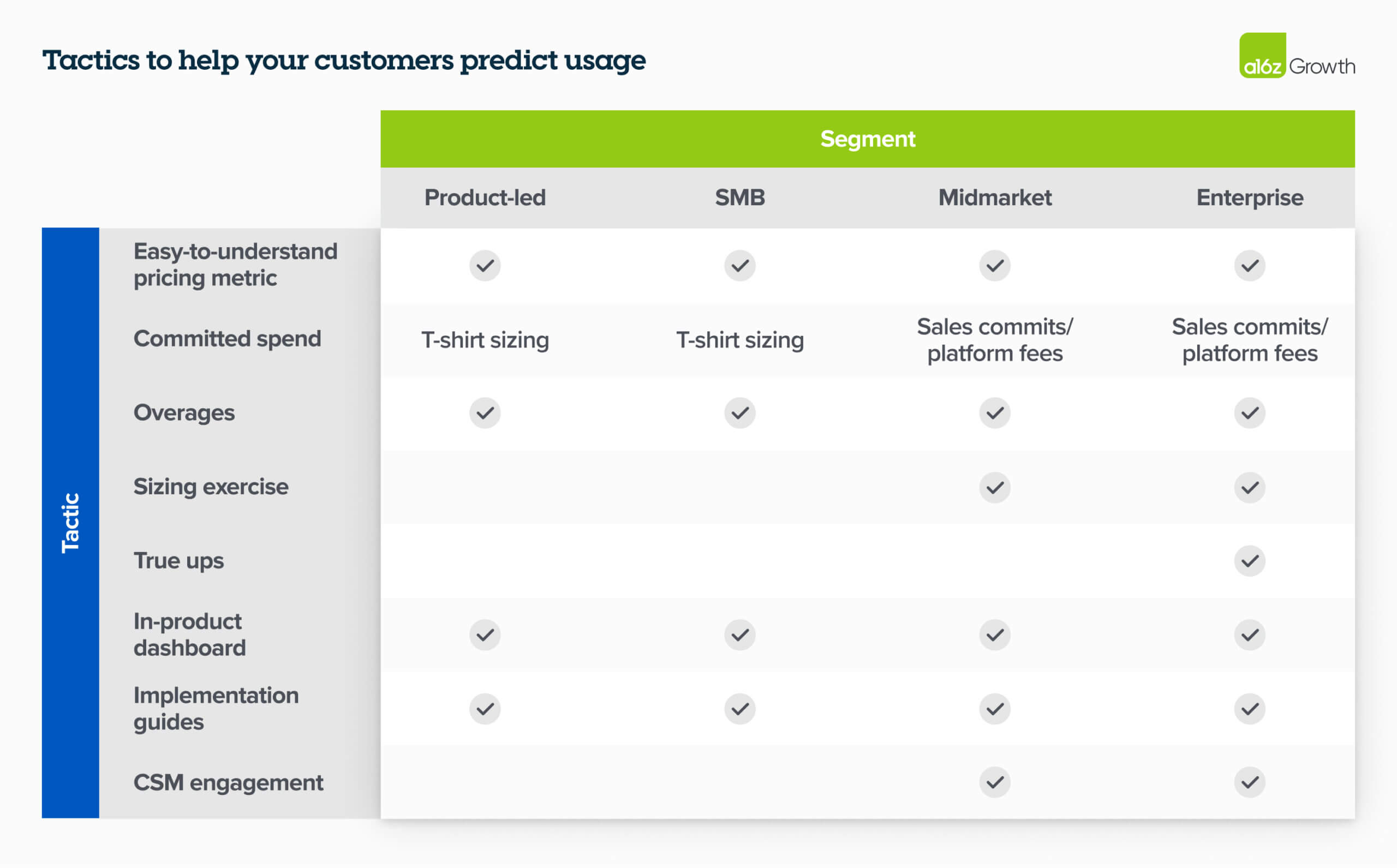

Given how often predictability is a pain point and how frequently growth-stage companies need to revisit their pricing structures, we’ve compiled a menu of common tactics—along with pointers on which approaches work best for different customer segments—you can use to help your customers more reliably predict their consumption of your product.

This list isn’t exhaustive and not all of these options will suit your business needs, but the more of these suggestions you can implement for the segments you serve, the likelier it is you can provide your customers with a smoother buying and usage experience.

Pricing

Use an easy-to-understand, easy-to-measure pricing metric.

Most effective segments: all.

This might be the most important element to get right in usage-based pricing. Your pricing metric should be transparent, easy to understand, and aligned with your value prop—the easier something is to understand and measure, the easier it is to track and predict. If your customers can’t immediately understand your pricing metric, they won’t be able to explain it to the budget holder, and they won’t be able to purchase your product. No one wants to sign blank checks.

Sometimes there’s an obvious way for these companies to measure their value proposition—a fintech company might bill per credit card transaction, or a SaaS company might bill per compute unit. But most of the time, these companies need to compile a few obvious but incomplete metrics into a single, new pricing metric. For instance, Databricks created a Databricks Unit, or DBU, composed of different compute and data processing metrics to measure a unit of processing power on their Lakehouse Platform. OpenAI bills by token and scales the price up or down depending on whether you opt for either a faster or more capable model.

There are a couple of things to keep in mind when you’re considering creating your own metric.

Generally, balance transparency with simplicity. A single, compiled metric might help your prospects understand your pricing structure during initial sales calls, for instance, but it might make it harder for them to track their own use of that metric. A good way to know if you’ve landed on the right metric is to test it for customer likeability. Put yourself in the customers’ shoes. Would you want to be charged that way? Is the metric fair and easy to understand? Will it scale with your customers’ use?

It’s also useful to look out for metrics that might unintentionally encourage bizarre behavior. This is one reason Google doesn’t charge for each Google Doc you create, for instance. If they did, chances are many users would just create one huge, long document! Time Warner Cable has also observed that their own customers would rather pay more for an unlimited cable service than pay less and only for what they consume—so it’s important to implement a pricing model that builds trust with your customers and aligns with how they consume your product.

Offer some form of committed consumption.

Most effective segments: PLG, SMB, midmarket.

Many companies we work with offer hybrid pricing models that include some form of committed consumption. This can look very different for different segments.

For SMB and PLG:

- Many growth-stage companies use “T-shirt sizing,” which offers different buckets with set amounts of usage. This approach offers new customers an easy, clear-cut way to start using your product. Generally, companies structure their tiers in such a way that companies who buy a “medium” tier of usage and use more than their allotment are incentivized to purchase the “large” tier of usage for a cheaper incremental per-unit rate. If customers do consume more than the usage limits allotted in their “T-shirt size,” many companies will bill those customers for overages (see next section).

For enterprise and midmarket:

- We’ve seen some successful software companies offer packages that allow customers to commit to consuming ahead of their run rate. Customers can roll over or pull forward credits, or they can commit to a set amount of credits upfront and draw down those credits over a period of time.

- We’ve also seen companies offer platform fees that include a set amount of usage. Any usage beyond the initial allotment is generally charged at a per-unit rate.

Carefully consider overages.

Most effective segments: all.

Hitting your customers with punitive overages—or charging your customers a standard rate, instead of their discounted rate, if they consume more than their commitment agreement—can guarantee you cash as a vendor, but it can also create friction between you and your customers and make it difficult to renew or expand that customer down the road. Consider carefully if you need these. And if you decide you do include them, try not to make them a surprise: use some of the other tactics we mention here to prevent their usage from skyrocketing and be upfront about the consequences of overuse.

Sales

Conduct a light-weight sizing exercise upfront.

Most effective segments: midmarket, enterprise.

Even if your customers aren’t committing, bringing a salesperson into your discussion with the customers can help them predict how much they’ll spend. These salespeople should constantly be in touch with whomever at your org researches customer usage patterns—product, growth, data science, or a separate function—and be able to consult confidently about how current usage trends and insights might apply to the prospect’s own business. (Otherwise, these prospects will do this work themselves and almost always forecast in a way that deviates from how your current customers are using the product.) This exercise can be especially important in downturn climates when customers have been spending at a certain run rate and that run rate needs to contract.

Offer true ups.

Most effective segments: enterprise.

In lieu of overages, you can reconcile and adjust your customers’ usage at the end of a billing period to ensure that they’re only billed for what they use. This is particularly helpful for companies that have unpredictable spikes or seasonal fluctuations in usage. True ups also scale with customer usage, since customers don’t need to renegotiate their contracts in order to continue consuming.

Product

Build an in-product dashboard to track usage.

Most effective segments: all.

With a dashboard that maps out last and current period’s usage, and predicts usage in the next, customers can easily track their accrued usage. We’ve seen some companies offer forecasts for the remaining billing period and the next billing period, which helps customers with near-term spend planning and limits surprise bills landing at the end of each billing period.

Many companies are also using AI/ML to help companies better predict usage and notify customers when they’re approaching their usage limits.

Customer support

Create implementation guides with best practices.

Most effective segments: all.

Creating guides that review your products’ features and capabilities, outline resource requirements, itemize best practices, and detail how your product can be scaled to meet customers’ growing needs offers users a solid resource for understanding how to get the most out of your product quickly.

Proactive engagement from customer success managers.

Most effective segments: midmarket, enterprise.

Customer success managers (CSMs) reach out when usage starts to spike and might supersede their typical or committed usage. In addition to flagging usage that’s trending too high, CSMs can also optimize the implementation of your customers’ products so they’re meeting their agreed-upon business needs.

As you offer your customers better ways to predict their usage of your product, you also lay the groundwork for more effectively tracking your own revenue as a vendor—and predictable revenue is the lynchpin of any company’s planning, execution, and ultimately valuation. There are other steps you’ll need to take in order to better predict your own revenue, which we’ll touch on in a future post.

“Andreessen Horowitz is a private American venture capital firm, founded in 2009 by Marc Andreessen and Ben Horowitz. The company is headquartered in Menlo Park, California. As of April 2023, Andreessen Horowitz ranks first on the list of venture capital firms by AUM.”

Please visit the firm link to site