In part five of our Drive to Subscribe series, we look into the critical factors to consider when adopting subscription billing software and examine a specific B2B sales use case supported by these advanced technologies.

The subscription market is continuing to grow at a significant pace, with subscription businesses growing 4.6x faster than the S&P 500 (1). However, finance teams and technologies are struggling to keep up, with recent evidence showing that 48% of businesses with a recurring revenue model struggle to meet accounting and reporting challenges (2).

Too many businesses are attempting to shoehorn the subscription model into their traditional Sales, ERP and financial operations with customisation or vulnerable and manual workarounds. This problem statement has seen the emergence of new subscription billing software. Here are some key considerations in the adoption of these technologies and an exploration of a specific use case that they are able to support within B2B sales.

A use case for subscription billing software

The rise in the monetisation of products and services via subscription and software as a service (SaaS) based offerings, as well as business models more generally centred around recurring revenue, has introduced a need for more flexibility over the management of customer’s subscriptions. This usually results in complex operations such as mid-term adjustments (additions of new products, upgrades or downgrades of existing products and removal of existing products from a customer’s subscription), adjustments that often need to be harmonised at the point of a subscription’s renewal and that will have a significant impact on areas such as revenue recognition and proration calculations.

Within business-to-business (B2B) models, traditional enterprise resource planning (ERP), configure, price, quote (CPQ) and sales software are beginning to adapt to accommodate these operations. A number of bespoke subscription management and agile billing platforms (that make up a market that was valued at $3.8 billion in 2018 and is expected to reach $10.5 billion by 2025) have also been designed to work in harmony with the wider systems architecture and support these complex operations with purpose-built data models (3). The impact of allowing customers to have this level of flexibility on revenue, customer retention and satisfaction is well evidenced and it is therefore crucial that the back office system setup and processes can facilitate it, as the shift to a recurring business model can be challenging.

Selling with co-termination vs mid-term adjustments

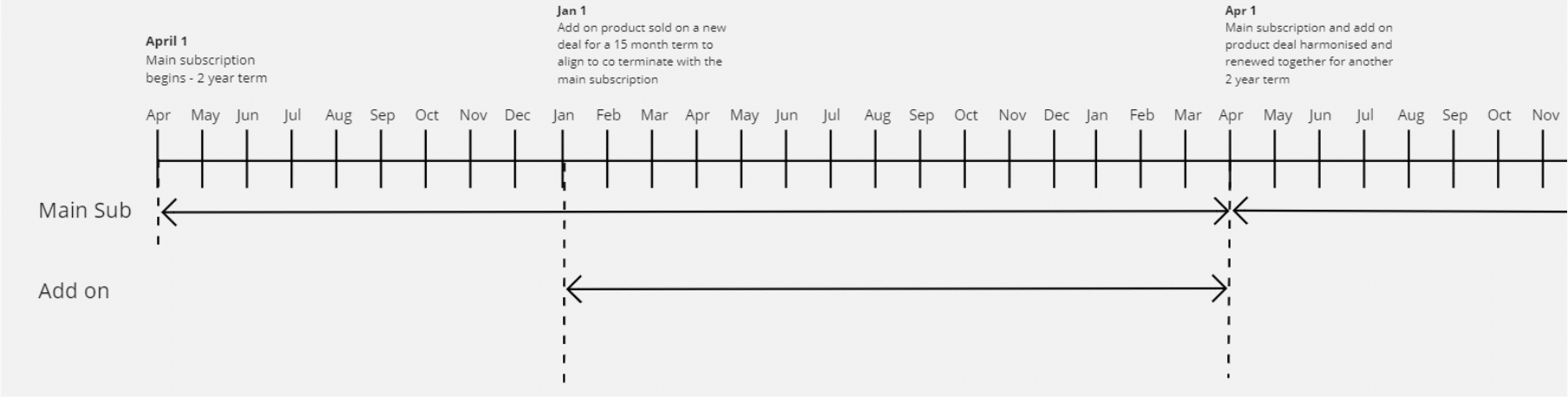

A common method in B2B sales processes when making mid-term adjustments to a customer’s existing subscription is to sell the change coterminously (whereby the end date of the new deal terminates at the same time as the end date of the original deal) with the original subscription renewal date, which is often used in customer relationship management (CRM) systems that haven’t been built to accommodate subscription-based offerings. At the point of renewal, the changes reflected through the additional sales would need to be reflected and harmonised with the original renewing subscription. This process can be time-consuming, require complex customisations to the underlying systems, or significant re-keying by sales operations teams. It also opens up potential data quality issues and reporting concerns, especially around churn and upsell calculations. Subscription management systems are designed to simplify these operations by treating the subscription itself as a container that has tightly controlled versioning and can be manipulated by individual, date-specific actions. This allows for the upstream sales actions to be done directly against the original subscription that is being ‘amended’ and the downstream billing and revenue operations, such as proration calculations, alignment of co-termination and amendments to revenue contracts, to be handled automatically and with little to no human intervention.

Example of selling with co-termination:

Allowing for more monetisation options and ways to sell with subscription billing software

Allowing for changes to be made to a subscription mid-term, with the complexities systemised and automated opens up the door to more pricing options and models. For example, it can be difficult to sell banded pricing (a common pricing model within SaaS businesses) and allow mid-term upgrades while operating within the bounds of co-termed selling. By allowing the direct amendment of subscriptions, customers can easily upgrade their product to a higher band in the middle of their term (for example, upgrading a product that allows ‘up to 10 users’ to a band that allows ‘up to 20 users’). This is due to the ability of the subscription billing engine to calculate the prorated credit (of the removed band) and prorated charge (of the band the customer is upgrading to) and net out the final charge to be applied, as well as any changes required downstream in the revenue systems. To carry out this specific use case with co-termed selling, it is likely that the customer’s subscription will not truly reflect the band they are in until the point that they renew and the co-termed sales are harmonised to the main subscription.

Modular nature of subscription billing software, how and where does it fit into a Lead to Cash architecture

Subscription management and agile billing software is typically modular and sits between either a self service ecommerce platform, or a CRM platform, and the back office ERP / General Ledger. The extent to which the subscription billing layer interacts with the CRM is dependent typically on the use of CPQ software. While some subscription billing platforms offer their own CPQ engines that sit within CRMs such as Salesforce, they are also set up to interface directly with other popular CPQ software such as Salesforce CPQ. The decisions made here will impact the level of integration effort required and will be a decision usually made on the required functionality of the CPQ and sales capabilities.

The second key decision when implementing subscription billing software is to determine if the billing, taxation and payment application should be carried out within the subscription billing platform, or within the ERP. Most subscription billing software is set up to handle both scenarios, whereby full billing and payment operations can take place directly in the system, with journal entries generated and handed off to the ERP to be loaded into the General Ledger, or the subscription billing software can inform the ERP of how and what to bill directly. This decision is typically influenced by the complexity of taxation logic and how complex an organisation’s accounting treatment is (such as the calculation and accounting of FX gain/loss between a large number of currencies) that ERPs are typically more robust at handling.

If you need help revving up subscription success for your business, please get in touch.

Clarasys is an international business consulting firm.

Please visit the firm link to site