Inflation remains front and center for consumers and businesses, which continue to reel from the double-digit rise in prices during the COVID-19 pandemic and the interest rate hikes designed to cool them. While price increases for goods have slowed, the climate remains uncertain, with inflation ticking up again as recently as February.

How should companies navigate the mood of shoppers, who remain cautious after being squeezed over the past two years, particularly in areas like food and housing? Harvard Business School faculty offer their thoughts about the pricing landscape and what businesses need to know in 2024.

Alexander MacKay: Focus on finding balance

Since 2021, as companies faced supply shocks and changes to demand in an inflationary period, executives have increasingly focused on consumer price elasticities. The price elasticity of demand describes how much quantities (or volume) would fall in response to a price increase.

Understanding broad trends in elasticities and underlying demand is critical for making companywide decisions about whether to change prices, or where on the premium-to-value spectrum to develop and introduce new products. Recent research documented a longer-run decline in price sensitivity for consumer products. However, this year, companies have observed more consumers pursuing “value-seeking behavior.”

A key consideration is whether the longer-run trends will be reversed due to changes in consumer shopping behavior, in response to inflation, or other macroeconomic factors. With these factors in mind, here are four things to focus on in 2024:

- Balancing margins and volume. For decisions about whether to adjust prices, it is not simply a question of how high prices can go, but rather how to optimally balance margins and volume while maintaining good relationships with consumers. The consumer response to price changes that happened in 2022 may not predict how consumers will react in 2024. Some products may be more profitable at lower prices and lower margins, while others might be more profitable when positioned as high-margin products.

- Developing new products. The development of new products can take several years. Anticipating the trends in consumer price sensitivity can provide producers with a significant edge in determining whether a new product is successful. It can help shift investments toward making improvements in product quality or reductions in costs.

- Short-run versus long-run responses. Over longer periods, the observable consumer response to a price change may be much different than in the short run. Evidence indicates consumers may take three years or longer to adjust to price changes. In the long run, consumers can more flexibly adjust habits. More sophisticated firms take this into account when formulating their strategies and making long-run forecasts.

- Attention of regulators. The Federal Trade Commission recently released a report about the impacts of supply chain disruptions on grocery stores. The FTC is sending a strong signal that it is paying close attention to grocery store prices. Executives should be weighing this regulatory attention when considering prices over the years ahead.

Alexander MacKay is an assistant professor of business administration at HBS and co-leads the Pricing Lab of the Digital, Data, and Design Institute.

Chiara Farronato: Dig into data to find regional and product differences

When I think of prices, I think of data, lots of data. We often look at aggregate price data, which recently have been showing that price increases are slowing down (or inflation is decreasing).

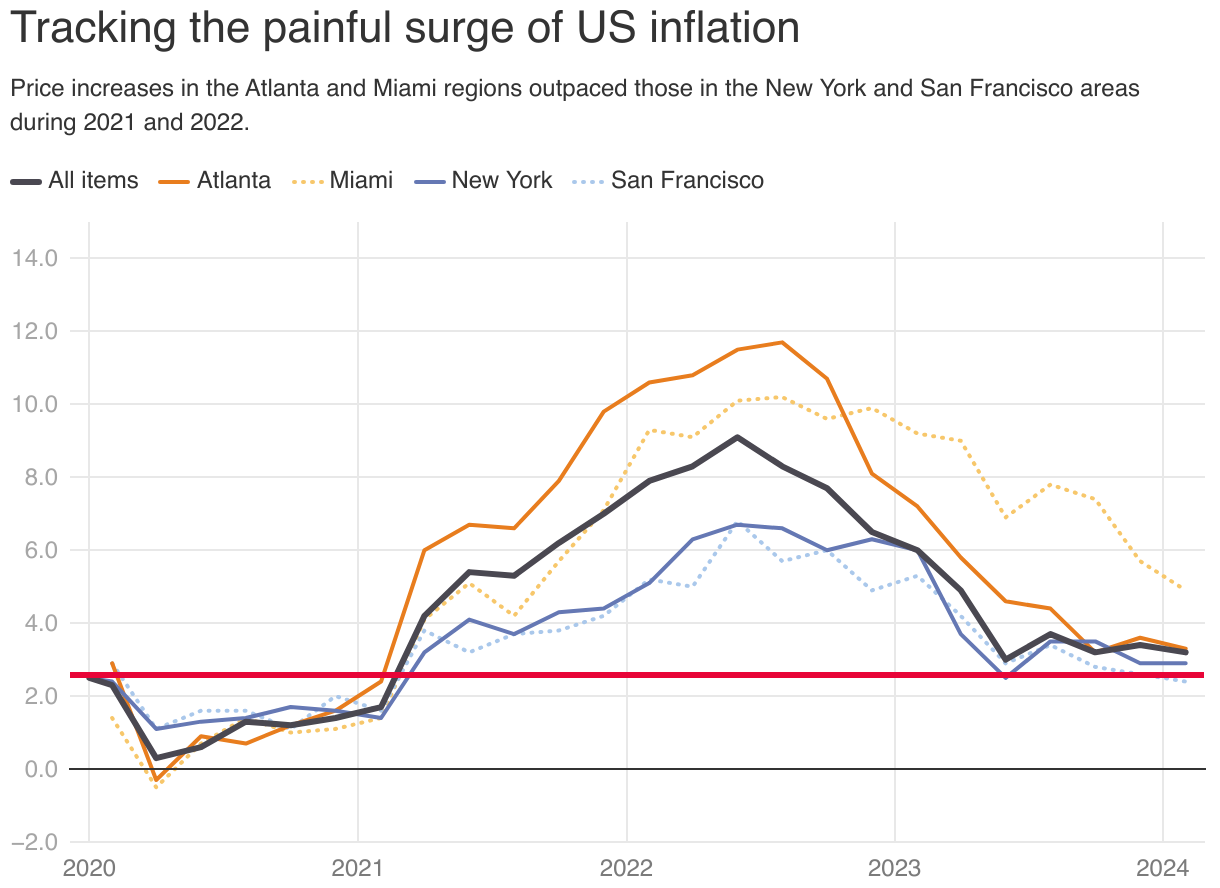

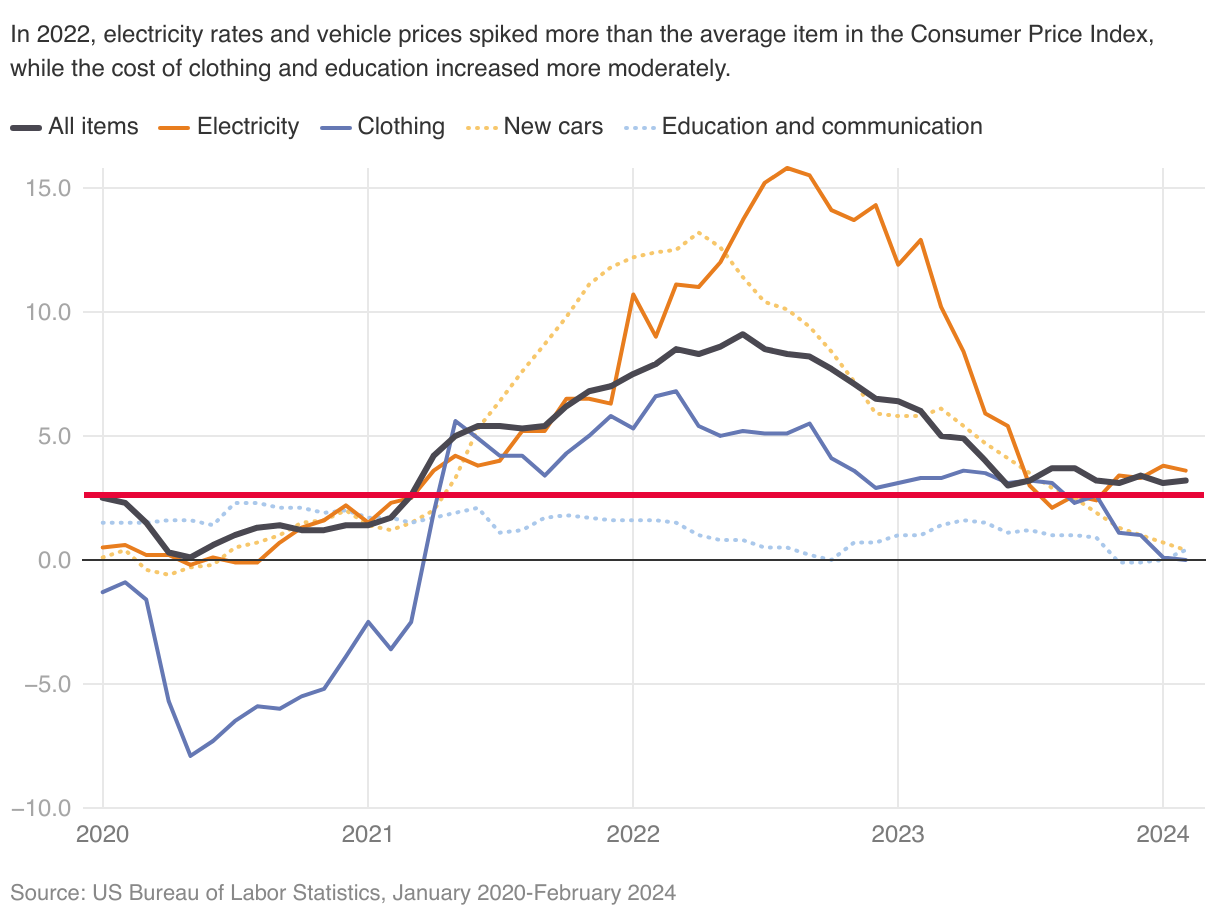

Indeed, that’s the case, but the average masks a lot of differences: across products, across geographies, across consumption patterns. And it appears that those differences have been increasing in the past few years, with some cities and some product categories experiencing much higher price hikes than others.

What does this mean in practice?

Even if inflation is slowing down, depending on where you live and what you buy, you may not experience this slowing down to the same degree as the official measures suggest.

Let’s take some examples from the plots below.

If you spend a lot of your budget on electricity, or you bought a new car in the last couple of years, you must have experienced significant price hikes, very likely way above the publicly announced inflation numbers. Similarly, if you live in Miami or Atlanta, you may feel like the aggregate inflation numbers are a lie.

There’s some good news on the horizon, though! In recent months, not only has inflation slowed, inflation across products and geographies has also started converging (all the lines in the plots are getting closer together). This means that regardless of your consumption patterns, you will hopefully be less shocked by your electricity bill, or the price of the eggs when you visit the grocery store.

Chiara Farronato is Glenn and Mary Jane Creamer Associate Professor of Business Administration at HBS.

Emily Williams: Sustained higher prices alter purchasing habits

The state of prices for consumer goods in the aftermath of the COVID-19 pandemic presents a complex landscape shaped by a blend of inflationary pressures, changing consumer behaviors, and adaptive strategies by both consumers and companies.

As we navigate through this evolving scenario, several trends have emerged that underline the current state of consumer goods prices and their broader implications on the economy and consumer behavior:

- Prices are 19 percent higher. In the wake of the pandemic, consumers have been confronted with prices that are, on average, about 19 percent higher than pre-pandemic levels. This sustained increase has prompted a shift in purchasing habits, with consumers increasingly opting for store-brand items over name brands, favoring discount stores, and reducing purchases of non-essential items. Such behavior is a direct response to the inflationary pressures that have squeezed household budgets, compelling consumers to seek better pricing and value, a trend referred to as “trading down.”

- Consumers are trading down in more areas than food. The transition to more cost-effective living extends beyond food choices. Individuals are cutting back on other non-essential spending, reducing outings, and becoming more strategic about their purchases. There’s a renewed focus on investing in durable goods from reputable brands, seen as a long-term saving strategy despite the upfront cost.

- Slower rise, no return to pre-pandemic prices. This shift in consumer behavior has not gone unnoticed by businesses. In the food sector, the resistance to price hikes has led to large companies decelerating their price increases from the peaks seen in the past three years. While this indicates a responsiveness to consumer pushback, it does not necessarily herald a return to pre-pandemic price levels. Nevertheless, certain categories such as eggs, apples, and milk have seen prices drop below their peak levels, offering some relief to consumers.

- Moderation helps cool inflation. The moderation in food price increases is contributing to the cooling of overall inflation, which has seen a significant reduction from a peak of 9.1 percent in 2022 to 3.1 percent [in early 2024]. This cooling of inflation, while a positive sign, comes amid varied consumer sentiments. While some consumers have expressed increased optimism, bolstered by factors such as an end-of-year stock market rally and labor market resilience, concerns over inflation persist, particularly as recent data indicates prices are still climbing at a rate higher than the Federal Reserve’s target.

- SNAP cuts underscore urgency. The consumer goods pricing landscape, reshaped by pandemic-induced behavioral shifts, reflects a complex balance of consumer adaptation to higher costs, business strategy adjustments, and market dynamics. Additionally, the end of expanded SNAP [the Supplemental Nutrition Assistance Program previously known as food stamps] benefits and a rise in food bank reliance starkly reveal socioeconomic disparities, underscoring the urgency for equitable access to consumer goods and post-pandemic economic recovery.

Emily Williams is an assistant professor of business administration at HBS.

You Might Also Like:

Feedback or ideas to share? Email the Working Knowledge team at hbswk@hbs.edu.

Image: Illustration by HBSWK. Photos from AdobeStock/Michele and AdobeStock/Locato.

“Harvard Business School is the graduate business school of Harvard University, a private research university in Boston, Massachusetts. It is consistently ranked among the top business schools in the world and offers a large full-time MBA program, management-related doctoral programs, and executive education programs.”

Please visit the firm link to site