Now that we’ve concluded the first quarter of 2024, we thought it would be a good opportunity to take stock of the state of consumption in China. In this edition of “China Brief”, we’ll do a quick scan of key macroeconomic indicators and zoom in on some of the core drivers of recent consumption growth.

While the Chinese economy faces continued headwinds and consumer companies are encountering increasingly fierce competition, one encouraging message emerges from our analysis: we’re off to an encouraging start in the Year of the Dragon.

Macroeconomic indicators holding steady

China experienced a moderate recovery in 2023, marking the first year of bounce-back since the conclusion of the COVID-19 pandemic. Although many harbored higher expectations, it’s crucial not to overlook the positive aspects:

— GDP growth & consumption: GDP grew by 5.2 percent last year, contributing 34 percent to global GDP growth. Admittedly, the growth we saw in 2023 was set against the relatively low base of 2022, a year marred by pandemic- induced lockdowns and stringent travel restrictions. A staggering 83 percent of this growth stemmed from a surge in consumption.

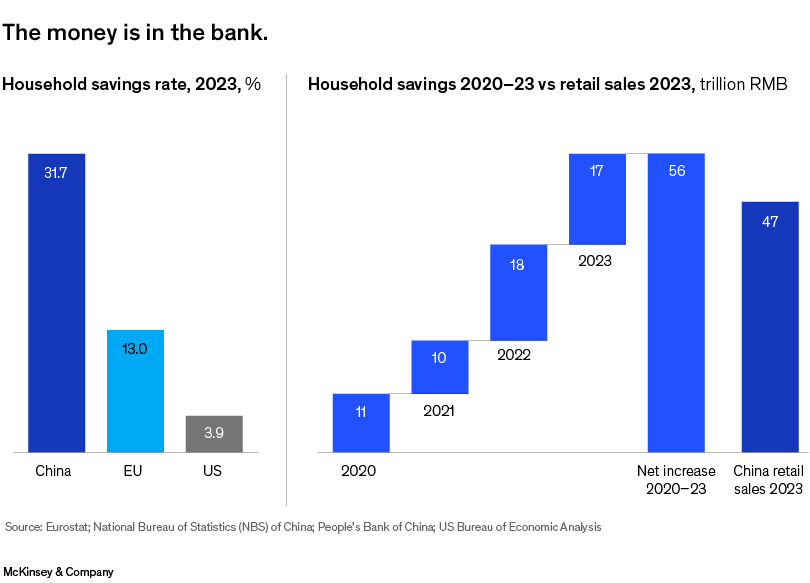

— Employment and income: China finished 2023 with a stable 5.1 percent urban unemployment rate (compared with 5.2 percent at the end of 2019). Inflation held steady at a modest 0.2 percent, while consumers saw their average disposable incomes rise by 6 percent. But as consumer sentiment continues its slump, consumers prefer to sock their cash away in the bank rather than spend it, pushing the savings rate higher. The savings rate in China hit 31.7 percent in 2023. This is propelling the country’s total pool of savings to record highs. To put the numbers into perspective, the total amount of new savings accumulated by Chinese consumers during 2020-23—56 trillion renminbi— exceeds the 47 trillion renminbi in retail sales generated during 2023. (Exhibit 1)

— FDI: Despite concerns around rising geopolitical tensions and a decline in inbound foreign direct investment (FDI) into China by 8 percent 2023, according to China’s Ministry of Commerce, it’s often overlooked that this was the third highest level of FDI in China’s history, only trailing the FDI that China attracted in 2021 and 2022.

— Exports: China’s exports grew by 7 percent during the first two months of 2024 compared to the same period last year, including a 5 percent increase in exports to the US.

While several macroeconomic indicators are pointing in a promising direction, there are a number of areas that are still cause for considerable concern, foremost of which is the continued slump in consumer and business sentiment. The collapse in property transactions in 2023 is a big factor behind the drop in confidence.

A 5 percent decline in exports in 2023, zero growth in fixed asset investment by privately-owned companies, and double-digit unemployment are other key factors driving a reduction consumer spending and investment.

Chinese consumers show promising signs

So, how did China’s consumers kick-off the Year of the Dragon?

The early months of 2024 paint a picture of a Chinese economy that is navigating the post-pandemic world with considerable momentum. While it’s too early to accurately forecast how the remainder of the year will take shape, key consumption indicators are heading in the right direction.

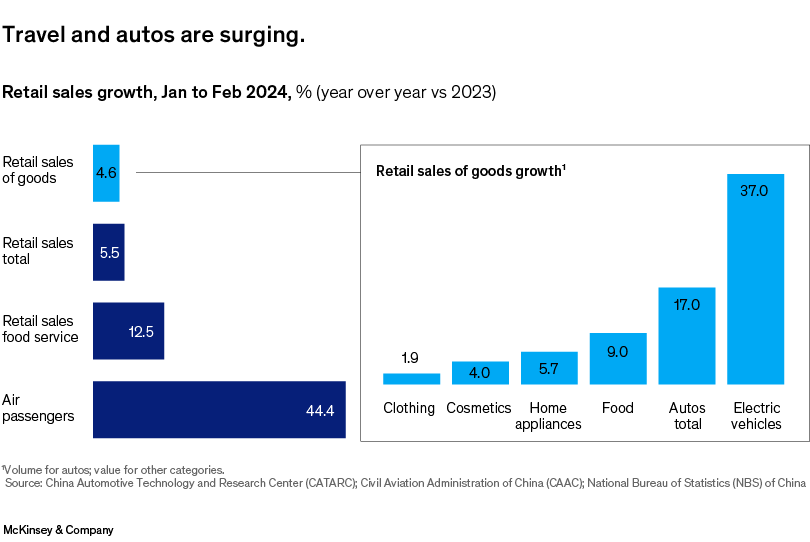

Retail sales in the first two months of 2024 show a healthy year-on-year increase of 5.5 percent, with goods contributing a 4.6 percent rise. Remarkably, foodservice sales leapt by 12.5 percent, indicating a robust recovery in hospitality sectors, possibly buoyed by increased consumer confidence and relaxation of any lingering pandemic restrictions.

Air passenger numbers soared by an astounding 44.4 percent. This upsurge is perhaps the most vivid indicator of renewed mobility and a resurgent appetite for travel and face-to-face business engagements, signaling that air travel has rebounded from the doldrums of the pandemic era.

The food sector saw a 9 percent year-on-year growth. The modest growth in cosmetics and clothing, at 4 percent and 1.9 percent respectively, could suggest a cautious consumer approach to discretionary spending in these segments. Home appliances experienced a moderate 5.7 percent increase, potentially reflecting a steady demand for home improvement (Exhibit 2).

The automotive sector represents another promising area of growth in consumption. While overall auto sales grew by a very healthy 17 percent, during the first two months of the year electric vehicles (EVs) outpaced this number with an impressive 37 percent surge, highlighting changes in consumer preference for greener alternatives, and the government’s push for EV adoption through policy incentives.

Travel bounces back

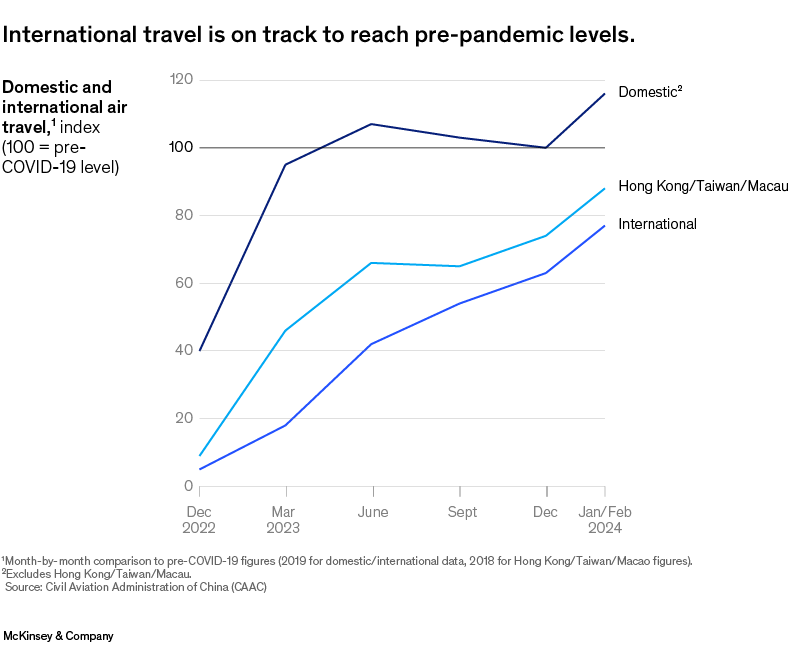

Both domestic and international travel have continued to bounce back. Travel within Mainland China now significantly exceeds pre-COVID-19 levels, with January and February seeing a 16 percent higher volume than the same period in 2019. This aligns with trends observed in the second half of 2023.

Domestic travel during this year’s Lunar New Year holiday jumped by 34 percent compared with the same period in 2023. This represents a 19 percent increase over the level reached in 2019.

Travel to Hong Kong, Macau, and Taiwan, as well as to international destinations, continues to see gradual month-by-month increases. International travel, as of January and February, reached 77 percent of 2019 levels, steadily rising from December, which reached 63 percent of 2019 levels, and September, at 54 percent of 2019 levels. (Exhibit 3)

We are now just counting the months until Chinese travel activity fully rebounds to pre-COVID-19 levels.

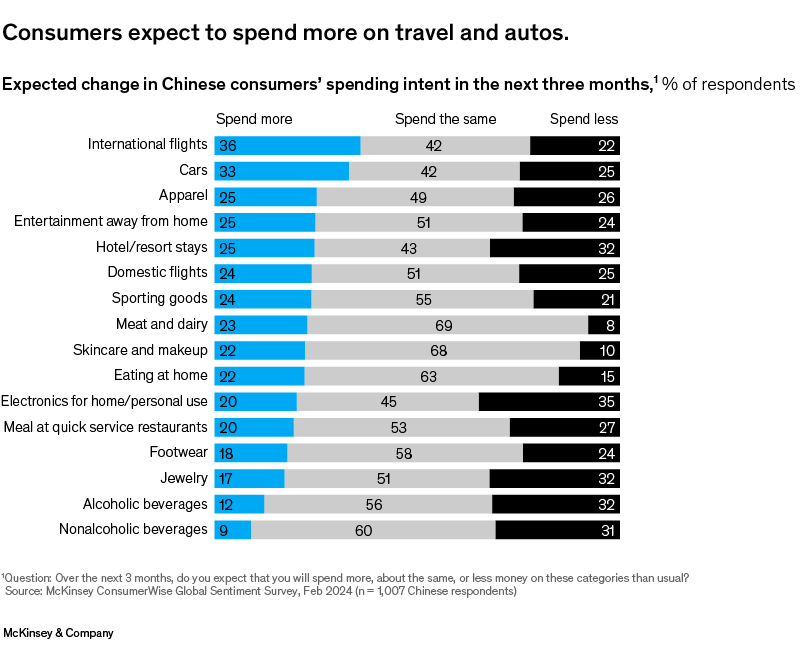

Indeed, McKinsey’s global ConsumerWise survey of consumer sentiment, conducted in February, suggests an optimistic trajectory for international travel, with 36 percent of respondents in China saying they intend to spend more on international travel over the next three months, the highest of all discretionary spending items. (Exhibit 4)

Despite the complexities of applying for overseas travel visas, as well as the high costs of flights and hotels, it looks increasingly likely that China’s travelers are on track to resume the pace of overseas trips they once enjoyed.

Interestingly, while expenditures on property and personal items such as apparel and cosmetics are decreasing, spending on higher-value items like cars and international travel are on the rise.

Overseas spending surges

Although international travel hasn’t fully bounced back, overseas spending has recovered disproportionately faster than the growth in the number of outbound travelers.

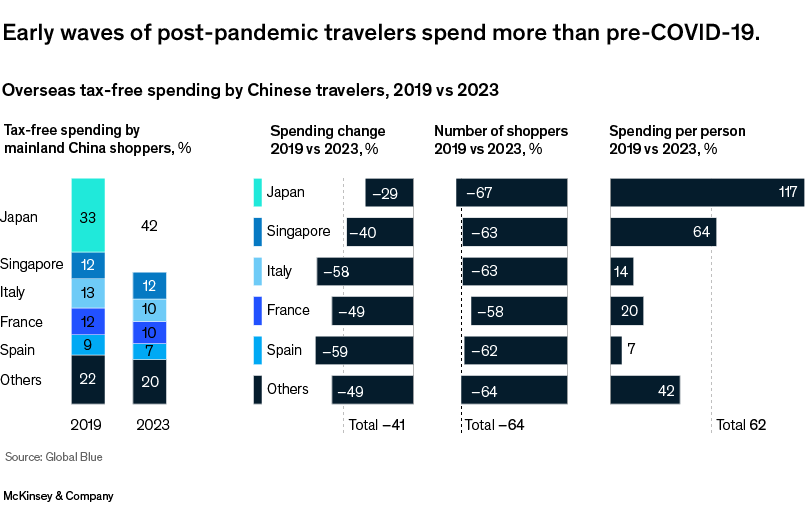

Despite a stark reduction in the number of shoppers—a likely residue of the pandemic’s impact—spending per person has surged. According to data from Global Blue, the average spending per Chinese traveler has substantially exceeded 2019 levels: 14 percent higher for those traveling to Italy, 20 percent higher for travelers to France, and a striking 117 percent and 64 percent higher spending per person for travelers to Japan and Singapore, respectively. (Exhibit 5)

These results surprised industry watchers, as many had predicted a decline in overseas luxury spending due to the development of a stronger domestic luxury market, and a price gap between domestic and overseas luxury items that has narrowed since 2019.

Japan’s leap in spending per person is a testament to the country’s enduring appeal and as a destination for luxury and technology goods, which Chinese consumers have long favored. Singapore’s sales spike might be attributed to its status as a financial hub and shopping destination. The substantial jumps in individual spending in Italy and France, despite a drastic fall in shopper numbers, could be reflective of a “quality over quantity” shift.

As travel rebounds, the pent-up demand and accumulated wealth during the pandemic seem to be channeled into more luxurious and high-value purchases, indicating the Chinese consumer’s desire to invest in unique and high-end experiences. This early wave of post-pandemic travelers from China may skew toward wealthier consumers, as they have more disposable income and can afford the higher flight and hotel costs that are prevalent today.

While the pandemic might have temporarily stemmed the flow of Chinese tourists abroad, the floodgates have opened to a wave of affluent spenders. For businesses in destination countries , catering to this new wave of luxury-focused consumers could be key to capitalizing on this emerging market dynamic.

Super-charged EV sales

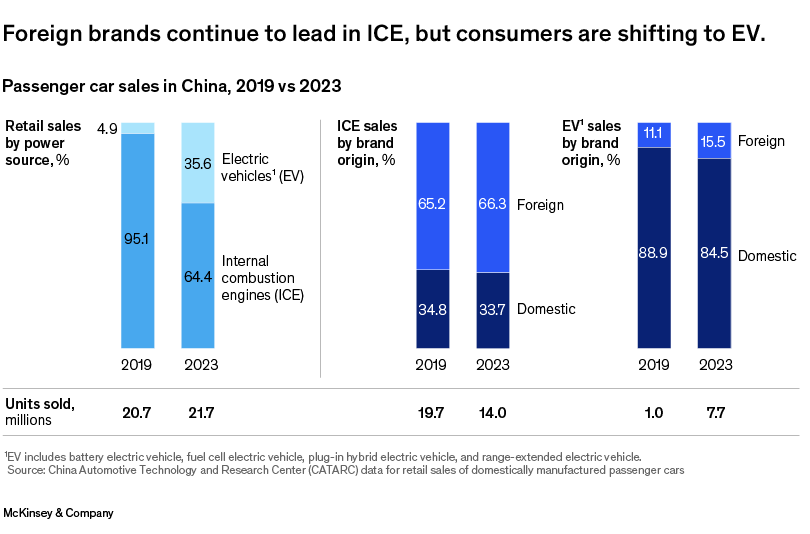

A 37 percent surge in sales of electric vehicles in 2023 drove a 6 percent rise in the overall market for passenger vehicles, which continued to grow by double-digits in the first two months of the new year. EVs now represent 35.6 percent of China’s total automotive market of 21.7 million vehicles.

The electric vehicle segment remains led by domestic brands, which held 84.5 percent share in 2023, dropping from 88.9 percent in 2019. Except for Tesla, which has carved out a notable 7.8 percent share, foreign brands have struggled to gain a foothold in China’s EV market.

While the overall size of the market for internal combustion engine (ICE) vehicles is declining, foreign brands have managed to hold onto their share of this still sizeable market, which in 2023 saw sales of 14 million units. Their share rose slightly from 65.2 percent in 2019 to 66.3 percent in 2023. (Exhibit 6)

In the EV segment, Chinese brands, along with Tesla, are perceived to offer superior options, and hence command a large portion of the market.

The transition from ICE vehicles to EVs is leading to a decrease in the market share of foreign brands, supporting a widely held belief that Chinese consumers prefer domestic car brands. In reality, however, the fact that foreign brands have maintained their share of ICE vehicles dispels the notion of a “go-local” phenomenon.

The journey ahead

While early consumption data for the first two months is promising, the verdict is still out on what this means for the remainder of the year.

Given the enormous savings Chinese consumers have accumulated over the last few years, once they regain their confidence, they’ll likely increase their spending. We also reaffirm our view that the era of double-digit growth is behind us, and companies will need to adjust their expectations accordingly to thrive in an increasingly competitive market. Success will require a more granular and targeted approach. Consumer marketers will need to focus their attention on identifying fast-growing consumer segments and product categories, while tapping into the ongoing shift in consumer preferences from products to services.

“Our firm is designed to operate as one—a single global partnership united by a strong set of values. We are equally committed to both sides of our mission: attracting and developing a talented and diverse group of colleagues and helping our clients create meaningful and lasting change.

From the C-suite to the front line, we partner with clients to help them innovate more sustainably, achieve lasting gains in performance, and build workforces that will thrive for this generation and the next.”

Please visit the firm link to site