Another way for projects to avoid legal uncertainty in the U.S. is to eliminate the possibility of the public investing in their tokens. To accomplish this, projects can issue transfer-restricted tokens (TRTs) or use off-chain “points” instead of tokens. TRTs use the ERC-20 standard to limit who can hold a token and where it can be sent, while points more closely resemble airline miles.

Both TRTs and points are typically non-transferable for a set period or until certain conditions are met, often tied to a project’s decentralization milestones. Importantly, this strategy does not require that tokens have no real use case (TRTs can be used with a smart contract that is part of the project, like a staking module, and points can be redeemed). But it does require preventing tokenholders from buying and selling the token on secondary markets.

Again, this strategy should support, not replace, a project’s long-term decentralization plans. A few of the benefits of TRTs/points:

- Reduced speculation: Minimize speculative trading by delaying token transferability

- Enhanced community building: Buy more time to build a robust community and governance framework

- Long-term value creation: Encourage long-term holding and engagement, aligning incentives between the project and its stakeholders

TRTs and points sound simple enough, and many projects use them carelessly. Don’t be fooled: Misusing these tools can have legal and regulatory consequences. Projects should consult their counsel to ensure they’re using them appropriately, and to avoid inadvertently running afoul of securities or money transmission laws.

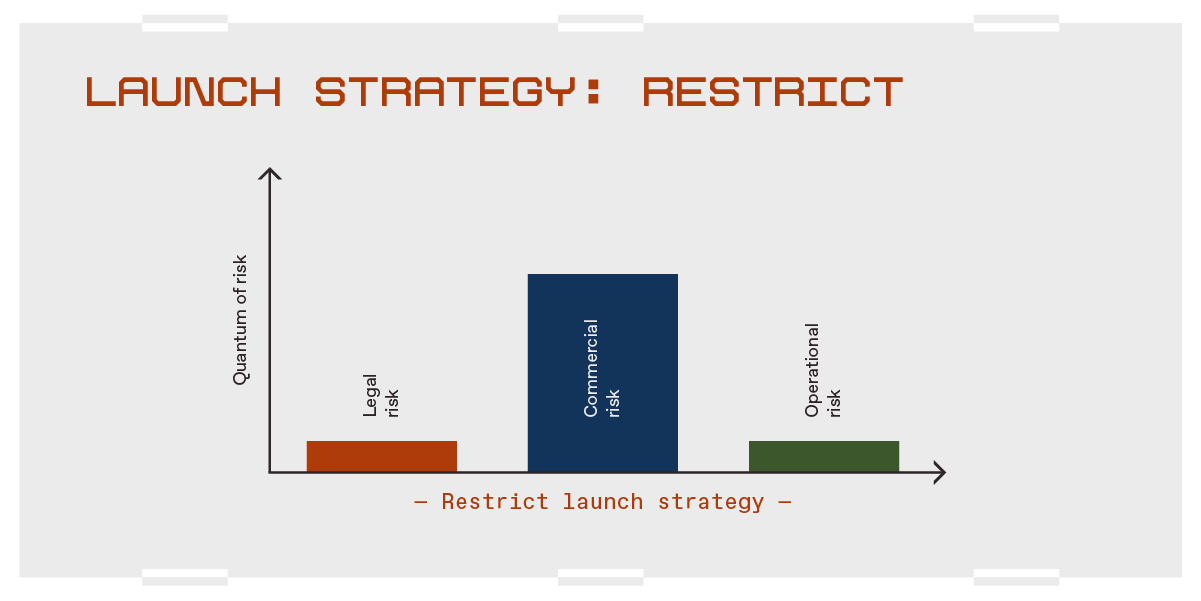

How to assess the risks:

Legal: TRTs and points can lower legal risk arising under securities laws when used properly.

The strategy hinges on making sure that no third-party can make an “investment of money” to acquire a project’s TRTs or points. If this is the case, distributing them would not satisfy the first prong of the Howey Test, and securities laws would not apply.

However, treating TRTs/points like investment products can cause problems. For instance, rewarding web3 participants with TRTs/points for engaging in economic activity that financially benefits the project; hyping the value of TRTs/points; promising future distributions of a specified number of transferable tokens in exchange for TRTs/points; and turning a blind eye to illicit secondary markets for TRTs/points. All of these activities can undermine the legal basis for this strategy.

Projects can guard against unauthorized secondary markets by using cease and desist letters, modifying a token’s terms of service, or even revoking assets and blacklisting addresses that participate in secondary markets.

Commercial: The key tradeoff with using TRTs/points is increased commercial risk.

This strategy allows projects to broadly distribute tokens, but does have limited utility when it comes to incentives. TRTs/points may work well for a project incentivizing users to engage in social activity, like attending a sporting event, completing a quest in a game, or posting on social media.

They are more challenging for use cases like decentralized physical infrastructure, where the project relies on people to use their own money to buy or operate equipment that facilitates the network. This is because users cannot sell their tokens to recover their funds, which may make them less willing to participate in the first place.

In other words, incentives may not be as compelling if users can’t sell them.

Operational: TRTs/points also reduce operational risk relative to other strategies.

With no secondary market, TRTs/points do not fluctuate in value, so they are not likely to have a significant impact on third-party developer or employee morale. However, the lack of a measurable price may also make them less useful as a motivational tool. And, of course, they cannot provide funding for operational needs.

Note that to preserve the regulatory treatment of TRTs/points, projects may need to adopt restrictions regarding communications and lockup periods.

—

Builders can mix and match all of these strategies based on a project’s characteristics and overarching business strategy. For instance, if a Layer 1 blockchain achieves significant decentralization during its testnet phase, the project developers may be comfortable with a global, fully-transferable token at the time of mainnet launch. Or the founding team may want to invest significant development effort into reaching certain milestones following mainnet launch. And, as a result, exclude the U.S. from distributions until the project reaches sufficient decentralization. Similarly, a web3 gaming project may seek to use a fully-transferable token outside the U.S. and transfer-restricted token within the U.S. until the game’s ecosystem has been sufficiently decentralized.

But when mixing and matching, avoid undermining the legal benefits these strategies afford. For example, launching a restricted token and listing it on a U.S. exchange at the same time would undo the legal protections the restrict strategy is intended to convey. Similarly, excluding the U.S. from a token launch while advertising the token heavily there undercuts the strategy’s protections.

Launching decentralized systems that stand the test of time is incredibly difficult, but it’s why most of us are working in web3. We can choose to see these challenges as a path to regulatory purgatory, or we can reframe them as opportunities for thoughtful innovation, and treat them as a set of constraints for designing better systems.

The DXR framework provides a path for entrepreneurs to more fully explore how tokens can drive decentralization without necessarily taking on all the risks that having a token entails. It can also empower them to build products that are more useful, more secure, and better for users – projects with tokens that last well into the future irrespective of the ongoing efforts of their founders.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.

“Andreessen Horowitz is a private American venture capital firm, founded in 2009 by Marc Andreessen and Ben Horowitz. The company is headquartered in Menlo Park, California. As of April 2023, Andreessen Horowitz ranks first on the list of venture capital firms by AUM.”

Please visit the firm link to site