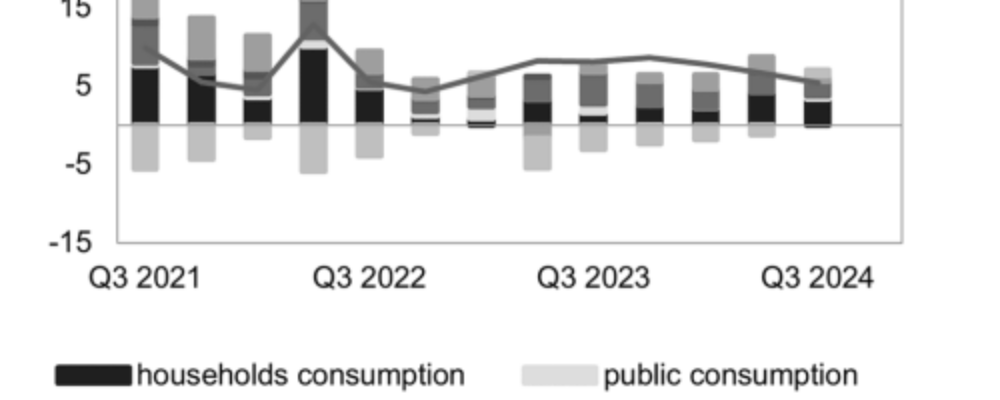

Confidence, or rather a lack thereof, is reflected throughout the economy: in retail sales (up 5.5% year on year in February, falling short of the consensus), private investment, imports (down 8.2% in February) and, above all, real estate indicators. Real estate is the main focus of concern: far from improving, key variables like housing starts, square footage sold and new construction have all deteriorated further in the early part of this year. With nearly half of all developers insolvent, the weakened real estate sector remains stuck in the first phase of its slow transformation: finishing projects already in progress and paid for that still offer a degree of profitability.

While the number of new construction projects has fallen 60% from its 2019 peak, average prices in major cities adjusted by a mere 6.3% in 2023. While this figure masks disparities between megacities that remain subject to strong demographic pressure (Beijing, Shanghai and Shenzhen) and other cities, it is indicative of the fact that the authorities are keen to regulate how far prices can fall, for three reasons:

- To avoid a negative wealth effect, with the real estate sector accounting for 70% of the assets of urban households.

- To avoid contagion to the banking system – still fairly robust despite its exposure to the real estate sector – if prices were to fall too sharply.

- To avoid further fuelling deflation, which would risk the price war that is already raging in the electric vehicle (EV) sector spreading to other sectors of the economy.

Second priority: avoid a price war

A price war is raging in the electric vehicle market. Battery maker BYD, now a giant in China’s automotive industry, is on the rampage. In 2023, it replaced Tesla as the world’s leading EV manufacturer, making China the leading exporter of cars, ahead of Japan and Germany. Since the start of this year, BYD, which is financially stronger than most of its competitors, has cut prices on its entry-level models even further, with basic models now starting at under US$10,000.

This price war is dangerous. Of course, it helps consumers in the short term by stimulating competition. But with the Chinese economy already struggling with very low or even negative inflation, it comes at a time when domestic demand is weak. While inflation finally returned to positive territory in February (coming in at 0.8% year on year), this was mainly down to a favourable base effect and the Chinese New Year, which tends to give prices a boost in sectors linked to the festivities (transport, hotels, catering, etc.).

In the automotive sector, two conditions must be met before a price war can happen: the authorities must provide high levels of subsidies (both directly to manufacturers – for example for research and development – and to buyers) and manufacturers’ margins must come down. Because they are targeting export markets, particularly in Europe, where they can charge higher prices while remaining competitive relative to American and European brands, automotive manufacturers are willing to accept a short-term squeeze on their margins.

But the European Union appears increasingly reluctant to throw open the single market to Chinese EVs, despite the fact that European consumers could benefit from lower prices and such a move would push up EV penetration compared to that of dirtier combustion engine vehicles. The Commission has thus kicked off an investigation to establish just what level of state subsidies Chinese EV makers are receiving, the idea being to use this argument to condemn unfair competition and put in place further tariff and non-tariff barriers.

Such an offensive would be very bad news for the Chinese economy, which is more reliant than ever on its manufacturing industry, particularly the “new three” (electric vehicles, solar panels and batteries), to maintain its industrial capability and sell off surplus production that cannot be absorbed by a sluggish domestic market. In February, the cumulative 12-month trade surplus reached a new record, coming in well above $1 trillion (at $1.096 trillion).

Third priority: offer an effective and credible political line

Until the Covid crisis came along, this was China’s great strength. These past four years, though, what markets expect and what the authorities want seem to have been out of alignment. Markets were disappointed first by the shakiness of the recovery in early 2023 and second by what they saw as inadequate fiscal stimulus from the government. As a result, certain decisions (e.g. to support equity markets, which were beginning to fall too fast) were hastily announced, serving only to further stoke fears over the real state of the economy.

Total stimulus measures over the last three years have been far from derisory, though they pale into insignificance compared with the huge stimulus campaigns of 2008 and 2015. However, they have failed to convince investors and consumers, and it is perhaps this that marks the starkest contrast with the past and China’s remarkable ability to find the right levers to revive the economic cycle.

If you look closely, however, what the authorities are saying is consistent with what they are doing: prioritising not only political stability and deleveraging – particularly in local government, responsible for much excess in this regard – but also the role of central government, the public sector and, above all, the Party at the centre of China’s economic life. Perhaps the problem lies in markets’ refusal to accept this change.

“Crédit Agricole Group, sometimes called La banque verte due to its historical ties to farming, is a French international banking group and the world’s largest cooperative financial institution. It is France’s second-largest bank, after BNP Paribas, as well as the third largest in Europe and tenth largest in the world.”

Please visit the firm link to site