Over a period of just 15 years, Europe has been confronted with a financial shock that originated in the United States, a pandemic shock that originated in China but could have come from anywhere, and an energy shock provoked by Russia’s invasion of Ukraine. These events have prompted a re-examination of efficiency/security trade-offs that arise as a result of international integration, and particularly as a result of specialisation in international trade and the vulnerabilities of global supply chains.

Economists and policymakers have long worried about similar trade-offs. At the most fundamental level, such trade-offs arise from the standard tension between growth and economic crises: higher growth is often accompanied by greater instability. For example, regulation of financial and product markets may prevent or mitigate financial or environmental hazards at the cost of dampening entry and growth of firms. Similarly, in open economies, trade and financial integration may be good for growth, but can expose economies to imported shocks.

The most recent set of concerns – as exemplified, for example, by a series of European Commission (2021, 2022) papers and an associated legislative agenda (see section 4, and McCaffrey and Poitiers, 2024) – differs from these standard preoccupations in two respects.

First, economic risks relate increasingly not just to crises or shocks, but to deliberate economic coercion by foreign governments or even non-governmental entities (such as criminal groups). This is probably the reason why the term ‘security’ – as opposed to ‘stability’ or ‘resilience’ – has become popular to describe the mitigation of economic, rather than just national security threats (we discuss the difference in section 2). One reason to be concerned with economic coercion is that China, an increasingly powerful and authoritarian country, has been applying coercion regularly in response to political actions by trade partners (for example, Australia’s call for investigations into the origin of the COVID-19 pandemic and Lithuania’s decision to let Taiwan open a representative office in Vilnius

). But the concern is not just about China: the policies of President Trump between 2017 and 2020 showed that even one’s closest ally can be tempted to leverage its market power and its control of the technical and financial infrastructures of globalisation. The possibility of a second Trump term is now prompting a reflection on the need for Europe to prepare for such a risk (Gonzales Laya et al, 2024).

Second, recent concerns have focused mostly on trade-related rather than financial vulnerabilities. This reflects the fact that trade-related vulnerabilities have become more prominent as a result of specialisation and the vulnerability of global supply chains that maximise efficiency, but at the cost of creating hidden fragilities. But the prominence of trade concerns may also reflect a rather myopic reasoning, as the last two or three external shocks that Europe (and, to a lesser extent, the US) has suffered have been trade-related: supply chain disruptions related to COVID-19 and energy price shocks following the Russian invasion of Ukraine.

In line with this concern, we focus mostly on trade-related external economic security. This should not be taken to imply that Europe does not need to worry about financial security. But unlike trade-related security, financial risks continue to be mostly of the financial-stability variety, linked to shocks and financial vulnerabilities rather than coercion. To the extent that financial coercion is a serious concern, it is linked to one main potential source: the United States if President Trump returns (see section 2). In contrast, trade-related external security risks are ubiquitous.

In this Policy Brief we seek to answer two critical questions. First, how should trade-related vulnerabilities be identified, and what trade relationships make Europe particularly vulnerable to shocks and coercion? Second, how can these vulnerabilities be reduced while minimising the costs of ‘de-risking’ and reducing the chances of unintended consequences? Four such potential costs come to mind:

- Foregoing some of the gains from trade specialisation and trade openness. This could weigh on European growth and competitiveness, which depend on export specialisation and on importing raw materials and intermediate inputs more cheaply than they could be produced at home (if at all). It could also make it harder to attain emission reduction objectives, by raising the cost of the transition to renewable energy sources. In turn, this could exacerbate social and political divisions related to climate action.

- Becoming more vulnerable to domestic shocks including natural disasters, epidemics and home-grown financial crises – and more generally, to any shock whose consequences would be mitigated by international trade and/or capital flows.

- Damaging international cooperation. This could include European Union cooperation with China on vital matters of common interest, such as climate-change mitigation, as well as respect for the rules of the multilateral trading system. Notwithstanding the damage that the World Trade Organisation has suffered over the last decade, these rules continue to be largely respected (Mavroidis and Sapir, 2024). An aggressive ‘de-risking’ of European trade relationships through trade policy tools and subsidies could trigger protectionist reactions from trading partners, particularly if measures violate WTO rules. It could also become an excuse for protectionists in the EU, who might use economic-security arguments to further special interests.

- Damaging cohesion within the EU. EU countries differ in their trade structures and their dependence on specific export and import markets. As a result, attempts to de-risk trade may have net benefits for some and net costs for others. If de-risking becomes a source of division, it may be counterproductive, as internal divisions in the EU are partly what an adversary – whether China, Russia or President Trump – might try to exploit (and indeed, divisions are what these three powers have tried to exploit in the past).

The remainder of this paper summarises as best we can the answers to these questions, drawing on a set of papers commissioned by Bruegel and CEPR (2024). Section 2 defines what we mean by economic security, and what risks we should be worrying about. Section 3 discusses how these risks should be addressed in principle. What trade relationships require de-risking? Section 4 discusses the instruments. How can protection be built that preserves the benefits of trade? A concluding section summarises the main lessons.

Defining risks to economic security

As noted by Bown (2024), economic security remains an emerging concept. At its most abstract level, it can be defined as both preventing bad economic outcomes and making sure that should risks materialise, the damage they cause is minimised. Societies care both about raising expected welfare and about reducing its volatility. Economic security is concerned with the latter.

Defined in this broad way, economic security has been a standard concern of policymakers for centuries – and not just of economic policymakers, since economic harm can be inflicted by ‘non-economic’ shocks, including political disruption and wars. The use of state intervention to address these concerns, including industrial policy and trade policy, is similarly nothing new (Kelly and O’Rourke, 2024). The question, then, is how the concept of ‘economic security’ differs from those of ‘economic crisis prevention’ or ‘national security’. To the extent that the perceived nature of the risk and risk propagation has changed, it is important to understand how it has changed, to avoid duplication, and to prevent overreaction to perceived new risks when the old risks and risk propagation channels might still be there.

Economists concerned with crisis prevention and mitigation typically focus on risks and vulnerabilities related to the financial system or the structure of production. For example, credit cycles can expose countries to financial crises, which are propagated internationally. Dependence on commodity exports or imports exposes economies to swings in international prices and to disruption to domestic production that relies on commodity imports.

Military and security experts worry about a different type of threat: harm that is inflicted purposely by outside actors, normally nation states, but also terrorist or criminal organisations. Murphy and Topel (2013) widened the definition of national security to include all “substantial threats” to the safety and welfare of a nation’s citizens, eg including national catastrophes and public health threats. Defined this broadly, national security would include preparedness and mitigation against any harmful acts conducted by foreign governments or non-governmental organisations with military or non-military means, including economic sanctions, and threats related to physical and information infrastructure.

The recent usage of the term ‘economic security’ is at the intersection of non-financial economic crises and national security in the broad sense defined by Murphy and Topel

. Specifically, it focuses on harm inflicted through international economic relationships – and particularly trade relationships – whether these reflect exogenous shocks (such as COVID-19-related trade disruption) or deliberate actions by foreign governments or non-governmental organisations (Bown, 2024; McCaffrey and Poitiers, 2024; European Commission, 2021, 2022). These risks are particularly relevant today because of the combination of economic integration through trade and FDI, specialisation, long supply chains and actors willing to engage in coercion through these channels.

It is in this sense that the term ‘economic security’ will be used in the remainder of this paper. In this definition, achieving economic security involves the prevention and mitigation of:

- Disruption to critical imports, whether accidental or deliberate;

- Economic coercion through restrictions or boycotts on specific exports, along the lines of actions taken by China against Australia; or through pressures on foreign companies even when they produce locally (for example, threats of depriving them from access to the domestic market, restrictions on profit repatriation, or expropriation);

- A broad disruption of global trade at a scale with macroeconomic impact, for example, as a result of geopolitical conflict leading to economic sanctions or a protracted tariff war with a major trading partner. Events that could trigger such scenarios include a Chinese attack on Taiwan, or the re-election of President Trump triggering a sharp deterioration of the political relationship between the US and the EU.

It is important to emphasise that this a narrow – perhaps inappropriately narrow – definition of economic security, for two reasons.

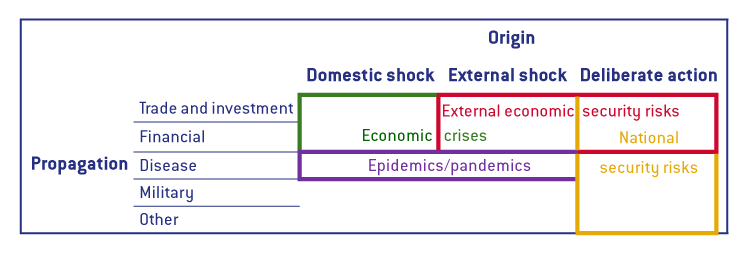

First, it disregards the possibility of economic disruptions as a result of domestic shocks, which historically have been a major source of economic crises (Table 1). Hence, a better term for the type of economic-security risks we discuss would be ‘external economic security’. This terminology reminds us that there could be trade-offs not just between economic security and economic growth, but also between external economic security and security from domestic shocks. International integration may increase exposure to the former, but offers protection against the latter.

Table 1: Varieties of welfare threats and propagation mechanisms

Source: Bruegel. Note: The columns in Table 1 define the origin of a bad event – an exogenous shock originating at home or abroad (production disruption, natural catastrophe, transportation or infrastructure disruption, confidence shock) or a deliberate action by a foreign government or a non-governmental entity. The rows define the propagation channel: economic activity related to trade or finance, disease, military action or other (for example, through IT infrastructure).

Second, the narrow definition largely ignores external economic security risks through financial channels. However, international finance – including the international payments system and the confiscation of financial assets located in foreign jurisdictions – is an obvious instrument of economic coercion and economic sanctions, as shown by G7 sanctions against Russia since its full-scale invasion of Ukraine. The main reason why financial risks do not feature prominently in the recent literature on European economic security is that Europe is much less likely to be on the receiving end of such sanctions, given the control exerted by the US and its allies over international finance. But this could rapidly change if President Trump is re-elected in the United States and decides to use financial coercion against Europe for whatever reason (for example, to force Europe to align its foreign or commercial policies with those of the United States, as was the case when the US threatened EU firms with ‘secondary sanctions’ for violating US-imposed sanctions on Iran).

A broader analysis of European economic security should take into account such financial economic risks and how to mitigate them. For now, the remainder of this paper focuses on trade and investment-related risks. These are particularly relevant for the relationship with China, but could also become relevant in the event of a return of President Trump and a revival of US tariffs against Europe, whether imposed for mercantilist or political reasons.

What to de-risk

Firms have incentives to avoid becoming dependent on one or a small number of suppliers or customers, particularly when those suppliers or customers are vulnerable to high risks outside their control, including politically motivated interference. Yet, as Mejean and Rousseaux (2024) have pointed out, the firms’ private interest in security may not be enough to take care of the collective EU security interest. Firms often fail to realise the extent to which suppliers or customers are themselves subject to risks, simply because they do not know the entire value chain. Firms also do not internalise the potential costs of supplier or customer dependency on the entire value chain, and ultimately the welfare of citizens. If a supplier relationship represents a critical link in that chain, the social costs of that link failing may far exceed the private costs to the firm. This argument, which is broadly consistent with the evidence presented by Bown (2024), can justify policy-led de-risking.

But what areas of trade require de-risking? How can policymakers tell when trade dependencies are excessive, in the sense that the economic security risks of trade outweigh its benefits, both for efficiency and growth and as protection against domestic disruption? The ideal way to answer this question would be through a firm-level model of trade and supply relationships, both across borders and within the EU. The model would ‘know’ who trades with whom, how specific inputs enter each stage of production, and to whom firms sell. It would also have information about the ease of switching suppliers if a supplier fails or sharply raises its prices. Such a model could be used to stress test European economies in relation to specific supply chain or customer risks. Where large effects are found, it would be used to identify trading relationships worth de-risking. Unfortunately, such a model does not exist and may never exist because of data limitations. We are therefore constrained by the available information and should make the best of it.

3.1 Critical goods and the risk of import disruption

Suppose we were mainly interested in risks related to import disruption. This would be the case if exports are either well diversified or go mainly to countries that one would not consider to be major sources of shocks. In that case, the following approach might be a close substitute for the perfect model. Using the most disaggregated data possible, one should identify products for which:

- A large share of EU consumption relies on imported inputs;

- Foreign supply of these goods is highly concentrated;

- Finding alternative suppliers in the event of a disruption is difficult, and

- Disruption to supply would have high economic costs. Unlike criterion 3, this criterion reflects the substitutability of products in either consumption or production, as opposed to the substitutability of supplier relationships.

Products that meet all four criteria would be prime candidates for de-risking.

This approach, which builds on work undertaken by the European Commission (2021), approximately describes the approach taken in Mejean and Rousseaux (2024). Their main innovation relative to the work of the Commission and other authors is step 3, which they implement by eliminating products for which “relationship stickiness” – the typical duration of firm-supplier relationships – drops below a specific threshold. For example, if the stickiness threshold is set at the sample median, the number of products for which the EU should consider itself import-dependent drops from 378 to just 105, and to just 49 if the 75 percent least relationship-sticky products are eliminated (Figure 1). Focusing only on upstream intermediate products – for which an export ban would affect many supply chains and hence have high economic costs – would reduce the list further, to just 21 products. For 12 of these, the main supplier is China.

Figure 1: Number of products for which the EU is import dependent

Source: Mejean and Rousseaux (2024). Note: The figure shows the numbers of products for which the EU is import-dependent according to various methodologies, starting with that of the European Commission (2021) (second blue bar) and adding the criteria proposed by Mejean and Rousseaux, based on the ratio of imports over domestic absorption (red bar) and the degree of product stickiness (green bar). Numbers in brackets refer to percentage of value of EU imports.

To these, Mejean and Rousseaux (2024) suggested adding a small number of “critical goods” that, if insufficiently supplied, “can result in human losses and other severe non-economic consequences”. These would include between two and 19 pharmaceutical products, depending on where the substitutability cut-off is set, as well as inputs to the green transition. Interestingly, most of these inputs – including most critical raw materials, which have been among the main justifications for the drive to de-risk imports, particularly from China – currently fail one or several of Mejean’s and Rousseaux’s dependency tests. While highly relationship-sticky, batteries and their components, hydrogen technologies, rare earth metals and solar panels fail the concentration test, and most components of solar panels fail both the concentration test and the relationship-stickiness test. Yet, Mejean and Rousseaux urged caution with respect to these products, on the grounds that demand for them is developing so fast that the structure of EU imports during 2015-2019, on which concentration indices and import needs are based, may be a poor proxy for trade dependencies in the future.

Mejean and Rousseaux’s work represents the most exhaustive analysis so far to identify dependencies on the basis of ranking critical imports with respect to concentration and relationship substitutability, and deciding on thresholds above or below which concentration is deemed too high or substitutability too low. Precisely because it is more thorough and comprehensive than previous attempts in this literature, Mejean and Rousseaux (2024) illustrates the intrinsic limitations of this approach.

- We have so far no systematic way of telling which imports are genuinely critical. Focusing on upstream products and pharmaceuticals may miss other products (such as computer chips), the accidental scarcity of which would cause large economic or non-economic losses. Meanwhile, some upstream products and pharmaceuticals might not be critical if they can be substituted by other products. The European Commission’s (2021) approach of designating whole “ecosystems” (sectors, such as health, energy, digital, electronics and aerospace) as critical, seems even more problematic, both because many products in these sectors are not in fact critical and because products outside these sectors that may well be critical could be missed (for example, most of Mejean and Rousseaux’s upstream products).

- As both Mejean and Rousseaux (2024) and Bown (2024) emphasise, data limitations imply that import dependence measures do not reflect indirect exposure. If the EU has an import exposure to a country that is itself import dependent on China for this product (or an important intermediate input), then direct import dependence on China might significantly understate total import dependence.

- The final lists can be very sensitive to how the cut-offs are set, which is somewhat arbitrary. For example, whether relationship substitutability thresholds are set at the twenty-fifth, fiftieth or seventy-fifth percentile adds or subtracts large shares of products from the sample.

- Supplier relationships in normal times tend to be relatively long (25 and 19 months, respectively, for the seventy-fifth and fiftieth percentiles in Mejean and Rousseaux’s sample). This implies that unless replacement duration is significantly shorter in a crisis, an import interruption could be very damaging even for products that are relatively non-relationship-sticky in normal times. But the impact of a forced interruption on the replacement period could go both ways. Firms seeking to replace suppliers under duress would have incentives to do so much faster than in normal times. However, finding new suppliers when many other firms are trying to do so could take longer and/or result in price jumps for scarce supplies, which could be very damaging.

3.2 Risk from export disruptions and from decoupling

Another problem is that an approach focused on reducing dependence on critical imports does not consider disruptions to exports, which could equally have a macroeconomic impact if they were highly concentrated in any one destination country. For example, 20 percent of EU exports got to the US, 13 percent to the United Kingdom and 9 percent to China; while 41 percent of UK exports go to the EU, 21 percent to the US and 5 percent to China. Furthermore, just as import dependency numbers ignore indirect exposures, so do export shares. For example, direct UK export dependency to China is only 5 percent, but the UK’s indirect exposure via the EU alone could be larger if UK products are part of the value chains of goods ultimately destined for the Chinese market.

While demand shocks via exports are a standard risk of trade integration, geopolitical conflict can take this risk to an entirely new level. First, hitting the exports of specific industries through import bans, high tariffs or social-media campaigns can be a form of geopolitical coercion. As reported by Bown (2024) and McCaffrey and Poitiers (2024), there are numerous examples of Chinese coercion of this type. This type of coercion is typically not macroeconomically critical, but may seek to exploit the lobbying power of groups that are hurt, as well as internal divisions (in the case of the EU, this may include divisions across member states). Second, deliberate economic sanctions can of course have a much greater impact than swings in export demand triggered by normal economic fluctuations, or even than an economic crisis in a trading partner.

Baqaee et al (2024) simulated the impact of a decoupling from China in a trade model with 43 countries and 56 sectors, in the form of a complete stop in trade between a ‘Friends’ bloc comprising the G7 countries, Spain, the Netherlands and an artificial country comprising the rest of the EU, and a ‘Rivals’ bloc including China and Russia, on the assumption that trade continues both within these blocs and with the rest of the world. As might be expected, the short-term effects are substantial, with German output calculated to decline by 3-5 percent of GDP. At the same time, the simulations suggest that the cost of a complete decoupling from China would be relatively low if done slowly over time: around 1.25 percent of GDP for Germany and Japan, while the US and the remaining European countries would suffer in the range of 0.47 percent to 0.69 percent of GDP. The intuition behind this result is that the welfare costs of an end to trade integration between China and the ‘Friends’ group are mitigated by the fact that the Friends continue to trade with each other and with the ‘Neutrals’, and that these groups are sufficiently large and diverse to preserve most of the gains from trade.

3.3 Putting it all together

Combining the insights of Baqaee et al (2024) and Mejean and Rousseaux (2024) with the assumption that external economic risks include not only exogenous shocks to trade but also coercion, and possibly a wider trade disruption involving China, leads to the following conclusions.

First, there is a strong case for de-risking concentrated exposures to critical imports, by either diversifying supply or making preparations to mitigate disruption. However, identifying such products turns out to be very difficult, mainly because it is hard to assess the criticality of products, ie the welfare losses inflicted by a shortage or price spike. While we know that some products are critical – chips, energy, some pharmaceuticals, some minerals and some upstream inputs – we do not know what other products are critical. A good way to start is by de-risking the products known to be critical. Because we don’t know how long it would take to find new suppliers in a crisis, or how price sensitive these imports might be to a loss of the main supply source, products known to be critical should be de-risked even if their relationship stickiness in normal times is fairly low.

The identification of such products obviously needs to take into account the costs as well as the benefits of de-risking. Take the example of solar panels and their components, often cited as a prime de-risking candidate because of their importance in the green transition and China’s overwhelming global market share (63 percent, according to Mejean and Rousseaux, 2024). However, the short-term economic costs to the EU of a complete stop in solar panel imports from China would be tiny (hitting mostly installation services, while leaving the solar capacity unchanged). Unlike imported gas from Russia, disruption to solar panel imports from China would have no direct impact on the energy supply, although it would affect the increase in installed energy capacity and would raise the cost of replacing panels that become obsolete. Hence, the main benefit of de-risking Chinese solar panel imports would be insuring against a (possible) disruption to the energy transition to renewables, which could sharply raise solar-panel prices. This needs to be weighed against the certain price impact of a decision to diversify away from Chinese solar imports and purchase panels from more expensive sources, which will slow the green transition.

Second, the de-risking of trade dependencies cannot be the only layer of protection against import disruption, because it will never be possible to identify and de-risk all critical products. Beyond trade de-risking, it is hence essential to strengthen the resilience of European economies against import shocks, whatever their source. This is an argument for a better-functioning and more flexible single market, and for the broadening of international trade relationships through free-trade agreements with friendly countries.

Third, it is important to de-risk export dependencies as well as import dependencies. For specific products, this could be done in three ways: by deterring coercion (as the EU’s new anti-coercion instrument, discussed in the next section, attempts to do); by offering EU producers incentives to diversify export destinations, particularly to reduce concentrated exposures to China; and through insurance mechanisms that reduce ex post the impact of export disruptions to specific products. The latter must of be designed in a way that avoids moral hazard, ie does not encourage concentrated exposures ex ante. We return to possible instruments for export diversification and ex-post protection in the next section.

Fourth, there is a role for deterring coercion, rather than just reducing vulnerability to it. This is because de-risking of export and import dependencies will never be complete – and should not be complete, given that de-risking needs to be weighed against the benefits of trade specialisation and continuation of trade with China and other countries that may use coercion.

Fifth, there is the question of whether the EU should reduce its overall trade integration with China to soften the blow of sudden trade disruption triggered by a geopolitical confrontation. According to Baqaee et al (2024), the cost of a gradual reduction in trade integration with China would be small for most EU countries, even if trade integration is reduced all the way to zero. Even for Germany, where the cost of complete decoupling from China would not be small, the cost of a partial reduction of trade integration – for example, reducing export and import shares by one third – would be small if pursued gradually. On this basis, policy measures to encourage a pre-emptive reduction in trade integration would be justified if all three of the following conditions are met:

- The probability of a very costly sudden trade disruption is considered to be sufficiently high, and

- Firm-level diversification of trade is not, by itself, sufficient to engineer this pre-emptive de-risking.

- Targeted (ie firm- or sector-level) export diversification efforts do not have a substantial impact in terms of reducing aggregate import dependency.

There is significant uncertainty around each of these points. With regard to points two and three, Bown (2024) found that trade diversion triggered by US tariffs on China and Chinese retaliation has further increased EU trade integration with China. With fresh US legislation directed against Chinese imports, such as the Inflation Reduction Act, this effect might continue. At the same time, the combination of a heightened sense of the risks created by concentrated exposure to China and the structural slowing of the Chinese economy might push in the other direction. Furthermore, targeted de-risking efforts may have an aggregate impact, particularly if they reduce concentrated exposures to China in major sectors for the EU economy, such as the car industry.

Finally, it is important to highlight two trade-related economic-security concerns that are the intellectual cousins of the risks identified and quantified by Baqaee et al (2024) and Mejean and Rousseaux (2024), but are not directly discussed in those papers.

The first is the obvious risk, already mentioned in section 2, of a broad disruption to European trade with the United States in the event of a return of Donald Trump to the US presidency

. Given the much larger share of US imports and exports in European trade, this could hit Europe even harder than a disruption to trade with China. While Baqaee et al (2024) did not directly simulate such a shock, this is suggested by their “EU autarky” scenario, which has substantial costs even in the long run, ie even when phased-in slowly (a permanent consumption loss of 9 percent of GDP).

It follows that de-risking the trade relationship with the US by reducing trade integration might makes sense only if an even more catastrophic sudden decoupling from the US is viewed as likely. However, a disruption to trade with the US would likely take the form of a (limited) tariff war rather than a trade embargo. This argues against a pre-emptive reduction in trade with the US. Instead, the EU must be politically prepared to fight a trade war with the US, if and when a returning President Trump decides to start such as war.

A second related concern is that exposures to China and other countries that might engage in coercion against EU firms could take the form of asset expropriation – in particular, expropriation of production sites. By removing an important source of foreign revenue and profits, this could impact EU firms in much the same way as an import prohibition. However, the risk would show up ex ante in the form of a concentration of profit sources, rather than concentrated exports, and the remedy could involve diversification of production sites and profit centres, rather than diversification of exports, as along with increases in capital buffers.

Summing up, our analysis results in five main calls for European policy action:

- Reduce import dependency for critical products;

- Diversify foreign revenue sources and/or strengthen firm resilience against potential disruption to foreign demand, asset expropriations or payment controls impeding profit repatriation;

- Deepen the EU single market and make it more flexible;

- Deter economic coercion of any kind, whether through imports or exports, or through other means such as expropriation;

- Possibly, limit overall trade dependency (and particularly export dependency) on China, at the aggregate level.

Achieving these objectives requires policies that are effective, that balance costs and benefits, and that minimise risks of unintended consequences. We next examine what such policy might look like concretely, starting with those the European Commission has already started implementing.

How to de-risk

As the outbreak of COVID-19 revealed dangerous vulnerabilities and called for a reassessment of the EU’s international economic relations, rising pressure from the US under the Trump presidency and the increasingly aggressive behaviour of the Chinese government focused the attention of European policymakers on the threat of economic coercion and prompted a redefinition of the toolkit with which they could respond. The EU took a series of major initiatives to strengthen its economic resilience and to equip itself to better counter malicious behaviour by economic partners (Box 1).

Established in 2005, it is independent and non-doctrinal. Bruegel’s mission is to improve the quality of economic policy with open and fact-based research, analysis and debate. We are committed to impartiality, openness and excellence. Bruegel’s membership includes EU Member State governments, international corporations and institutions.

Please visit the firm link to site