Britain’s housing stock has been dubbed the “worst value for money” in a Resolution Foundation report. With the media reporting that the UK is in the midst of a housing crisis, you might not be surprised by the news, but how the UK compared to other countries could still shock you.

Read on to find out more about the research conclusions and why soaring house prices could mean it’s more important than ever that you secure a competitive mortgage.

British property buyers are “paying more for less”

Many other countries are battling a housing crisis too. In a lot of developed countries, demand for property is outstripping supply and it’s led to climbing house prices, even after concerns that the Covid-19 pandemic and rising interest rates would lead to a fall.

Across almost every metric the Resolution Foundation measured, including housing costs, floor space, quality, and wider price levels, the UK fell short. Indeed, the study found that Brits are “paying more for less” and the UK housing stock offered the “worst value for money of any advanced economy”.

UK homes were found to be some of the smallest among the countries included in the report. Indeed, the average floor space per person in the UK is 38m2. That’s significantly smaller than many similar countries, including the US, Germany, France, and even Japan. Indeed, even properties in high population density New York were found to offer a more spacious 43m2 per person.

It’s not just the space that could present challenges for UK homeowners – the UK’s housing stock is also the oldest of any European country.

More than a third of homes in the UK were built before 1946. In comparison, the number of homes built before the end of the second world war is just 21% in Italy and 11% in Spain.

As older properties tend to be poorly insulated when compared to newer counterparts, Brits could be paying higher energy bills as a result and might be more likely to face damp issues.

With a general election set to be called this year, the housing crisis could become a key topic during election campaigns.

Rising house prices could mean a competitive mortgage is crucial for your budget

If you’re looking to purchase property, news that the UK’s house prices are high can be frustrating.

Signs suggest the market is slowing – house prices fell by 1% in March 2024 when compared to a month earlier, according to the Halifax House Price Index. However, experts aren’t predicting a sustained fall. Indeed, Halifax noted that house prices have shown “surprising resilience” in the face of higher borrowing costs due to interest rates rising.

There might be little you can do to bring down house prices, but you could save money by choosing a competitive mortgage deal.

Even a small decline in the interest rate you’re paying could cut your household’s outgoings in the short term and really add up when you calculate how much interest you’d pay over the full mortgage term.

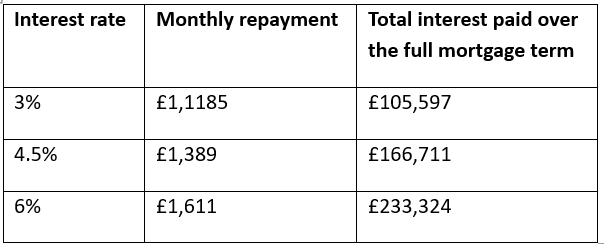

The table below shows how the interest rate would affect your expenses if you borrowed £250,000 through a 25-year repayment mortgage.

Source: MoneySavingExpert

As you can see, taking some time to secure the right mortgage deal for you could reduce your regular outgoings and potentially save you thousands of pounds over the full mortgage term.

Considering how lenders may view your application could be worthwhile. For instance, are there any red flags on your credit report that might mean a lender offers you less competitive terms or even rejects your mortgage application?

Identifying the lenders that are more likely to offer you a lower interest rate could be useful too. According to the Bank of England data, there are around 340 regulated mortgage lenders and administrators operating in the UK. So, shopping around might lead to a deal that’s better suited to you.

Understanding the lending criteria of each lender can be difficult, but may be important for assessing how likely they are to approve your application. An independent mortgage adviser could search the market on your behalf to find a lender that may be right for you – it could make securing your new property or mortgage smoother and less stressful.

Contact us to talk about your mortgage needs

If you need to find a mortgage that suits you, we could help. We’ll work with you to understand your needs and provide support throughout the mortgage application process. Please contact us to arrange a meeting.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

The post Britain’s housing dubbed “worst value for money” of any advanced economy appeared first on Black Swan Financial Planning.

“Black Swan Financial Planning was established in 2000, and since then became one of the top independent financial adviser firms in the UK.”

Please visit the firm link to site