New online-privacy regulations and reduced use of online “cookies,” which track people’s movements on websites, have been lauded by online-privacy advocates—but they’ve made things tough for corporate marketers. It means that today, most marketers are finding it harder to measure the efficacy of their online campaigns with the level of granularity they could in previous years.

Tracking specific individuals online has become much more difficult, forcing marketers to find new ways to measure the impact of their spending. But this change is also spawning new innovation. We’re excited to see an emerging category of new marketing-measurement tools, many championed by new startups, that are modern, dynamic and focused on first-party data, meaning data owned by a specific brand drawn from its own financials or customers with their consent.

Today’s Privacy Backdrop

Data privacy regulations have been getting stronger since the European Union implemented its landmark GDPR policies in 2016, and California enacted its CCPA in 2018. However, in our view, the most impactful policies have been Apple’s iOS 14.5 release in 2021 and Google’s 2022 announcement to sunset cookies. iOS 14.5 required brands to include a prompt allowing users to opt-in or opt-out of data tracking, and Google’s move severely deprecated the value of third-party data from cookies. This trend has continued with Apple’s iOS 17 release in June 2023 which removed unique link tracking and user fingerprinting. Now, marketers are forced to rely on measurement methodologies that use first-party data.

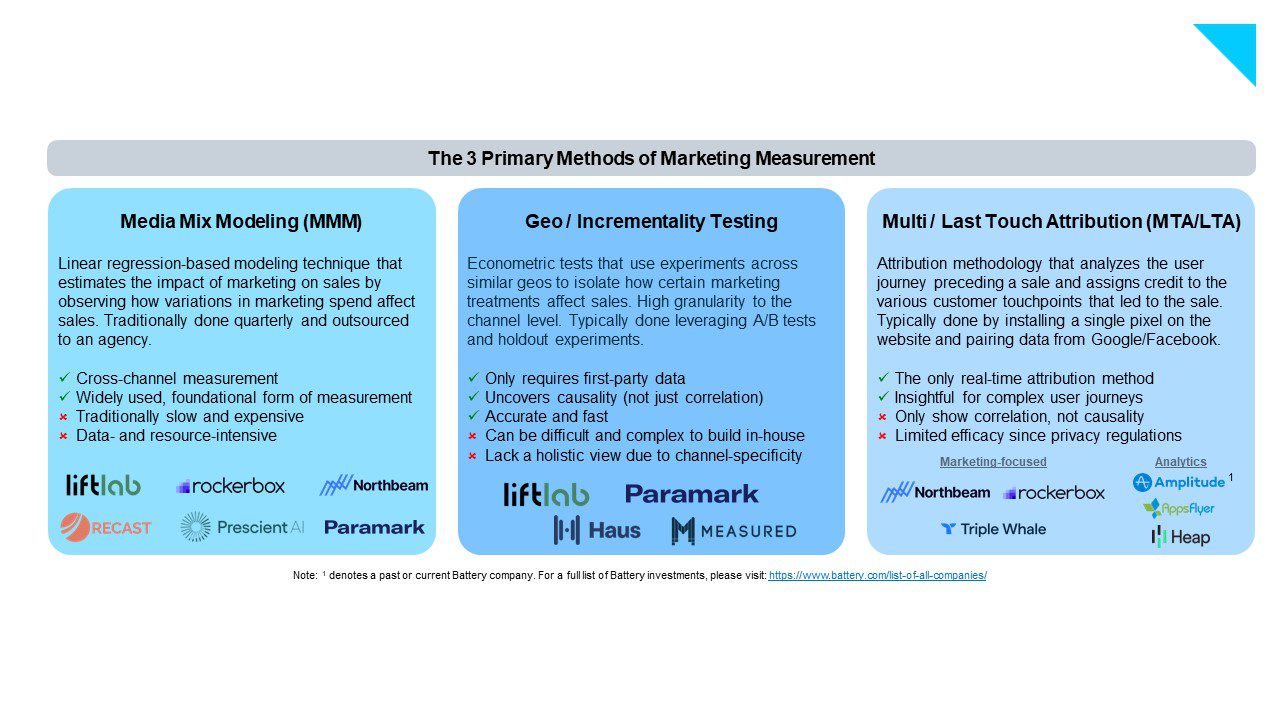

Today, marketers primarily use three key methodologies for evaluating the ROI on spending. We’ll provide an overview of each of these and discuss how they are evolving in light of the deprecation of cookies and third-party data.

The 3 Primary Methods of Marketing Measurement

Multi-Touch Attribution (MTA)

MTA is an attribution technique that detects all interactions across the customer journey to determine which touchpoints resulted in an actual conversion event (signup, sale, etc.). This is a more elaborate derivative of Last Touch Attribution (LTA), which simply attributes conversion to the last marketing interaction that a customer had.

To understand MTA at work, imagine that a customer who purchased a product had first learned about the brand from a Google search on, say, “best travel backpack,” after which a paid search ad for a luxury travel brand appeared. Later, the same customer clicks on an Instagram ad from that brand that was uniquely served up to them given their search history, ultimately resulting in a sale. Both paid search and Instagram would receive attribution credit for the sale based on weightings determined by the marketing team.

MTA can be effective for multi-step journeys and capturing cross-channel attribution in real time. However, it has two important caveats to consider. First, while MTA proves correlation (the user who clicked a paid search link ultimately made a purchase), it does not explain causation (which touchpoint actually led to the conversion). Second, MTA relies on user-level identification that is becoming less reliable due to privacy changes.

Companies like Rockerbox, Northbeam and Triple Whale are modernizing MTA by enabling brands to track user touchpoints with first-party data instead of third-party cookies. Analytics companies like Amplitude*, Heap and Appsflyer also make software to track user journeys for marketing attribution.

Media Mix Modeling (MMM)

MMM is a linear regression-based modeling technique that estimates the impact of marketing by observing how variations in marketing spend affect sales. MMM measures the impact of marketing across all channels (online and offline) and aims to calculate the relative impact of each channel, providing an apples-to-apples comparison across channels. It works best over longer time horizons and is typically conducted once or twice per year.

MMM was first introduced decades ago but has remained a fundamental attribution methodology since. Traditional MMMs were designed in a pre-digital era with fewer marketing channels, less dynamic marketing strategies and simpler customer journeys.

Today, the marketing environment is much more complex. Paid-media decisions are often made on a weekly basis, and consumer journeys have multiple touchpoints. New marketing channels continue to enter the landscape (TikTok, Snap, podcasts) and brands old and new are becoming omni-channel. For example, D2C brands like Harry’s, Casper and Away* have opened up brick-and-mortar retail stores while incumbents like Nike, Walmart and Target are investing heavily in e-commerce.

In order to adapt to this changing environment, companies like Recast, Rockerbox, LiftLab and Paramark are modernizing MMM with software-based models that are faster and offer more frequent updates (e.g. weekly). They’re also quite agile and adaptable to dynamic spend levels, and they provide actionable insights on how to adjust strategy.

Geo Testing

The third key measurement method is geo testing, which uses statistical experiments to isolate how marketing affects sales. For example, marketers will first select geographies that can be considered “apples-to-apples” comparisons, like Cleveland and Cincinnati, and then run different marketing plans in each geography to isolate the effect that marketing has on sales. Say, over the course of a month, Cleveland receives zero marketing spend and Cincinnati receives $500K of Google ads. Then, marketers can measure the efficacy of the ad spend by analyzing the difference in sales generated over that month between the two cities. Geo tests vary in complexity (e.g. testing multiple different geos and spend levels in one experiment) and can be carried out across many different paid-media channels.

The greatest strength of geo testing is that it is immune to privacy changes since it doesn’t require any user-level data, but instead utilizes higher-level metrics like sales and ad spend.

Also, geo testing provides two unique insights into marketing efficacy:

- Causality. By isolating a single variable in the experiment (marketing spend), marketers can uncover the direct causal relationship between ad spend and revenue generation.

- Incrementality, which answers the question of ‘how many sales would have occurred anyway even if a customer had not seen an ad?’. For example, if a customer searches for “Patagonia backpack” and then clicks a paid search link for Patagonia, the sale will appear attributable to paid search even though the customer was already searching for Patagonia directly and likely would have made the purchase anyway without seeing the paid search link.

Companies like LiftLab, Haus, Paramark and Measured are building software powered by modern econometrics to productize geo testing into a simple and easy-to-use UI.

Marketing Measurement in Practice

In the real world, sophisticated marketing teams often use a mix of these methodologies. Each has unique strengths and weaknesses that make them complementary when used together: MTA is used for day-to-day paid spend decisions, MMM is used for longer-term planning/budgeting across channels, and geo tests are used for determining the optimal level of spend in each channel. These methodologies can also be used to better inform and refine the inputs of the others. For example, geo test results can be used to bolster MMM assumptions and MMM results can inform when it’s time to run or re-run geo tests.

Conclusion and Market Opportunity

At Battery, we believe that evolving privacy policies and regulations have forced marketers to change how they measure their ad campaigns, leading to the creation of many new and exciting companies within the marketing-measurement space. Ultimately, we think a category leader will emerge and become the all-in-one platform for marketing measurement based on first-party data, combining MMM, geo testing and MTA. This one-stop platform will provide growth marketers with one cohesive product suite to measure all of their marketing spend, collect and analyze marketing and customer data and benchmark marketing performance across their peers.

If you are building or investing in this space, we would love to speak with you!

*Denotes a past or current Battery company. For a full list of Battery investments, please visit: https://www.battery.com/list-of-all-companies/

The information contained herein is based solely on the opinions of Michael Brown, Dallin Bills and Adam Piasecki and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity.

The information and data are as of the publication date unless otherwise noted. Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.

The information above may contain projections or other forward-looking statements regarding future events or expectations. Predictions, opinions and other information discussed in this video are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Battery Ventures assumes no duty to and does not undertake to update forward-looking statements.

Back To Blog

“Battery Ventures is an American technology-focused investment firm. Founded in 1983, the firm makes venture-capital and private-equity investments in markets across the globe from offices in Boston, Silicon Valley, San Francisco, Israel and London.”

Please visit the firm link to site