4 July 2024

Firms’ inflation expectations are key for monetary policy makers. The ECB Blog presents new survey data on these expectations, evidence on what influences them, how they change when new information becomes available, and if they matter for the plans and choices firms make.

Setting prices, negotiating wages, deciding how much to invest or how many workers to employ – these are all choices companies make that have profound implications. When taking these decisions, firms typically consider their own business needs, the behaviour of their competitors, the state of the economy and how they think it will evolve. How firms form their expectations about inflation, and how these expectations influence their decisions, is therefore important for central banks.

The inflation expectations of euro area firms are not very well understood. One reason is that they are not measured in a consistent way across countries. The 2020/21 ECB monetary policy strategy review highlighted this information gap, and so the ECB recently expanded its euro area wide firm survey, the Survey on the Access to Finance of Enterprises (SAFE), to include regular questions on firms’ inflation expectations. This new source of data now allows us to explore several important questions: What influences firms’ inflation expectations? Do firms’ inflation expectations react to news about the inflation outlook? And do these expectations matter for firms’ plans and decisions?[1]

What influences firms’ inflation expectations?

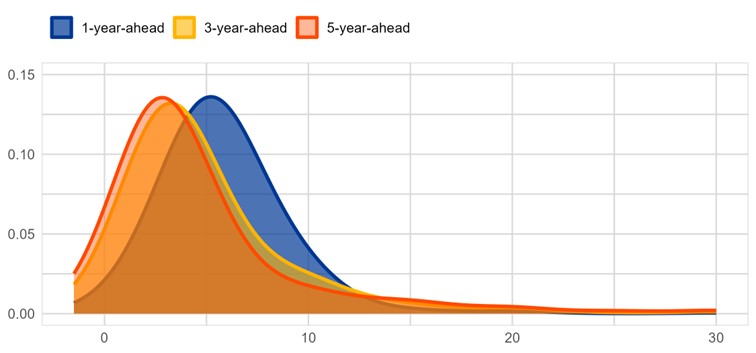

Chart 1 provides a first glimpse of euro area firms’ inflation expectations as of June 2023, with three points standing out. First, firms tended to expect inflation one year ahead at 5.8 percent on average, to be somewhat higher than actual inflation (of 5.5 percent) at the time. Second, they expected that inflation would come down, with expectations of inflation 3-years-ahead and 5-years-ahead at 5.0 and 4.8 percent on average, respectively. Third, firms have very different views on where they expect inflation to be in the future, especially the more distant future, as shown by the dispersion in their responses. While on average firms expect inflation to moderate over time and come closer to the ECB’s 2% inflation target, they have more widely differing views on where inflation is going in the longer run.

We also find that inflation expectations of euro area firms are distinct from those of households or professional forecasters. Firms on average expect higher inflation than professional forecasters, but in this they are similar to households.[2] At the same time, firms’ expectations one year ahead are more widely dispersed than those of professional forecasters and less than those of households.

Chart 1

The distribution of inflation expectations across euro area firms.

x-axis: level of inflation expectations in percentages per annum, y-axis: share of firms

Source: Survey on the Access to Finance of Enterprises and authors’ calculations. Note: The chart shows kernel densities of firms’ inflation expectations at various horizons.

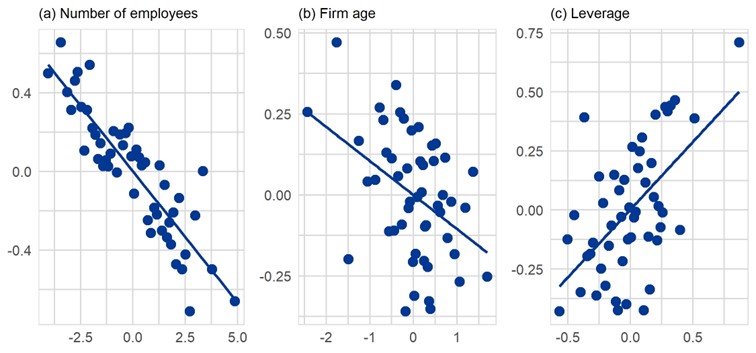

The new SAFE data also provides insights on the factors that influence firms’ inflation expectations. For example, firms’ inflation expectations correlate strongly with the characteristics of companies. Concretely, smaller and younger firms have, on average, higher inflation expectations than larger and older firms (Chart 2, panels (a) and (b)). Also, firms’ investment plans, leverage and access to credit seem to play a role. Firms with higher debt ratios, for instance, tend to have higher inflation expectations (Chart 2, panel (c)). Finally, it matters who within the surveyed firms is responding: male managers tend to have lower inflation expectations than female ones, and chief financial officers have lower expectations compared with respondents that have other positions within the firm.

Chart 2

The relationship between firms’ characteristics and inflation expectations

x-axis: number of employees and firm age (in logarithms relative to the average), leverage (in percentage points relative to the average), y-axis: firms’ 1-year inflation expectations (in percentage points relative to the average)

Source: Survey on the Access to Finance of Enterprises, Orbis and authors’ calculations. Notes: The charts show binned scatter plots of various firm characteristics and firms’ inflation expectations. The shown data is shown relative to the average within countries, sectors and survey waves.

Do firms’ inflation expectations react to inflation news?

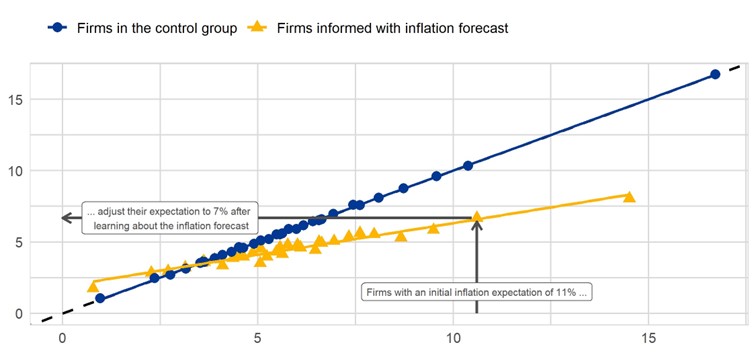

So, are firms’ inflation expectations affected by information about the euro area inflation outlook? In our study, we use a randomised controlled trial to tackle this question. Specifically, we first asked firms where they expect inflation to be in one year, in three years, and in five years. We then randomly split the firms into two groups. The so-called “treatment group” was given the latest available expert forecast for inflation, which we took from the ECB’s Survey of Professional Forecasters (SPF).[3] This “information treatment” revealed to firms that professional forecasters expected inflation to be 2.8% in one year. The control group received no information. The firms in the treatment group were then asked again about their inflation expectations at the three time horizons. These firms then had the opportunity to revise their inflation expectations in the light of the information received – while the control group was not asked again.

Overall, firms tended to respond to new information about inflation by adjusting their expectations.

Once the firms in the treatment group had learnt about the inflation forecast, they significantly changed their inflation expectations. For the 1-year-ahead inflation expectations, this change can be seen in the yellow line in Chart 3. Firms reduced their expectations around halfway towards the inflation forecast of 2.8% that had been provided to them. This means that firms that expected inflation to stand at 11% in a year’s time, for example, revised their expectations downwards to around 7%. In contrast, firms that already expected inflation to be close to the 2.8% expert forecast saw little need to change their expectations.

The revised expectations of firms in the treatment group is shown by the yellow line which is less steep than the blue line (45°), which represents the control group of firms that were not given the possibility to adjust their expectations. Overall, firms tended to respond to new information about inflation by adjusting their expectations. This happened despite the survey having been run during a high inflation period in June 2023, during which firms may already have been more aware of publicly available information such as current inflation, forecasts, and the inflation target of the central bank.

Chart 3

Firms’ adjustment of 1-year-ahead inflation expectations upon learning about the inflation forecast

x-axis: firms’ expectations before the information treatment, y-axis: firms’ expectations after the information treatment (both in %)

Notes: The chart is a binscatter plot of firms’ inflation expectations before the randomised information treatment (“prior expectations”) vs after the information treatment (“posterior expectations”). Huber weights are applied to minimise the influence of outliers.

Firms’ inflation expectations matter for their business decisions

The final step was to analyse whether firms’ inflation expectations matter for their economic plans. We looked in particular at how new information about the inflation outlook affected firms’ plans and decisions about setting wages and prices, about employment and other costs.

We observe that firms with higher inflation expectations plan to increase their prices by more, while also expecting larger cost and wage increases. Relative to the control group, firms that received the information treatment, and thus lowered their inflation expectations, generally planned smaller price increases and were more likely to keep prices unchanged. These firms also expected wage and cost increases to be generally more moderate. This suggests that firms do respond to new information about the inflation outlook by adjusting not only their beliefs about inflation, but also their decisions.

In conclusion, euro area firms’ inflation expectations in the SAFE represent a rich and novel source of data. It complements the wealth of information stemming from surveys of households (CES) and professional forecasters (SPF) in the euro area. These data are key to improving our understanding of how firms form expectations and how that affects their decisions. Our results suggest that successful policy communication matters to guide inflation expectations, which in turn affect firms’ economic plans.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Check out The ECB Blog and subscribe for future posts.

“The European Central Bank is the prime component of the Eurosystem and the European System of Central Banks as well as one of seven institutions of the European Union. It is one of the world’s most important central banks.”

Please visit the firm link to site