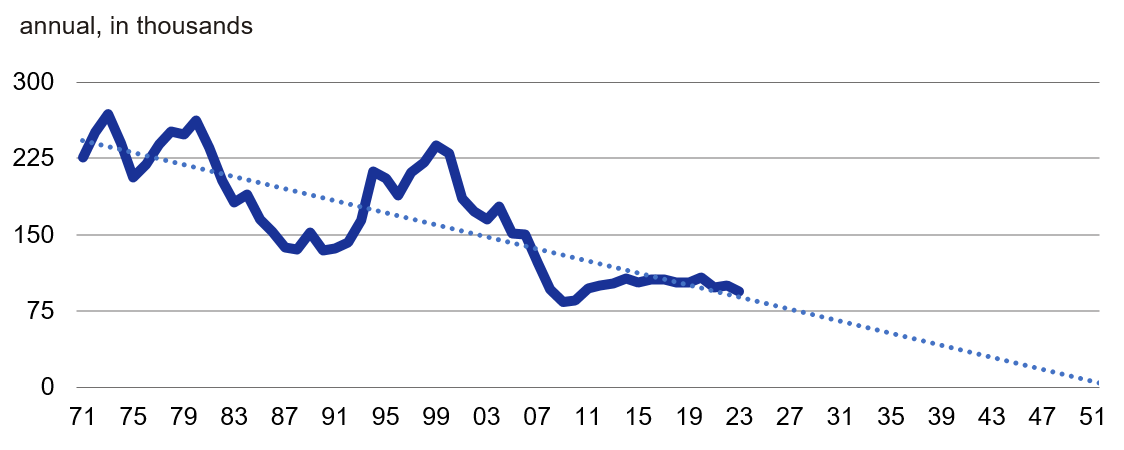

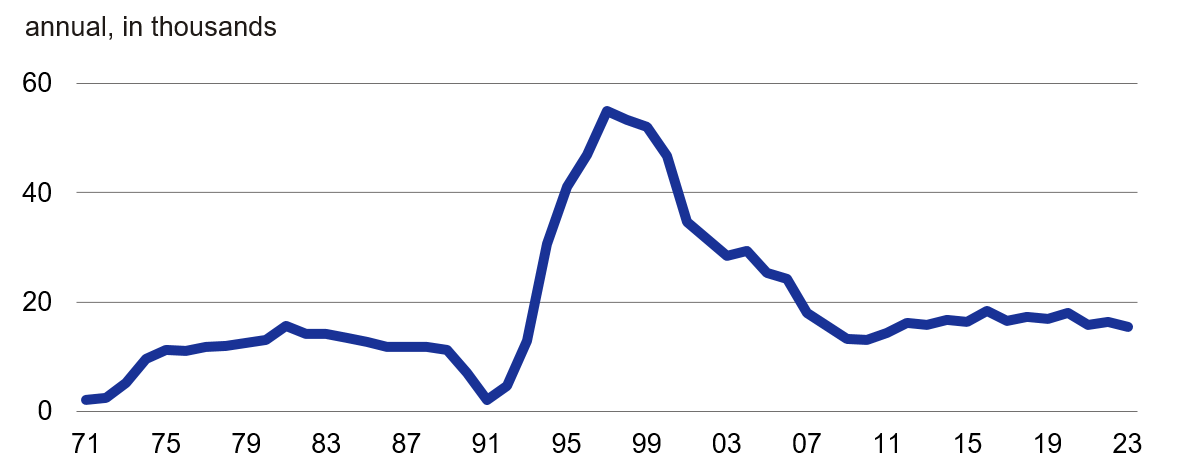

Over more than 50 years, the number of newly built single-family homes has trended lower

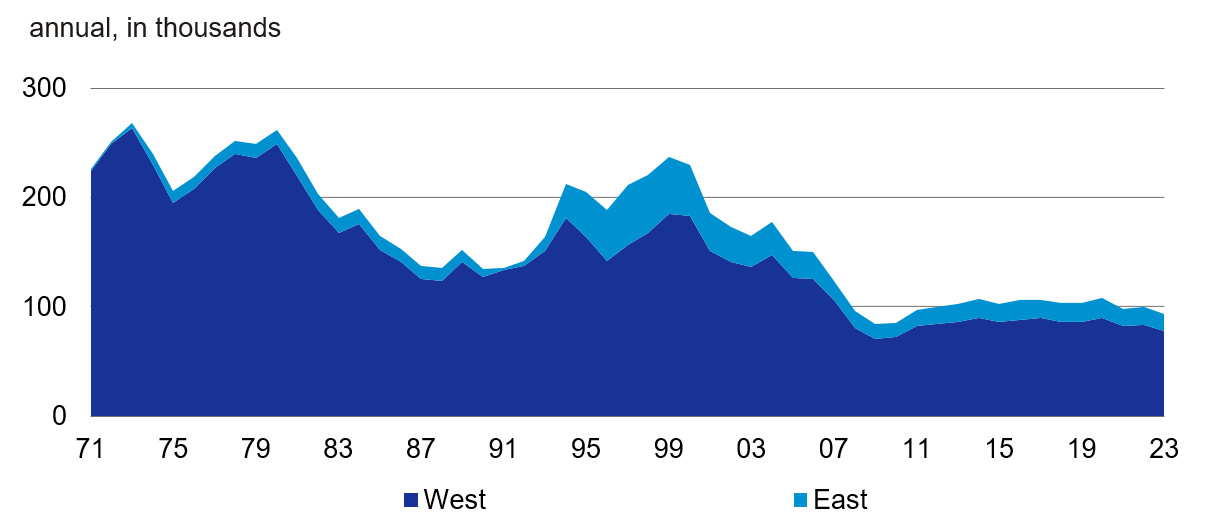

In the 1970s, around 250,000 single-family homes were completed each year. This figure had fallen to less than 150,000 by the time of reunification. Subsequently, there was a strong catch-up in the new states. At the peak in the mid-1990s, nearly 250,000 were again being built each year. However, this was followed by years of decline which ended in an all-time low of just 84,000 units in 2009. There was subsequently a shallow recovery over the boom years until 2022. In this period no more than 110,000 were completed per year. In 2022 and 2023, high building costs and interest rates, and the regulatory shock from the Heating Act, led to another dip with fewer than 100,000 units completed annually. At the same time, building permits for single-family homes plummeted by around 60% compared to 2021. In the coming years, construction is therefore likely to continue to fall significantly.

Structural drivers: Urbanization, construction costs and housing shortage

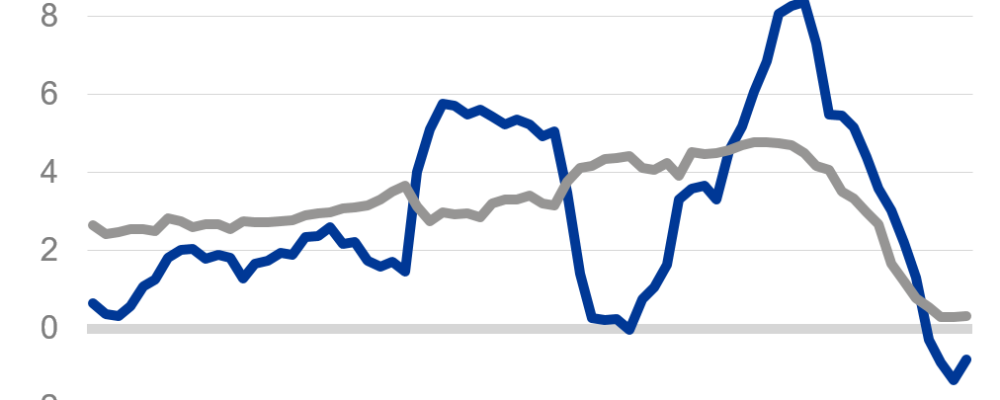

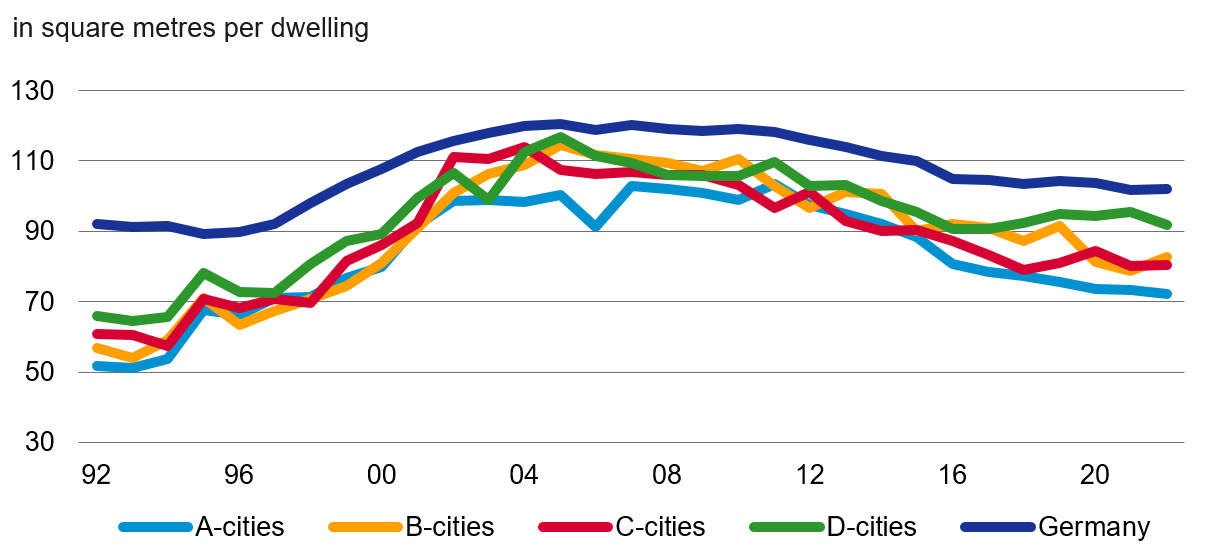

Urbanization is a long-term driver of the structural decline in the construction of single-family homes. Both historically and today, labour markets in cities and metropolitan regions are in many ways more attractive than in rural areas. They offer short distances of travel, very good medical care, a wide range of cultural activities and much more. Accordingly, migration is towards metropolitan regions. The demand for housing is concentrated in small spaces. Land and housing are becoming scarce and expensive. Prices and rents are rising. As a result, small apartments are preferred over large houses. In addition, high energy and material prices, the shortage of skilled labour and a sharp increase in building costs overall make homes unaffordable for many households. We expect this to remain the case in the future. In particular, the shortage of skilled labour is likely to worsen significantly. Hence, the trend towards the building of large multi-family houses and small apartments is likely to continue.

Climate and environmental protection targets weigh on supply

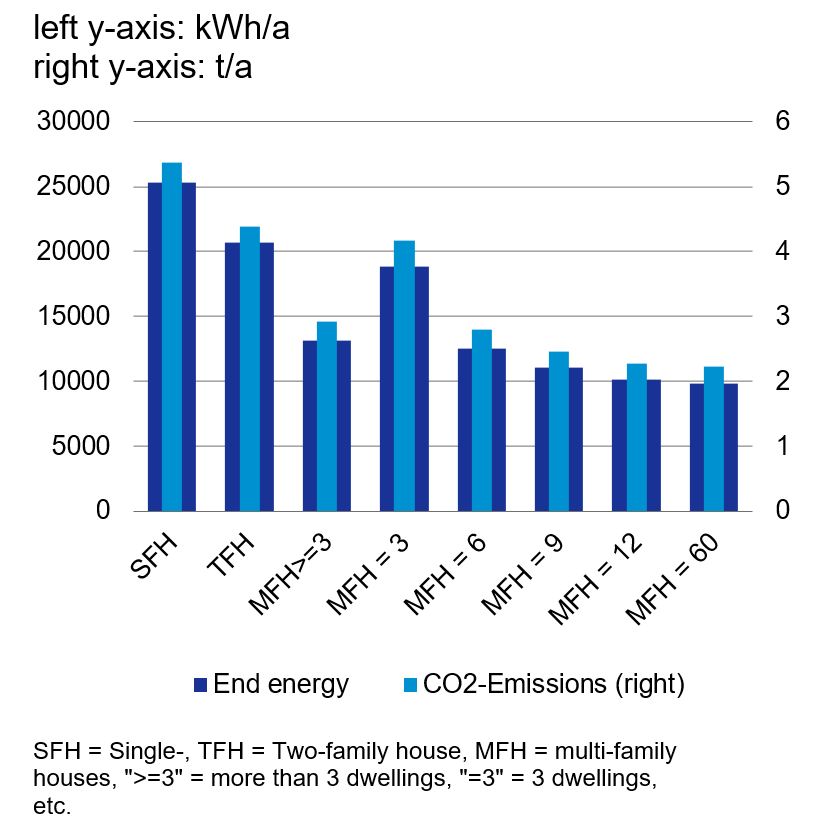

For two-family houses these figures are twice as high and for single-family houses they are 2 ½ times as high. CO2 emissions are also reduced due to lower demand for building materials such as concrete, steel and glass. In addition, many districts and cities are increasingly endeavoring to prevent further sealing of settlement and traffic areas. Some locations – in particular Hamburg-Nord[2] , Münster[3] and Wiesbaden[4] were mentioned in the press – have already been very restrictive in their approach to building permits for single-family homes in recent years.

Will we reach the point where no new single-family houses will be built?

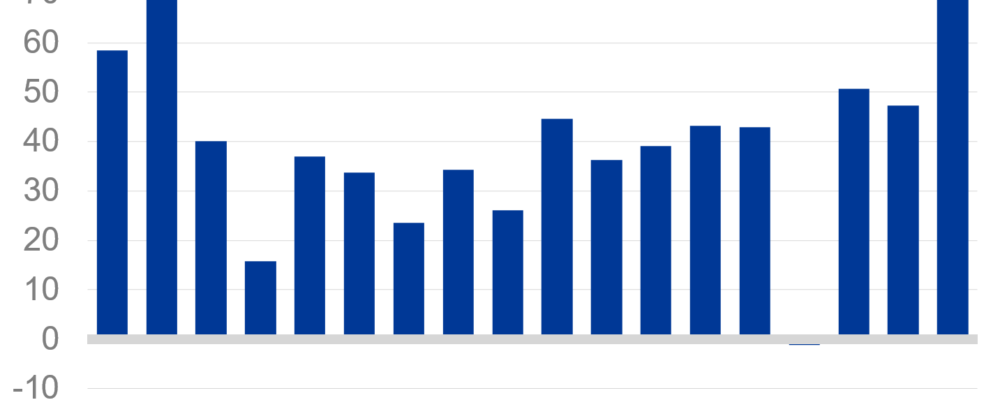

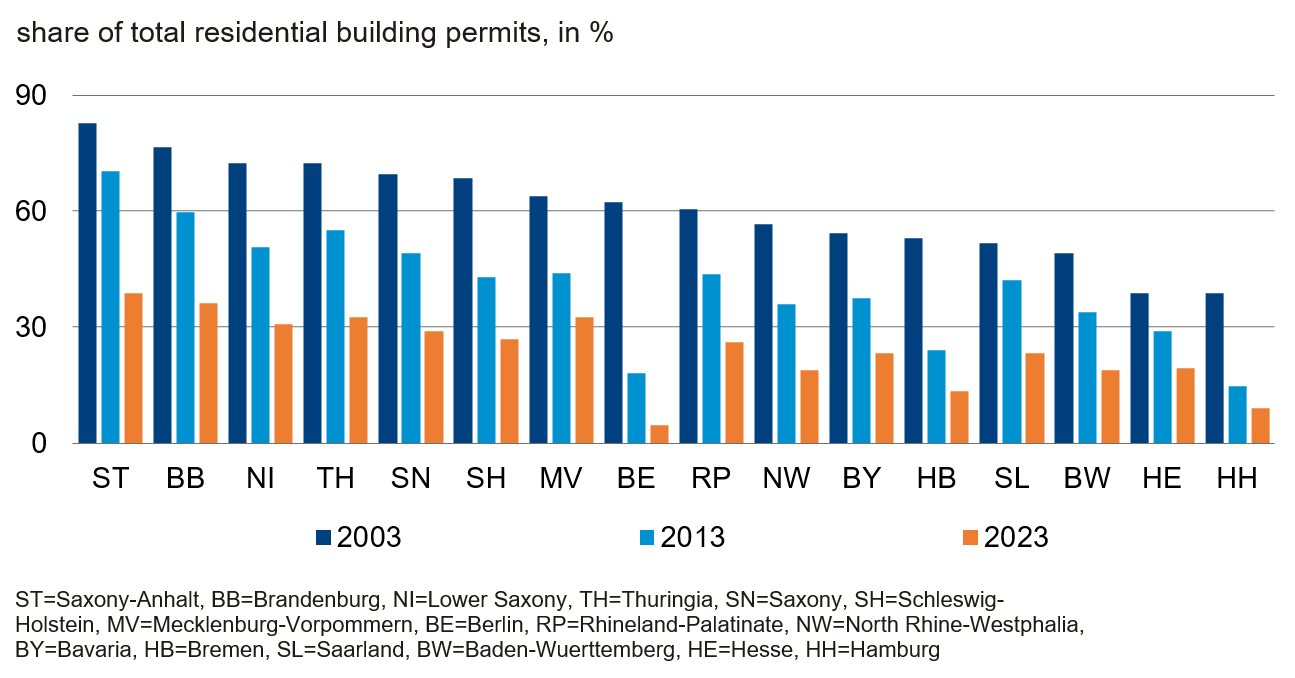

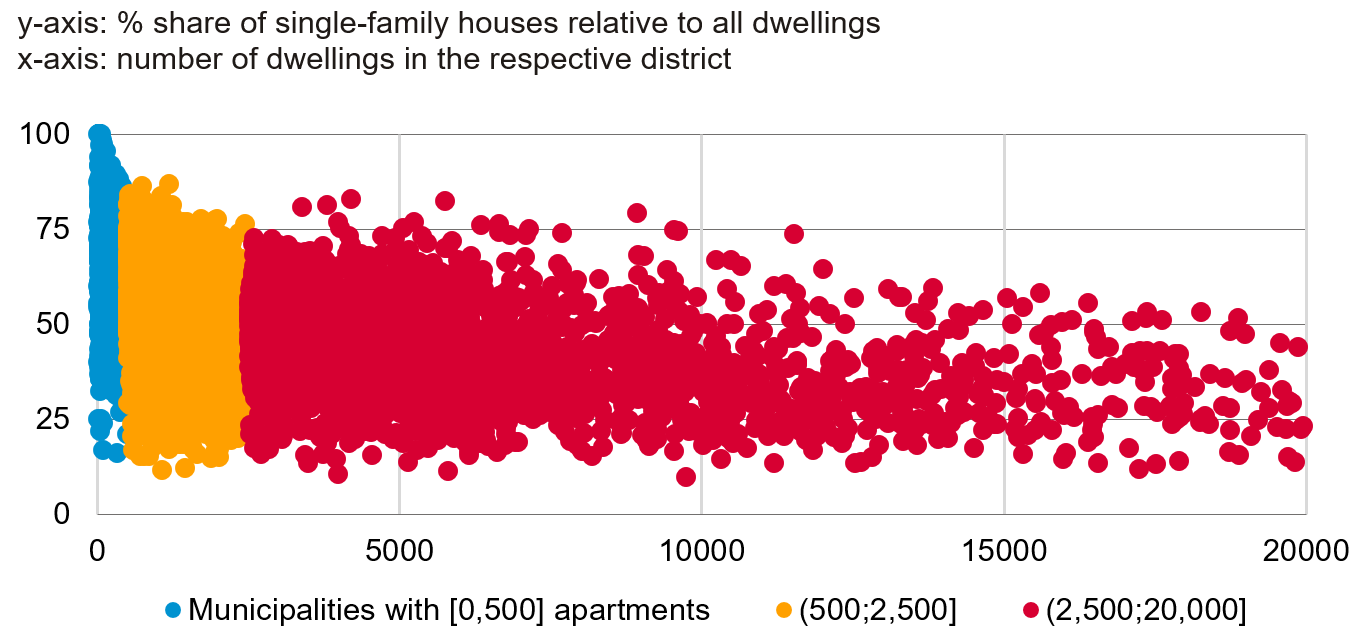

Both nationwide and in all federal states, the share of building permits for single-family homes, which account for more than 80% of existing homes, is falling. This effect has been particularly strong in city states. From 2003 to 2023, the proportion in Bremen fell from 53% to 13%, in Hamburg from 39% to 9% and in Berlin from 62% to less than 5%. If the nationwide trend were to continue as shown in figure 1, around 3,000 fewer homes would be built each year relative to the previous year. As a result, the very last single-family home would be built around 2050. However, a simple extrapolation probably overstates this trend. Most people in Germany live in small municipalities with only a few thousand or even a few hundred apartments per community. There, the share of single-family houses relative to the total housing stock is very high. Due to the focus on local needs, the large supply of space, the importance of building land for municipal finances, and lower building costs, single-family homes are likely to remain important in smaller municipalities. As a result, nationwide building permits are expected to decline structurally over the coming years but then trend towards a figure of possibly 20,000-40,000 single-family homes per year in the long term.

Rental housing market for single-family homes

According to the 2022 census, there are around 16.3 million single-family homes in Germany – a figure that has barely increased in recent years. This number is expected to stagnate and, if only a few tens of thousands of single-family homes are built per year in the long term, their stock and consequently market supply are likely to fall due to demolition. In some metropolises and metropolitan regions, this could occur even earlier. Nevertheless, single-family homes are expected to remain a desirable form of housing for the foreseeable future. Due to this imbalance, prices of such homes might rise structurally and more strongly than prices of apartments. Renting out single-family homes is also likely to become even more attractive in many cities and metropolitan regions than it already is today.

- Ein Wohngebäude-Klima-Modell für Deutschland, Deutsche Bank Research, Juli 2023.

- https://www.buergerschaft-hh.de/parldok/dokument/74376/gruen_rot_in_hamburg_nord_verbietet_einfamilienhaeuser.pdf

- See https://www.stadt-muenster.de/stadtplanung/bebauungsplanung/faq-einfamilienhaeuser

- https://www.wiesbadener-kurier.de/lokales/wiesbaden/stadt-wiesbaden/der-schleichende-tod-des-einfamilienhauses-2556629

Deutsche Bank AG

Please visit the firm link to site