A year ago, most experts thought the US economy was thundering headlong toward recession, as the Federal Reserve moved at a historic pace to slow inflation by bridling interest rates.

Yet, despite recent tremors in the stock market, no recession has materialized. Part of the reason may be stock and credit market dynamics—and investor behavior. HBS Working Knowledge spoke with Robin Greenwood, the George Gund Professor of Finance and Banking at Harvard Business School, about the role markets may play in shaping economic conditions.

This conversation has been lightly edited for length and clarity.

“Financial crises come out of periods of overheated credit markets.”

Rachel Layne: Part of your research with HBS Professor Samuel Hanson explores market behavior, including examining the origin of financial crises. Where do financial crises come from?

Robin Greenwood: Financial crises come out of periods of overheated credit markets. We try to track crises using a measure of overheating that we developed and call the “Red-zone.” The Red-zone is a combination of credit expansion and high asset prices.

In the domain of houses and real estate, for example, if real estate prices are up, and at the same time there’s a lot of household credit expansion … it’s a measure that you’re in the Red-zone. We found that that is very predictive of crises.

Generally, that and a couple of other papers that Sam Hanson and I have worked on over the years have been about trying to understand the credit market bubbles and frothy credit markets—and how those are different from equity market froth.

Layne: How so?

Greenwood: Frothy stock markets happen when people get excited about companies and are very focused on the potential upside. Frothy credit markets are when people stop worrying about the downside.

Now, they can be related. The times when you’re excited about the future also may be times when you’re less worried about things failing. Yet, they’re different phenomena.

So, why is it that people were willing to do so much lending in 2005, 2006, and even into 2007? Well, they were just less worried about those credits failing.

Layne: What can people look for in terms of signals right now, with the Fed trying to keep inflation under control and things not progressing quite as quickly as they probably would have liked?

Greenwood: There are really two things happening.

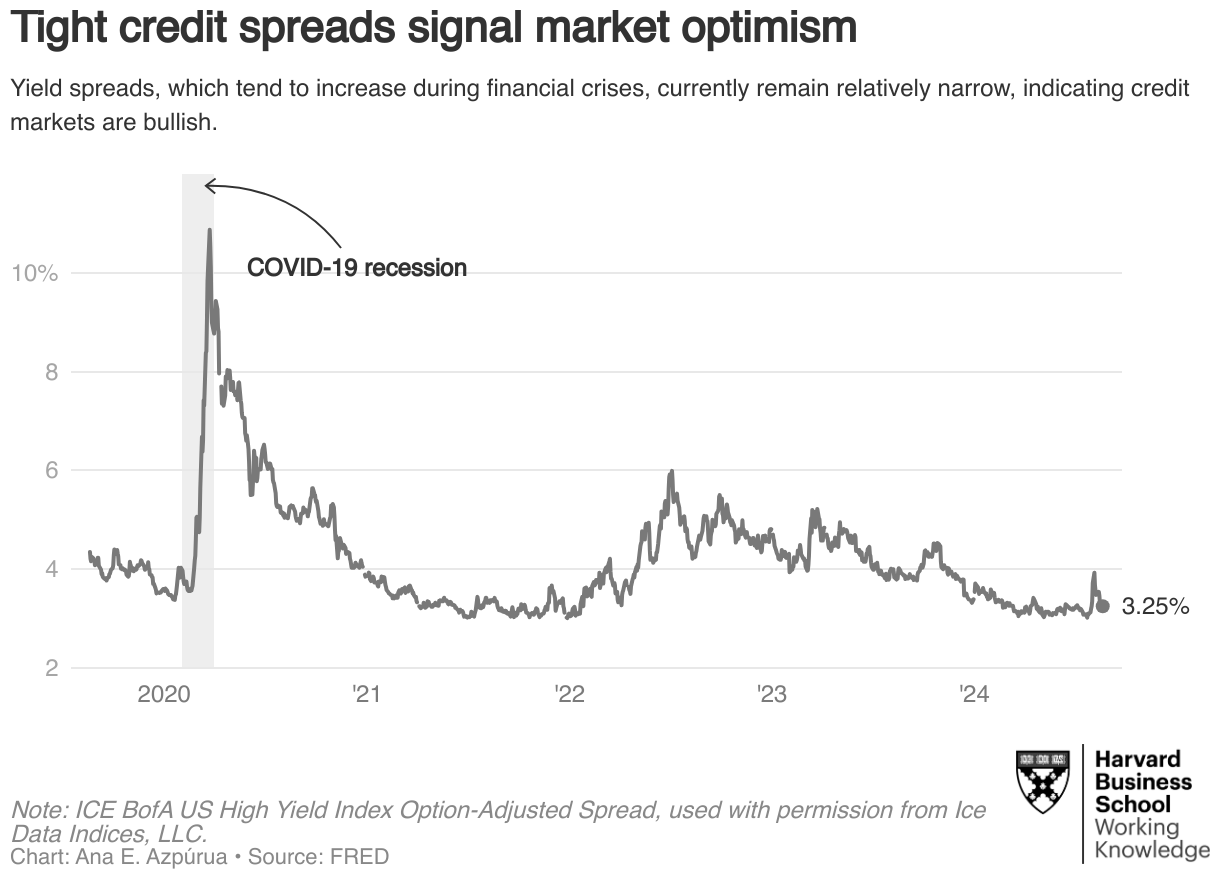

On the one hand, credit spreads are tight. The high-yield spread is the spread between the yields [the return an investor expects to receive annually until a bond matures] on a high-yield bond relative to a corresponding Treasury.

You look at those numbers that are very low today relative to history. For example, those numbers went way up during the financial crisis. They went up again during COVID-19. But they’re back down at very low levels. That tells you that credit markets are bullish in that sense.

On the other hand, credit expansion has been modest. This is driven by the Fed tightening cycle. So, you want to ask overall, are we in a credit bubble? The answer is no, according to the data that we know right now.

Layne: So, you don’t really see a bubble and burst happening just yet. But you seem to be saying that policymakers should keep an eye out, particularly on corporate credit. Why?

Greenwood: You should monitor the credit markets, because collapses in credit are extremely detrimental to the economy. The vast majority of crises happened following periods of that Red-zone, which is following periods of rapid credit expansion.

“The key thing here is that it’s not when the level is high, it’s when the change is high—when credit is expanding a lot faster than the economy.”

Layne: And how do you measure the rapidity of credit expansion?

Greenwood: We’re looking at the change in credit-to-GDP ratio and credit-to-gross domestic product. So, the key thing here is that it’s not when the level is high, it’s when the change is high—when credit is expanding a lot faster than the economy. That is when you should watch out.

Layne: What can we learn from these patterns now?

Greenwood: I think the Fed is doing a great job. Many people have been shocked that we have had a dramatic tightening of monetary policy over the past two years, and yet, not only is the economy robust, housing prices are robust. It’s almost a mystery as to why things are so strong with such significant tightening.

Layne: There have been some warning signals, such as the Silicon Valley Bank collapse last spring. But that particular dynamic hasn’t seemed to spread as much as people feared it would. Is that part of the mystery?

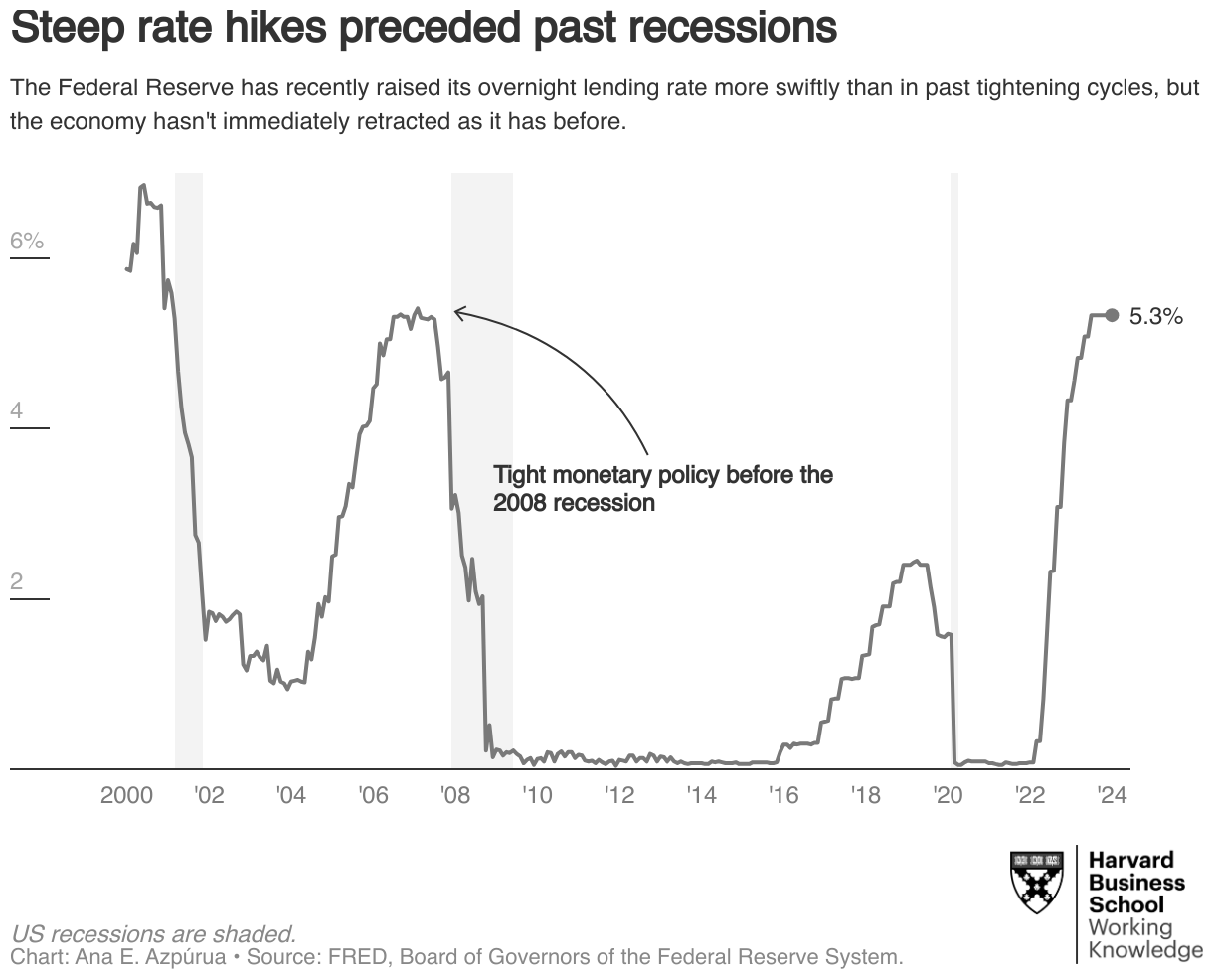

Greenwood: Yes. This [chart shows] the federal funds effective rate. It’s a very good summary of monetary policy and how tight it is. You can see that the last time the Fed tightened was in 2004 through 2006, preceding the financial crisis.

So, we had this huge boom, tightened, and then basically the world fell apart. Recently, they’ve actually tightened even faster, that line is steeper. It’s remarkable. We went from 1 percent to 5 percent. Here we’re going from zero to 5.5 percent. And the economy is basically robust.

If you look back over Fed history, I mean, the last time we had as aggressive tightening as this was under Volcker in the 1980s.

Layne: How does that play into sentiment?

Greenwood: We think that sentiment is probably sustaining this credit market.

“I would say the post-crisis menu of regulations by and large has been effective.”

Layne: How do the stock markets come into play here? They are setting records.

Greenwood: It’s not just the credit markets that are doing well, the stock market is also doing well. I would say there’s a general market optimism that we’re seeing across the board.

Layne: Is what we’re seeing today tied to the Dodd-Frank law and mean some of the post-financial crisis [of 2008] requirements for large banks are working?

Greenwood: I would say the post-crisis menu of regulations by and large has been effective. Some of that is Dodd-Frank. A lot of that is just the Fed driving higher capital requirements for the banks. That has probably been the single factor contributing to financial stability.

On the other hand … we have seen a lot of migration of activity outside of the banks. We know a little bit less, for example, about how vulnerable some of that activity is.

For example, it used to be that if you were a $100 million business and you wanted, say, an inventory loan, you would go to a bank like Bank of America. Today, you may do that, but you might also go to any number of private lenders.

You Might Also Like:

Feedback or ideas to share? Email the Working Knowledge team at hbswk@hbs.edu.

Image: Image by HBSWK with asset from AdobeStock/Metamorworks

“Harvard Business School is the graduate business school of Harvard University, a private research university in Boston, Massachusetts. It is consistently ranked among the top business schools in the world and offers a large full-time MBA program, management-related doctoral programs, and executive education programs.”

Please visit the firm link to site