Global stock markets fell sharply on 5 August 2024, causing concern for investors. The Dow Jones Industrial Average posted its worst day in around two years and the Japanese stock market saw its biggest drop since Black Monday in 1987.

As an investor, it’s natural that you may be concerned about this uncertainty. After all, you’re likely to have invested so you can grow your wealth to achieve your financial goals in the future. Consequently, if the value of your investments falls, you may worry that it could be more difficult to reach your aims and live your dream lifestyle.

However, it’s important to remember that these recent events are just a few in a long line of global stock market upsets including the Wall Street crash in 1929 or the 2008 financial crisis.

Additionally, markets typically recover and continue growing after a period of volatility. In fact, one simple chart demonstrates that short-term fluctuations are very common, and they shouldn’t necessarily be a cause for concern.

Read on to learn more.

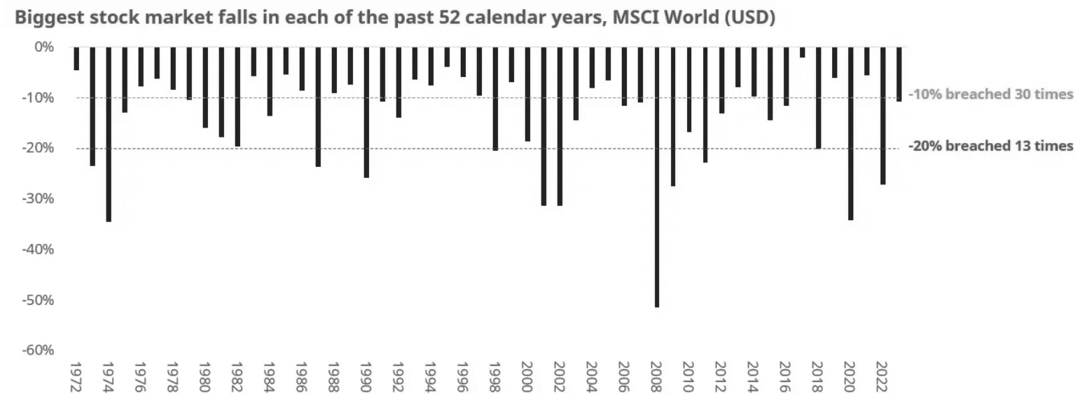

Global stock markets posted a 10% loss in 30 out of 52 years

If you’ve ever invested, you will have seen the line: “The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested.”

Stock markets are uncertain places, with the value of shares changing on a minute-by-minute basis on most trading days. On any given day a market can post a substantial loss, or a substantial gain.

Indeed, the Guardian reports that the Japanese Nikkei index rose by 10.3% on 6 August having fallen by 12.4% the day before.

In reality, global stock markets regularly post losses, yet still tend towards growth in the long term. As such, you may still be able to work towards your goals if you hold your investments when markets fall.

The following chart shows how common stock market fluctuations are. It illustrates the biggest stock market fall in each of the 52 years prior to 2024. The figures are based on the MSCI World Index – an index of more than 1,400 companies across 23 developed markets.

Source: Schroders

As you can see, the global stock market experienced some losses in every single year. In 30 out of the 52 years, the largest fall exceeded 10%. Additionally, in 13 of those years, the markets fell by more than 20%.

However, despite these short-term losses, it’s important to consider the long-term growth that you may achieve when you invest.

For example, Curvo reports that the MSCI World Index posted a total return of 226.7% in the 10 years to July 2024. In the 20 years to July 2024, total returns were 620.4%, despite the dips illustrated in the graph above.

This demonstrates that you don’t necessarily need to panic when markets fall because fluctuations are a regular occurrence. More importantly, markets often correct themselves and continue growing in the long term.

The key is to be patient and to remain invested, even if markets have taken a dip.

Naturally, past performance doesn’t guarantee future returns, and you always adopt some level of risk when investing. Still, the historical data suggests that if you remain calm and hold investments during a period of volatility, you may still be able to achieve your financial goals.

A financial planner could help you stay calm and focus on your goals during a period of volatility

The news of a stock market fall in August 2024 may have caused you to worry. In some cases, when the value of your investments falls, you might even be tempted to sell stocks to avoid further losses.

Yet, if you had cashed out after the initial fall, you may have missed out on further growth when markets bounced back.

For example, according to MarketWatch, the Dow Jones Industrial Average recovered after a shaky start to August and reached a record high by 26 August 2024. In fact, at the time of reporting, MarketWatch counted that the Dow Jones had posted a record high 23 times so far in 2024.

That’s why it’s important to take a long-term view of your investments and remain calm during periods of volatility.

Working with a professional financial planner could help you achieve this. We will support you in creating a long-term investment strategy that allows you to work towards your financial goals.

Additionally, we can act as an impartial sounding board and may help you avoid emotional decision-making during a market upset.

Get in touch

If you are concerned about how market fluctuations could affect your financial plan, we can reassure you.

Email enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

The post The one chart that shows you don’t have to panic if stock markets fall appeared first on Black Swan Financial Planning.

“Black Swan Financial Planning was established in 2000, and since then became one of the top independent financial adviser firms in the UK.”

Please visit the firm link to site