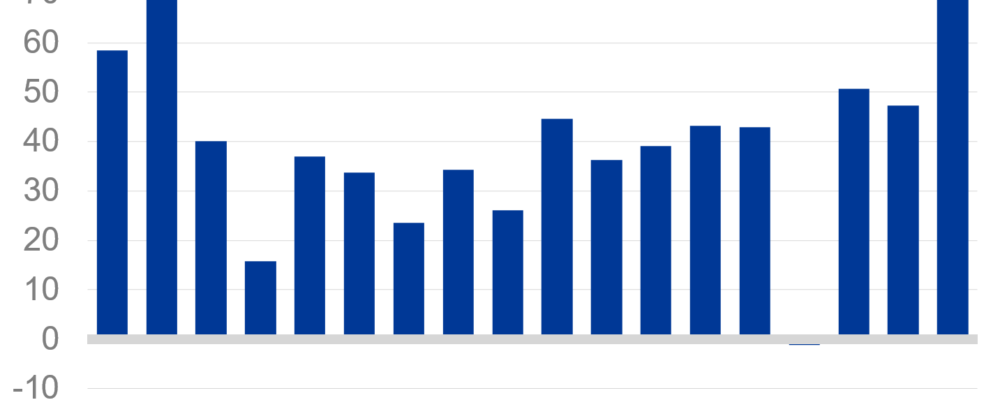

Volkswagens’s recent public considerations to possibly shut down plants in Germany and lay off employees for operational reasons came like a bombshell. Nevertheless, we have been pointing out for some time that the balance between production and employment in the automotive industry in Germany is disturbed. Currently, domestic production (production index) is almost 23% below previous highs. Although employment has also fallen in recent years, the decline versus the former peak is, at -8%, significantly smaller. This indicates a fall in productivity.

In addition, demand for electric cars in Europe is currently weak. Many of the easily persuaded customers have already decided to buy an electric car. However, other potential car buyers are currently cautious. Therefore, the industry’s high investments in converting its plants are not yet paying off. Capacity utilisation in the automotive industry has fallen to its lowest level since the COVID-19 crisis, according to data reported in Q3 2024. We do expect that demand for electric cars will increase again sooner or later due to expected technological progress. However, given the current circumstances, it is not surprising that there are discussions about prospective job cuts in the industry. These are likely to be even more intense in the supplier industry, even though they will not always make the media headlines.

Deutsche Bank AG

Please visit the firm link to site