17 September 2024

Energy-intensive firms continue to suffer from low profits margins even as energy prices have fallen from their peak. The ECB Blog discusses implications for the green transition in the EU.

Skyrocketing energy prices during the recent crisis ate into most firms’ profit margins across all industries. Using Belgian data, we find that many firms regained profitability when prices fell again. But energy-intensive businesses didn’t recover in the same way. This is bad news, including for Europe’s ability to achieve its climate objectives, because low profits make it harder for firms to finance their green investments. In addition, energy-intensive firms must prepare for the impending increase in carbon emission costs following the full implementation of the European Union (EU) Emissions Trading System (ETS). This financial pressure limits the internal sources of financing of the most carbon-intensive firms. So where can this financing be found? One option is government support. Another option is the recent proposals from the incoming European Commission to provide targeted assistance for the transition of the energy-intensive sector.

The uneven recovery from the recent energy price shock

The euro area’s economy has been significantly affected by the recent surge in energy costs, with energy-intensive companies bearing the brunt of this shock. Our research reveals a contrasting picture: while less energy-dependent firms have managed to restore their profit margins after the shock, energy-intensive firms have not. These firms, crucial to the EU’s industrial competitiveness, experienced significant drops in input costs due to falling energy prices in 2023, but failed to see a rebound in their profit margins.

We used confidential 2021-23 quarterly firm-level data for Belgium for our research. These data allowed us to examine how 1,205 energy intensive firms (e.g. steel mills, chemical and cement plants, and fruit and vegetable farms), employing 96,000 workers, absorbed the energy price shock. We then compared their experience to that of the other 13,040, less energy-intensive, manufacturing firms, employing 486,000 workers.[2] We focused on Belgium as comparable recent and detailed firm-level information covering the energy price shock and the recovery from the shock is not available for other countries. Nevertheless, Belgium is an excellent sample as it hosts one of Europe’s main petrochemical clusters, has a very energy-intensive manufacturing sector, and boasts a similar industrial structure to Germany, the Netherlands and Italy.

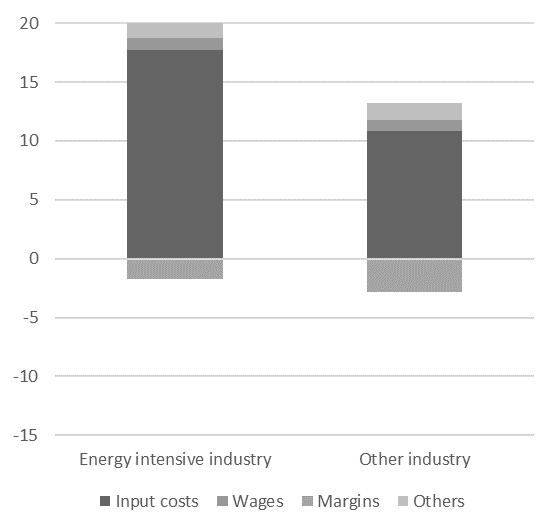

Chart 1

Decomposition of the change in sales per worker into inputs, wages and margins over the period 2021-22

Source: Author’s calculations based on Belgian firm-level data.

Notes: Sales refers to nominal sales in euro. Analysis is carried out at the detailed sector level. Manufacturing industry is split into 48 sub-sectors according to the classification used for the Supply Use Table (SUT). Energy intensive industry includes Belgium most gas intensive sectors, i.e. fruit and vegetables, fertilisers, inorganic chemicals, agrochemicals, glass, bricks, cement and lime, concrete, steel and steel rolling. Other industry includes the 38 other manufacturing sectors.

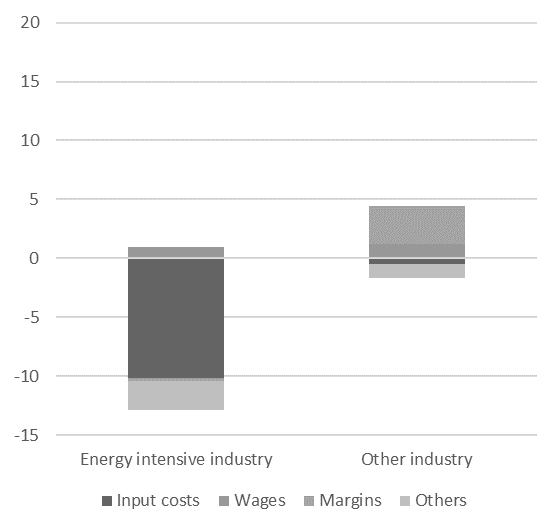

Chart 2

Decomposition of the change in sales per worker into inputs, wages and margins over the period 2022-23

(pp contribution, year-on-year change)

Source: Author’s calculations based on Belgian firm-level data. Notes: Sales refers to nominal sales in euro. Analysis is carried out at the detailed sector level. Manufacturing industry is split into 48 sub-sectors according to the classification used for the Supply Use Table (SUT). Energy intensive industry includes Belgium most gas intensive sectors, i.e. fruit and vegetables, fertilisers, inorganic chemicals, agrochemicals, glass, bricks, cement and lime, concrete, steel and steel rolling. Other industry includes the 38 other manufacturing sectors.

Charts 1 and 2 break the 2021-22 and 2022-23 change in sales per worker down into contributions from input costs, wages and profit margins.[3] Energy intensive and other industries have adapted differently to the energy price shock. 2022 (Chart 1) saw a substantial rise of more than 10% in nominal sales per worker across the board, linked primarily with increased input costs (blue bar) – particularly for energy-intensive sectors. Both groups of firms gave up a part of their margins to cushion the increased costs. In 2023 energy markets normalised and energy-intensive firms experienced significant drops in input costs due to falling energy prices. So, this should have made life easier for energy intensive industries. And yet their profit margins failed to recover, as shown in Chart 2. Conversely, less energy-dependent firms, which did not experience any significant drop in input costs, managed to restore their margins and made up for previous profitability setbacks.

Successes and challenges of European carbon taxes

The energy-intensive firms must also prepare for an additional cost increase amplified caused by an expected rise in carbon price exposure. This issue is tied to the ETS (Emissions Trading System), the main policy instrument that regulates EU industry’s carbon emissions. By imposing a financial burden on carbon emissions from industrial installations and aviation, this system is expected to incentivise investments in low-carbon production techniques and pressure heavily polluting firms to either adapt or exit the market.

As discussed previously in The ECB Blog, the EU ETS has demonstrated its effectiveness in driving down greenhouse gas emissions. The scheme achieved its 2020 emission reduction target in 2014, six years early. More recently, emissions covered by the EU ETS fell by a substantial 16% in 2023 compared to the previous year. This significant drop means that more than three quarters of the targeted reduction by 2030 (relative to 2005 levels) has already been realised.[4] These results underscore the EU ETS’s role as a cornerstone of the EU’s climate policy.

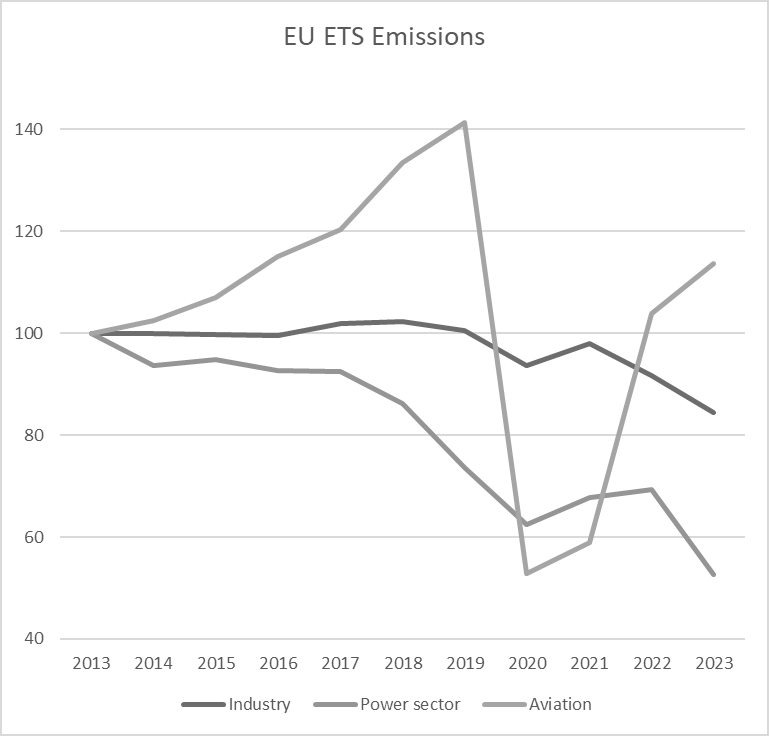

Chart 3

Relative evolution of emissions from different sources regulated by the EU ETS

(2013 = 100)

Source: EU Transaction Log accessed via EUETS.INFO, version May 2024. Notes: Power sector includes emissions from stationary installations with NACE 2-digit code 35. Industry includes emissions from all other stationary installations. 2013 is chosen as reference year as this is the start of Phase 3 of the EU ETS. Excludes emissions from Great Britain.

The power sector, which includes firms such gas and electricity providers, (48% of EU ETS emissions in 2023) has emerged as a frontrunner in emission reductions since 2013, marking the beginning of Phase 3 of the EU ETS. This sector’s progress (Chart 3, orange line) stems largely from two key factors: the widespread adoption of economically competitive renewable energy sources and the transition from coal to natural gas. Notably, the power sector contributed 80% of the 2023 reduction in emissions. This is on the one hand remarkable and good news. But on the other hand, it means that it becomes harder and harder to reduce emissions in the power sector. And that puts the spotlight on manufacturing industries.

The industrial sector (47% of EU ETS emissions in 2023) has not made similar progress as the power sector over the past decade (Chart 3, blue line). This disparity is partly due to regulatory differences, such as the allocation of free emission allowances to manufacturing industries, and partly due to the technical challenges to green production processes.[5] Industry still faces uncertainty regarding the financial feasibility of carbon-abatement technologies.

So what’s the problem?

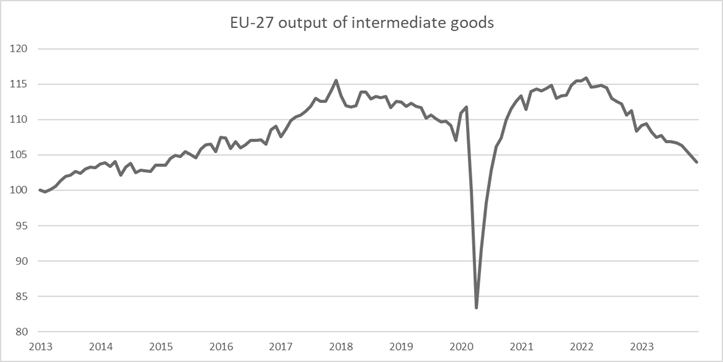

Furthermore, recent emission reductions from industry predominantly reflect output declines rather than improved carbon efficiency. While recent data on the output of industrial firms participating in the ETS is unavailable, these firms predominantly produce intermediate goods, including metals, chemicals, cement, paper, and glass. Notably, emissions from the industrial sector decreased by 14% between 2021 and 2023, while the output of intermediate goods within the EU experienced a decline of approximately 7% over the same period and about 10% when comparing December 2021 to December 2023 (Chart 4). This means that the reduced emissions were to a large extent realised by producing less rather than by greening the production processes. This conflicts with the ETS’s goal of balancing emission reductions with continued economic growth. Moreover, the phase-out of free emissions allowances accelerates from 2026 and the gap between actual emissions and free emissions widens, leaving firms to a more severe carbon price exposure and an increase in costs. As discussed in an earlier post on The ECB Blog, vast investment in carbon efficiency of the industrial sector will hence be needed if emission reduction targets are to be met without a continued drop in industrial output. Otherwise, European firms risk becoming “brown zombies” – entities unable to compete in an increasingly green economy.[6]

Chart 4

Production of intermediate goods

(2013 = 100)

Source: Eurostat Production in Industry (calendar adjusted, sts_inpr_m).

Notes: Power sector includes emissions from stationary installations with NACE 2-digit code 35. Industry includes emissions from all other stationary installations. 2013 is chosen as reference year as this is the start of Phase 3 of the EU ETS. Excludes emissions from Great Britain.

Clearly carbon tax revenues are a potential financing source. They primarily flow into Member States’ national budgets and, possibly offer some financial support for businesses. However, assuming realistic carbon prices, these revenues are likely insufficient for Member States to provide substantial funding to these firms.[7] Firms will therefore need to source funds internally or rely on other funding sources.

Broader Implications

The continued squeeze on the profit margins of energy-intensive industry makes it harder for these firms to internally finance the investments they want to make. Falling margins may therefore impede crucial investment in carbon abatement technologies, potentially leading to higher future carbon costs and eroding industry’s edge in the transition towards low-carbon production. More generally, high energy costs pose a broader threat to economic growth. This situation not only jeopardises green investments but also undermines the overall economic stability necessary for a sustainable transition to low-carbon production.[8]

Our findings can be of relevance for other euro area countries with significant energy-intensive industries, particularly Germany, Italy and the Netherlands. These economies likely experienced similar effects, given their comparable industrial structures and exposure to energy price fluctuations. These technologically advanced industries are important for Europe’s shift to carbon neutrality and maintaining its industrial competitiveness. The retention of these energy-intensive sectors in light of the climate transition demands coordinated efforts and substantial investments, combining firms making the necessary adjustments and external policy support measures. In this regard, the proposed Industrial Decarbonisation Accelerator Act in the next European Commission is very promising.[9]

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Check out The ECB Blog and subscribe for future posts.

For topics relating to banking supervision, why not have a look at The Supervision Blog?

“The European Central Bank is the prime component of the Eurosystem and the European System of Central Banks as well as one of seven institutions of the European Union. It is one of the world’s most important central banks.”

Please visit the firm link to site