Switzerland recently signed a free trade agreement with India within the framework of the EFTA. The world’s most populous country is seen by many Western states as a promising alternative to the increasingly authoritarian China. The agreement is undoubtedly a success, but it did not come without concessions. The next step will be for Parliament to deal with the agreement, to which the Federal Council submitted the dispatch this week.

Whilst the first part of this two-part blog focused on investments, this second part is dedicated to the trade in goods and services in the Trade and Economic Partnership Agreement (TEPA). Here it becomes clear that the Tepa is less far-reaching in terms of both breadth and depth than other EFTA-agreements.

First-mover

With the Tepa, the EFTA hopes to gain a “first-mover advantage” over other Western trading partners. By lowering tariffs for industrial and, in some cases, agricultural products, the EFTA is gaining a competitive advantage over the EU, the UK and Canada, which do not yet have an agreement. The flip side of the coin is that the first countries to conclude a free trade agreement also pay the price. The following countries then benefit from the experiences and mistakes of the pioneer.

In this context, it is remarkable that India is prepared to abandon its protectionist tradition of focusing on its own production to some extent. The country has already negotiated free trade agreements with Australia and the United Arab Emirates. The negotiations with the UK, the EU and Canada, some of which have been ongoing since 2010, show that India is not only gearing its trade policy towards regional partners, but is also consciously seeking partnerships with Western countries.

India also hopes that this will give it an advantage over its rival China. It also wants to secure its place in international supply chains and strengthen its position as a hub between the Arabian Peninsula and the Four Asian Tigers.

Goods for India’s SMEs: an opportunity for Swiss industry

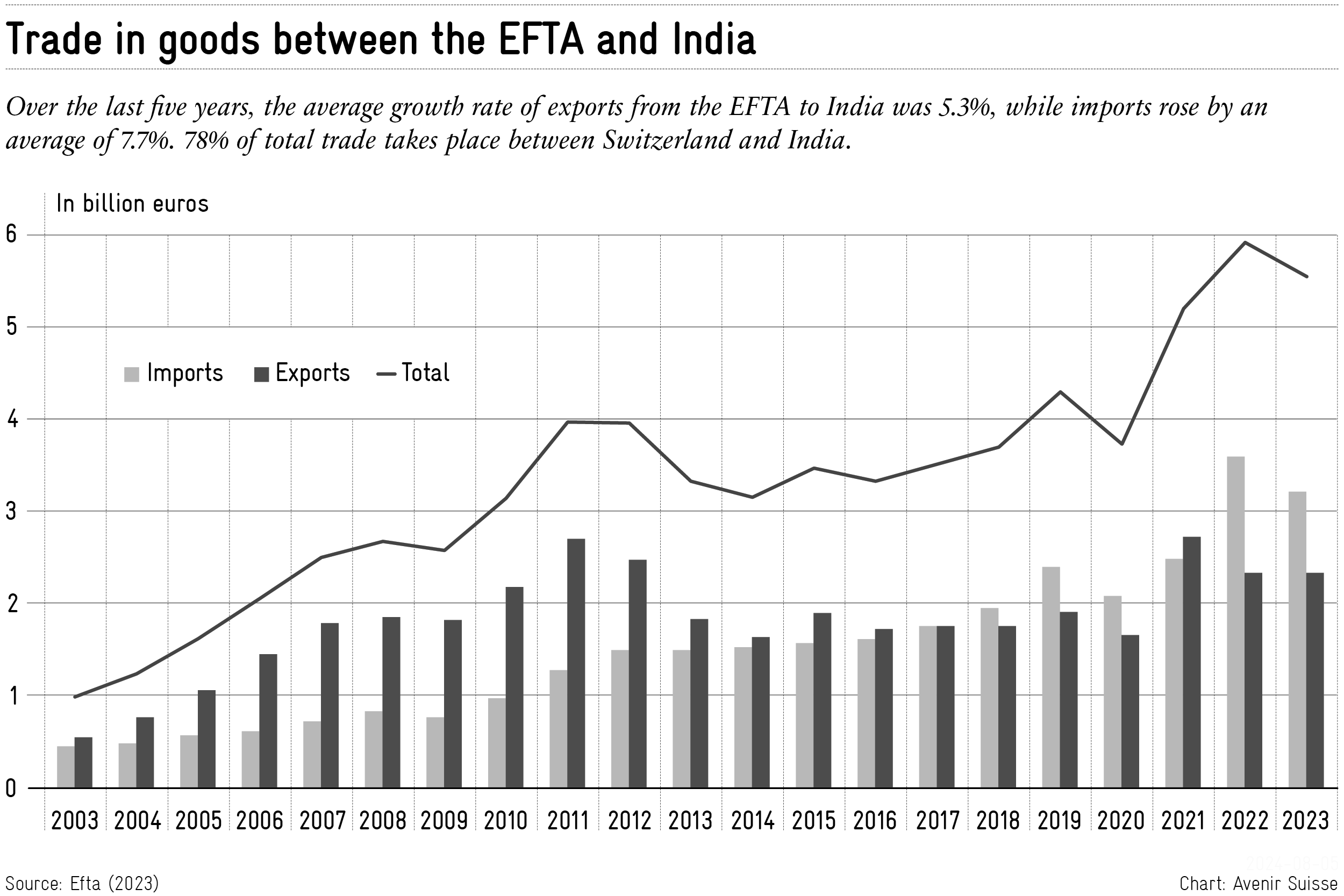

Bilateral trade in goods between India and the EFTA has only gained limited momentum in the last decade. The volume of trade has increased six-fold since 2003 (see chart). However, India’s share of the EFTA’s global exports and imports has only risen slightly over the last twenty years and has never exceeded the 1 percent mark.

India’s high tariffs put a brake on broad product diversification, as they increase the cost of imported goods and therefore restrict access to a wider range of international products. This has a concrete impact on trade structures on both sides. For example, organic chemicals account for over 30 percent of India’s exports. Gold, which in contrast to India’s free trade agreement with the United Arab Emirates is de facto excluded from the agreement, accounts for over 80 percent of EFTA-exports.

The TEPA is expected to initiate a trend reversal here. Products such as machinery, watches and chemicals will benefit from improved market access in future and will find a growing sales market in India. Overall, market access will improve for around 94.7 percent of current Swiss goods exports (measured by value of goods). In matters of intellectual property that are important for the pharmaceutical industry, protection corresponds to the WTO Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS). However, it slightly exceeds the previous level.

Trade in goods: incomplete liberalization?

Even if tariff reductions diversify trade, the country-specific concession lists can mitigate these effects. For example, India grants concessions to Switzerland, Norway and Iceland for dairy products, pharmaceuticals, textiles and optical devices. For chocolate, drinking chocolate powder, chocolate coating and coffee capsules, India only grants market access to Switzerland, but not to Norway.

Some trade experts have therefore described the agreement as problematic. Of course, a more extensive opening would have been desirable. Such exceptions make it more difficult for companies to gain market access and thus to establish new supply chains. In addition, India is often keen to phase out the agreed tariff reductions in stages rather than immediately after they come into force. Some tariffs are only reduced or abolished after five or ten years.

However, as with investment promotion, a pragmatic standard must also be applied here. A historically very protectionist country like India can probably only take small steps towards opening up. India is likely to have removed many agricultural products from its concession lists, as it is repeatedly confronted with farmers’ protests. As India’s tariffs are still relatively high, the annual savings for EFTA exporters through tariff reductions will nevertheless be considerable. Although India’s growing, well-educated middle class with corresponding purchasing power would have benefited from further opening up to the EFTA, the negotiators probably left it at a compromise in view of social inequality.

Services: selective professional recognition

With regard to services, the TEPA can certainly be seen as an enhancement of the GATS commitment (WTO’s General Agreement on Trade in Services). The TEPA could also have served to partially counteract the shortage of skilled workers in Switzerland, e.g. in information technology. However, compared to the multilateral commitments that India has entered into in the WTO, the text of the agreement shows only very limited trade benefits in so-called Mode 4 (services where a natural person temporarily moves to another country).

While China is known as a production location, India is considered a services hub in Europe and worldwide due to its global network. Various of India’s trading partners, such as Australia, are using Mode 4 to counter the domestic shortage of skilled workers.

However, India seems to be pursuing a different strategy to bring its skilled workers to the western industrialized countries: Instead of working towards Mode 4, India is pushing for the removal of permit and licensing requirements first.

The EFTA states would then negotiate with the professional associations on the admission criteria and the comparison of diplomas and degrees depending on the sector. In a few years, this could lead to an amendment of the agreement or at least to an annex with a list of recognized professional qualifications.

It is interesting to compare this with the agreements that India has concluded with the United Arab Emirates and Australia (see box). While the agreement with Australia clearly specifies the professions and sectors for mutual recognition, Tepa states that mechanisms for regulated professions of “mutual economic interest” are to be agreed within two years. The aim is to recognize Indian diplomas for these professions as part of an annex without an in-depth case-by-case examination.

The EFTA’s efforts vary depending on its proximity to the EU

The EFTA is making efforts to facilitate India’s access to its market in the services sector. For example, Norway is the only country to open up to specialists in traditional Indian medicine (Ayurveda).

Norway has its own approach to trainees, also known as “stagiaires,” and adopts the EU category of “graduate trainees,” thereby adhering to the EU’s trade agreements. Switzerland does not have its own trainee agreement with India and is generally reluctant to admit trainees from non-EU countries, as this category belongs to the exceptionally admitted third-country nationals.

| People mobility in the FTAs of India | |||

| Authorization for admission | Recognition of professional qualifications and diplomas | Sectoral most-favored-nation treatment | |

| ECTA (India-Australia) |

Working holiday maker visa and post-study visa | Within 12 months of entry into force for regulated professions in ‘mutual interest’ | Yes -> access to RCEP |

| CEPA (India-United Arab Emirates) |

Work permit for the partners and children of service providers | Within ‘reasonable time’ for listed professions: Architects, engineers, doctors, veterinarians and dentists, accountants and auditors, nurses, and company secretaries | no |

| TEPA (India-EFTA) |

Graduate trainees (Norway), work permit for spouse and children | 2 years after entry into force for regulated and licensed professions of mutual interest | no |

A special feature of the ECTA is a sector-specific most-favored-nation clause, which declares that trade advantages granted to one state must also be granted to all other contracting parties. India can demand negotiations if Australia makes further concessions to a third country. Conversely, India waives future concessions in 31 sectors, while Australia retains a reciprocal right.

There is no such clause in the TEPA, as India does not want to use the Tepa as a stepping stone for accession to a major regional agreement. India could therefore not demand better market access conditions from Switzerland if EFTA/Switzerland negotiates more favorable conditions with Malaysia or Vietnam. Conversely, Switzerland should not demand improvements if India grants better conditions to the UK or the EU.

Partner out of pragmatism

India has long been seen as a beacon of hope for the global economy. During Bill Clinton’s visit 24 years ago, topics such as nuclear disarmament and India’s conflict with its neighbor Pakistan were still at the top of the agenda. These topics have not lost relevance, but India’s growing economic influence is increasingly coming into focus.

For Switzerland and the EFTA, the TEPA is a success. In times of increasing security and geopolitical turmoil, this step also showcases their ability to act. However, an agreement that promotes investment and aims to open up markets in accordance with traditional trade rules is inevitably a compromise. In terms of trade in goods and services, the TEPA could have been broader (inclusion of gold, all agricultural products and more service sectors) and deeper (sector-specific most-favored-nation clause, zero tariffs from entry into force) compared to other EFTA free trade agreements.

The practical benefit of this partnership lies less in the reduction of customs duties on free trade than in the legal certainty for EFTA investors, who will find better conditions in India. Ultimately, India’s concessions still bear the hallmarks of an agrarian-dominated electorate – despite the moon flight and impressive growth forecasts.

Part 1: “Switzerland bets on India.”

“Avenir Suisse is an independent think tank that works for the future of Switzerland by developing evidence-based, liberal, free-market ideas.”

Please visit the firm link to site