Political polarization has seeped so deeply into US society that it shapes who Americans befriend, date, and marry, where they live, raise their families, and retire—and how they run their businesses.

A recent paper illustrates how the partisan divide permeates corporate America, segregating executive suites, start-up firms, and even entire professions and industries. Within finance, in particular, decisionmakers’ political views influence investment returns, credit ratings, asset allocations, loan terms, and bond yields, says Elisabeth Kempf, the Jaime and Raquel Gilinski Associate Professor at Harvard Business School.

“Political polarization can create distortions within the economy,” says Kempf, one of the coauthors of the new review. “Partisanship seems to be a really important determinant of many decisions made by businesses.”

“Political homogeneity of executive teams in the US has become more and more of a relevant problem over the past eight years or so.”

US politics are heating up ahead of the November presidential election as voters evaluate candidates Vice President Kamala Harris and former President Donald J. Trump. With the economy itself on the ballot and each major party offering starkly differing prescriptions for growth, it’s more important than ever to understand how political leanings shape the business, the workplace, and beyond.

“Political homogeneity of executive teams in the US has become more and more of a relevant problem over the past eight years or so,” Kempf says.

“We see it in views of the economy or views of certain risks, like the risk posed by certain political events or climate change or by the pandemic. There’s even the growing importance of partisanship in determining who works together and who does financial transactions together.”

How politics cuts across business

Written with Margarita Tsoutsoura, an associate professor of finance at Washington University in St. Louis, the analysis draws from data such as executive surveys, voter registration lists, campaign donation records, and corporate reports.

Three takeaways include:

1. Workplaces are divided by political party

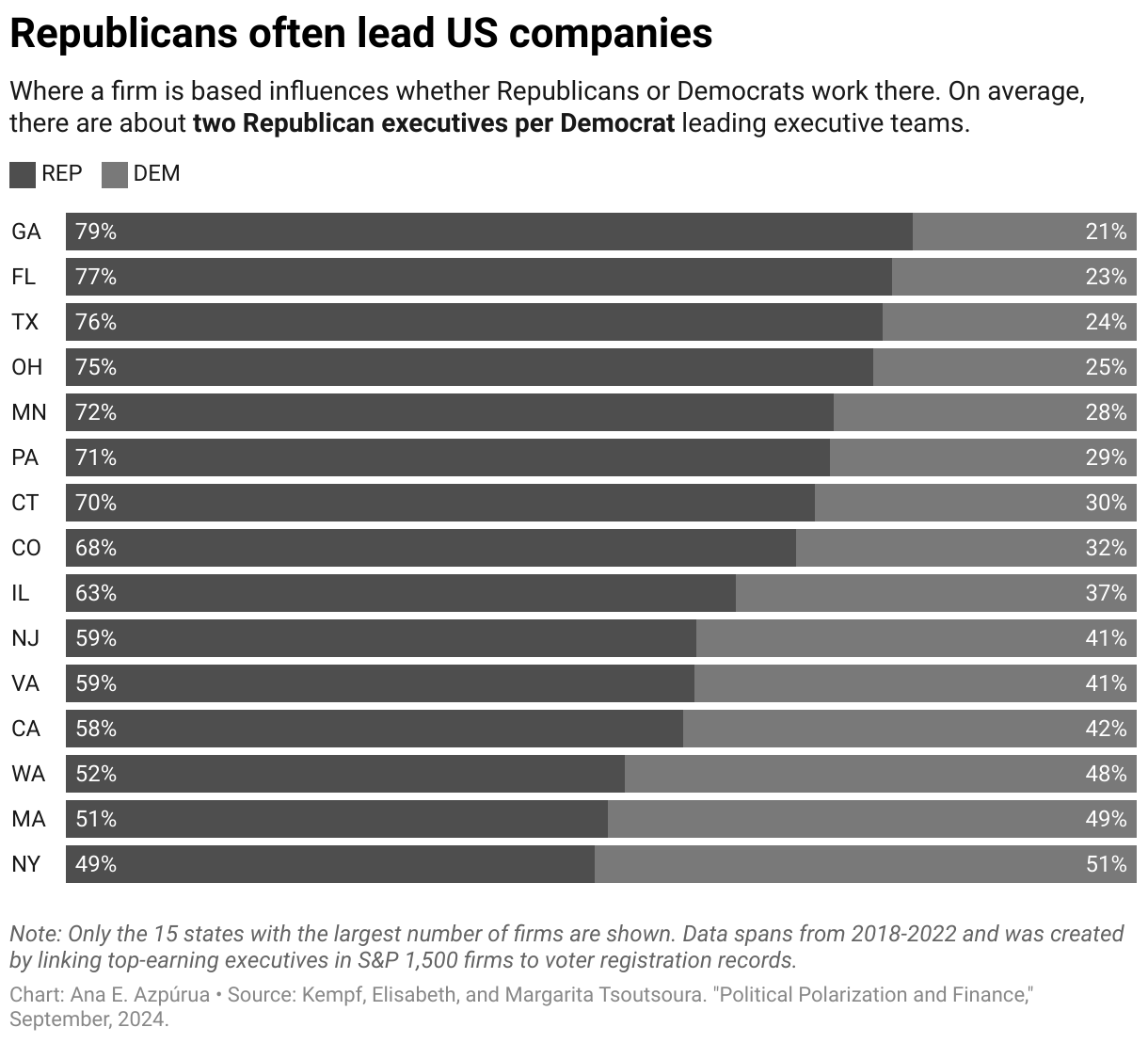

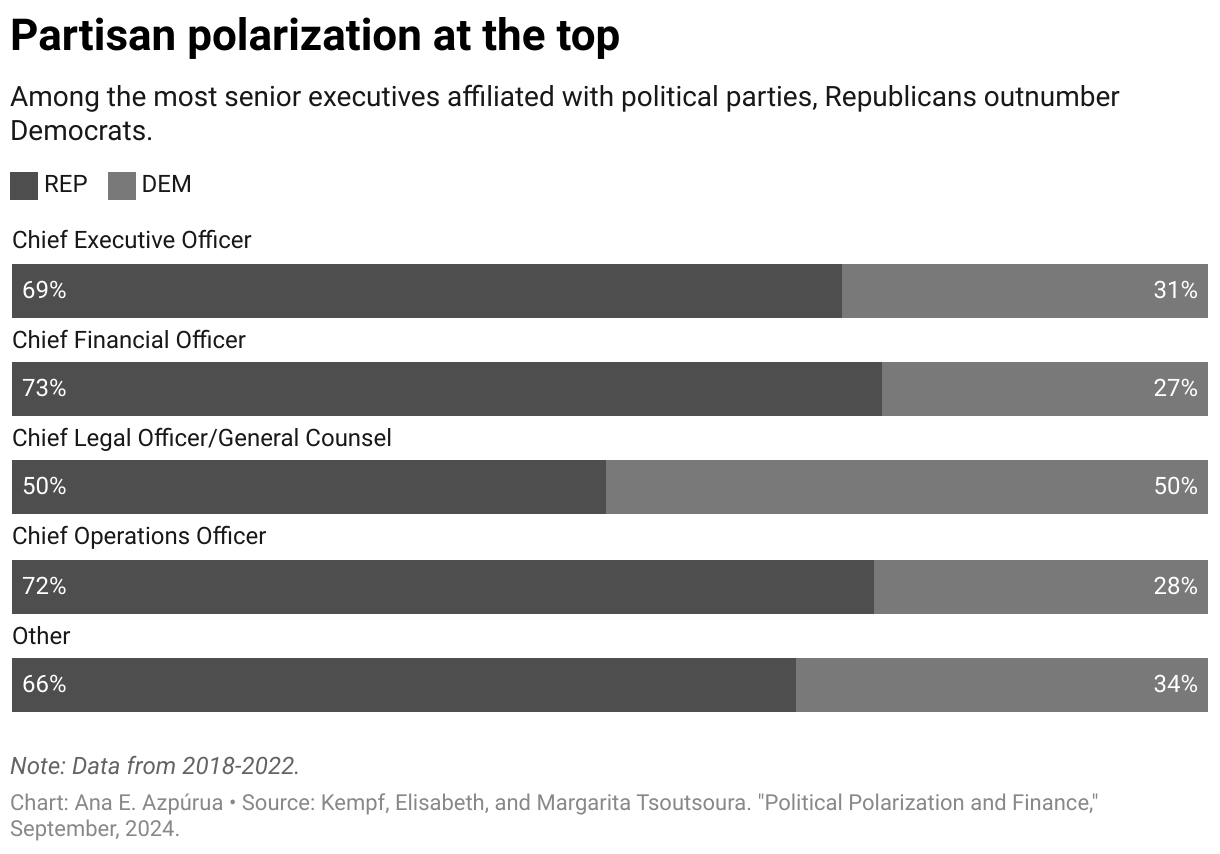

Using voter registration data and information from business research firm L2, one study revealed “substantial partisan segregation” at the highest levels of executives at S&P 1500 firms, with 66 percent of corporate leaders who affiliated with a political party registered as Republicans.

The partisan divide within executive suites differs depending on where firms are located. For instance, more than 75 percent of executives in Florida and Georgia are registered as Republicans, compared with 50 percent in Massachusetts and New York, the same study shows.

Partisan divides exist even within specific professions. Democrats accounted for more than 50 percent of chief or general legal officers at firms, but Democrats made up only 27 percent of chief financial officers. Similar fissures occur within entire industry sectors, such as a higher percentage of Democrats working at utility companies, but a lower percentage of Democrats employed at energy companies.

“It’s quite striking to see these large differences in the political composition of certain industries and certain roles at firms,” says Kempf. “It shows how political segregation is so prevalent.”

2. Politics affects analyst ratings

Another study examined the work of corporate credit analysts working at Fitch, Moody’s, and Standard and Poor’s, who cover approximately 2,000 US firms. Analysts who were not affiliated with an incumbent president’s party (referred to as “misaligned” analysts) downward-adjusted ratings more often than aligned analysts covering the same firm at the same time, the study shows.

The partisan leanings of intermediaries, such as credit-rating analysts, can have “sizable effects on firms’ cost of capital and investment decisions,” Kempf and Tsoutsoura write.

The researchers estimated that during a four-year political cycle, a firm loses 0.52 percent to 0.62 percent more of its market capitalization (between $89 million to $107 million) if it is rated by a misaligned credit-rating analyst as opposed to an analyst who is politically aligned with the incumbent president.

“A significant increase in bond yields also occurs that corresponds to 5.9 basis points over a four-year period,” Kempf and Tsoutsoura say in their new paper.

Additional studies have found similar partisan decision-making patterns by other financial professionals, such as bankers when making pricing decisions

in the US syndicated loans market and mutual fund managers when making asset allocations near the time of an election.

3. Entrepreneurs and inventors influenced by politics

Yet another study found that Republicans on average are 26 percent more likely to start a business than Democrats—and that partisan start-up gap significantly widens when Republicans take control of the presidency.

Alignment with the president’s party also seems to impact the pace of innovation. A study of patent filings shows that patent activity by Democratic inventors after the 2008 presidential election, won by Democrat Barack Obama, was 2 percent higher than patent activity by Republican inventors. But their relative patent productivity dropped by 3.8 percent around the 2016 election won by Donald J. Trump, a Republican, the study finds.

‘Too much political homogeneity’

Sharing a colleague’s politics is not always bad for business. There is some evidence that mergers and acquisitions are more likely to occur, and are more likely to be smoothly implemented, if they’re conducted by executives who share the same political ideology, Kempf says.

“You seem to lose something when you don’t have differing viewpoints when making decisions.”

But she adds that more research needs to be conducted to find the true extent of partisanship within the economy and corporate decision-making.

“It’s still an open question whether this tendency toward partisanship in the workplace is truly good or bad, but the cleanest evidence we have points in the direction that too much political homogeneity is bad,” she says. “You seem to lose something when you don’t have differing viewpoints when making decisions.”

You Might Also Like:

Feedback or ideas to share? Email the Working Knowledge team at hbswk@hbs.edu.

Image: HBSWK with asset generated by Midjourney, an artificial intelligence tool.

“Harvard Business School is the graduate business school of Harvard University, a private research university in Boston, Massachusetts. It is consistently ranked among the top business schools in the world and offers a large full-time MBA program, management-related doctoral programs, and executive education programs.”

Please visit the firm link to site