3 October 2024

Monetary policy decisions have direct financial consequences for many consumers, especially as they influence mortgage conditions. The ECB Blog looks at how these effects differ based on consumers’ mortgage situations and why that matters for the transmission of monetary policy.

Consumers’ expectations about real interest rates influence their decisions about saving, borrowing and investment. What really matters to people, according to standard economic models, is the combination of expected nominal interest rates and expected inflation, which determines the real (i.e. inflation-adjusted) cost of borrowing. Lower interest rates may encourage consumers to consider buying and financing a house via a mortgage or by dipping into their savings. Higher interest rates, on the other hand, might be a reason to postpone those decisions. This highlights the important role that consumers’ interest rate expectations play in the transmission of monetary policy.

When looking at the transmission of interest rates to households it is particularly useful to focus on their expectations about real interest rates on mortgages. Mortgages usually involve large amounts of money, especially in relation to households’ incomes. Therefore, expected changes to mortgage interest rates can have a significant effect on consumers’ budget planning and their willingness to spend. The ECB’s monthly Consumer Expectations Survey (CES) asks around 20,000 people across the euro area a range of questions, including their expectations about interest rates and inflation. The data collected give an idea of the real interest rate expectations of euro area consumers.[1]

Expected real interest rates and the housing market

Real interest rate expectations for mortgages have risen noticeably since October 2022, i.e. shortly after the start of the rate hiking cycle in July 2022, implying a significant tightening of households’ financial conditions (Chart 1, blue line). This is clear from the combined expectations of falling inflation rates and higher nominal mortgage interest rates. Looking back over the period since early 2022, the increase in nominal mortgage rate expectations (Chart 1, yellow line) was similar to, albeit somewhat lower than, the evolution of actual mortgage rates on new mortgage lending (Chart 1, green line).

Chart 1

(Real) interest rate expectations

(annual percentage change)

Source: ECB Consumer Expectations Survey (CES), ECB (MIR – MFI Interest Rate Statistics), latest observation: June 2024. Notes The actual cost of borrowing for house purchase is measured as the euro area average interest rate for households for housing loans, only considering new business (available from SDW: MIR.M.U2.B.A2C.AM.R.A.2250.EUR.N). Weighted estimates for CES. Each month, the CES elicits a generic interest rate expectation by asking: “In 12 months from now, what do you think will be the interest rate on mortgages in the country you currently live in?”. Inflation expectations are measured as average implied mean from a beta distribution fitted to consumers probabilistic forecasts. The average real (mortgage) interest rate is calculated as the average difference between the nominal (mortgage) interest rate and the mean of the individual inflation forecast distribution. Real interest rate expectations have been winsorised at the most extreme five percent to account for outliers.

Digging deeper into the CES results shows that the overall transmission of monetary policy is critically linked to consumers’ housing and mortgage status. This reflects the important role played by housing decisions for household balance sheets and their loan repayment obligations. As shown in Chart 2, different countries have quite different mixes of home ownership and mortgage types.[2] While in some countries a larger proportion of homeowners has fixed-rate mortgages, in countries such as Spain, Portugal and Finland more flexible adjustable-rate mortgages were particularly popular when consumers acquired their houses in the past. In Portugal, for example, many consumers might be affected by rising interest rates immediately. At the other end of the spectrum are countries in which most consumers report loans with fixed rates for certain periods, such as the Netherlands or Germany. There, mortgage debtors are more likely to only experience the increasing costs for interest rates with a delay when they re-finance their mortgage or after its conversion at a new market interest rate level.

Because of these differences across the euro area, the transmission of monetary policy decisions has likely been faster in countries with a larger share of adjustable-rate mortgages and slower in those countries with a less rate-dependent housing structure. Homeowners without a mortgage, who are for example much more common in Italy than in the Netherlands, are not directly affected by changes to interest rates via their home financing but may be indirectly affected by the impact of higher rates on their wealth (e.g. if house prices decline). Renters, who are much more prevalent in Germany than in Spain, are also not directly affected by higher mortgage repayments due to changing interest rates, although there may be an indirect effect if landlords raise rents because they themselves have a mortgage.

Chart 2

Interest rate exposure across countries

(percentage of consumers, by country)

Source: ECB Consumer Expectations Survey (CES), February 2024. Notes: Weighted estimates. The Figure depicts the percentage of consumers by housing status in February 2024. The CES collects on experimental basis additional data on households’ housing status including homeowners’ mortgage type in a specialised module on housing markets every February.

Higher interest rates and inflation expectations

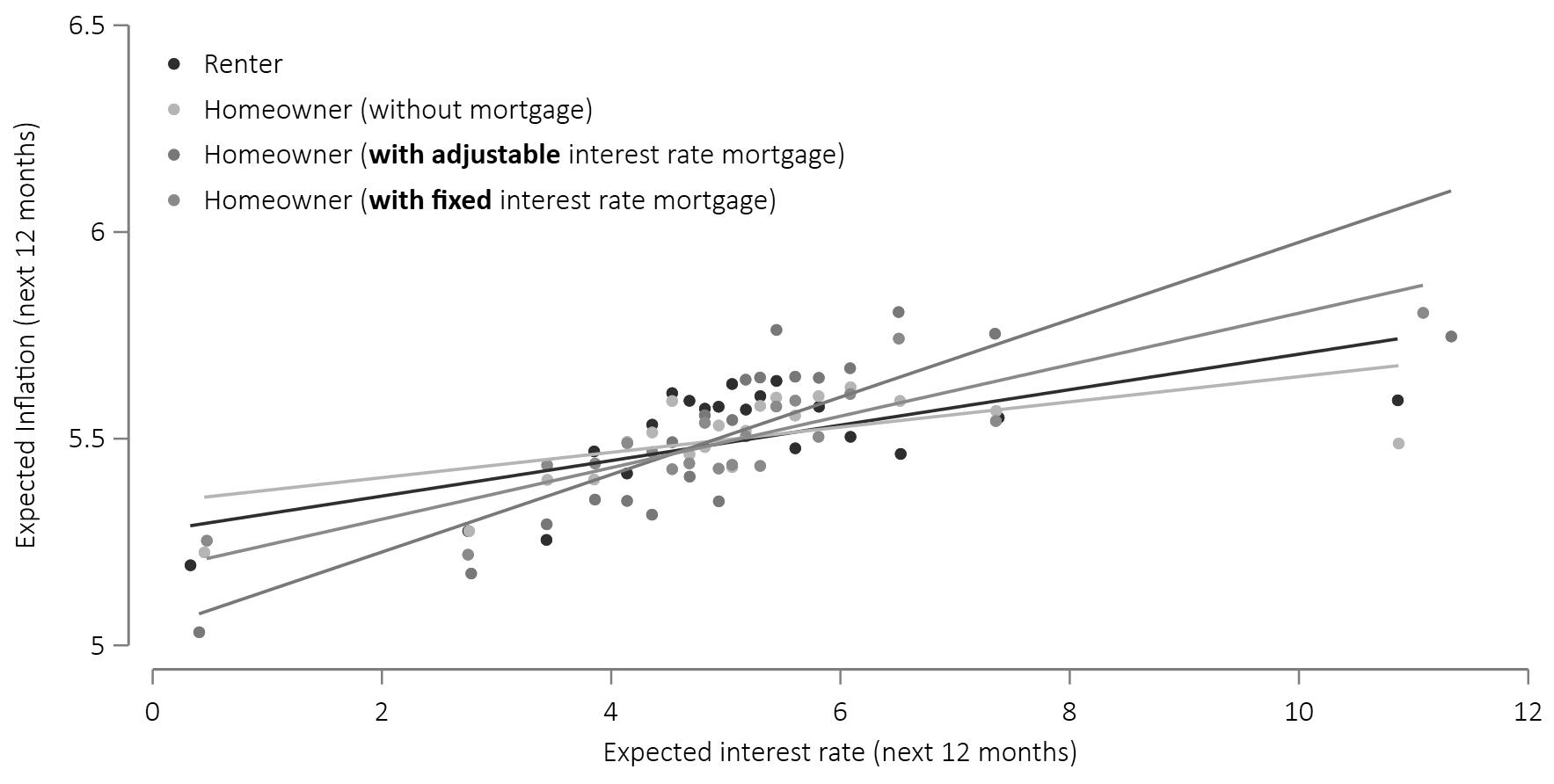

So, what is the perceived connection between consumers’ expectations about inflation and their expectations about interest rates? Survey participants who expect relatively higher interest rates generally also expect relatively higher inflation rates over the next twelve months (Chart 3). This suggests that consumers don’t necessarily expect higher interest rates during a period of monetary policy tightening to lead to lower inflation, at least not in the short term. One potential explanation for this positive association is that consumers might also expect lenders to increase interest rates to compensate for inflation in their lending activities. A different possible reason for this positive association is the role of rate-sensitive mortgage payments, which may have a direct impact on consumers’ living expenses and raise their inflation expectations.[3] In other words, higher interest rate expectations may be a source of broader concerns about the cost of living, which are in turn reflected in inflation expectations. This alternative explanation is supported by the fact that the positive relationship between nominal interest rate expectations and inflation expectations is strongest for consumers who hold an adjustable-rate mortgage and are therefore most exposed to changes in interest rates (Chart 3, red line).

Chart 3

Interest rates as a cost to consumers

(annual percentage changes)

Source: ECB Consumer Expectations Survey (CES). Notes: Weighted estimates. The Figure depicts a binscatter plot of the average implied mean from a beta distribution fitted to consumers probabilistic forecasts of inflation over the next 12 months (y-axis) against consumers interest rate expectations over the next 12 months (x-axis) based on pooled Jul. 2022 to June 2024 data. Each of the fitted lines accounts for individual fixed effects and wave dummies showing thereby the within-individual updating of expectations.

The role of housing in the transmission of monetary policy is also reflected in a growing divergence in how households perceive their financial situation today compared to 12 months ago depending on their housing situation, and in particular on the nature of their mortgage contract. The share of households that see their financial situation as worsening has steadily declined as inflation has fallen from its peak in late 2022. The CES data also highlight, however, that consumers with adjustable-rate mortgages are consistently much more likely to see their financial situations as getting worse (orange line in Chart 4). In addition, some households have also been struggling to service their mortgage payments. When the level of short-term interest rates peaked in October 2023 about 15% of adjustable-rate mortgage holders participating in the CES expected to be late with their mortgage payments over the next 12 months. This contrasts sharply with the 5.8% of fixed-rate mortgage holders with the same expectation.

Chart 4

Consumers who think their financial situation is worsening

(percentage of consumers, by housing situation)

Source: ECB Consumer Expectations Survey (CES), latest observation: June 2024. Notes: Weighted estimates. Each month, consumers are asked: “Do you think your household is financially better off or worse off now than it was 12 months ago?” on a scale of “Much worse off”, “Somewhat worse off”, “About the same”, “Somewhat better off” or “Much better off”. Consumers are classified as having a worse financial situation if they answer with much worse off or somewhat worse off.

In this blog, we show that during the recent monetary tightening phase consumers adjusted their real interest rate expectations. We also provide evidence that the tightening of monetary policy has been transmitted differently to different euro area households, in part reflecting their divergent housing and mortgage situation. Looking ahead, a resetting of the interest rate on fixed rate mortgages which originated during the low interest rate period would likely imply a delayed contractionary effect on euro area households at currently prevailing interest rates. A close monitoring of housing market developments for consumers, including through the lens of individual-level household data, contributes to our understanding of the ongoing monetary transmission.

The views expressed in each blog entry are those of the authors and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Check out The ECB Blog and subscribe for future posts.

For topics relating to banking supervision, why not have a look at The Supervision Blog?

“The European Central Bank is the prime component of the Eurosystem and the European System of Central Banks as well as one of seven institutions of the European Union. It is one of the world’s most important central banks.”

Please visit the firm link to site