Money worries are a common occurrence for many people in the UK, and ongoing economic challenges have only heightened these concerns.

Indeed, research from the Financial Conduct Authority (FCA) has revealed that 43% of UK adults – more than 22 million people – feel stressed or anxious due to rising living costs. This worry can affect many areas of your life, ranging from your financial and emotional wellbeing to your relationships.

Financial anxiety often occurs in several ways, and you may experience symptoms such as:

- Poor sleep

- Depression

- Physical pains

- Difficulty concentrating

- Weight gain or loss.

Thankfully, there are practical strategies that can help you feel more confident and optimistic about your financial situation.

Since 10 October is World Mental Health Day, continue reading to discover five steps to alleviate your financial anxiety and feel more in control.

1. Identify the source of your financial anxiety and any specific triggers

A vital first step in tackling your financial anxiety is identifying its root cause. Whether you have a fear of instability, concerns about your retirement, or worries about providing for your loved ones, the uncertainty regarding your finances can become overwhelming.

As such, you may want to sit down and take the time to carefully reflect on the source and triggers of your anxiety and then write them down. This can provide some much-needed clarity and make your issues far more manageable.

Understanding the origin of your financial anxiety doesn’t just help you become more self-aware, but can also help you feel more in control.

2. Talk to your friends and family

Sharing your worries regarding your finances with your loved ones can be incredibly beneficial.

Despite this, discussing financial matters is still somewhat taboo in the UK. Klarna reveals that 32% of adults feel too uncomfortable to discuss their wealth with peers, despite 44% regularly worrying about money.

Opening up about your financial concerns is a helpful way to process them more effectively and may even lead to practical solutions.

Indeed, your friends and family might offer a new perspective or encourage you to develop a plan, such as setting up a realistic budget or cutting unnecessary spending, both of which can alleviate your anxiety and help you feel more in control.

After all, a problem shared is a problem halved, and simply discussing your financial woes with your loved ones can lift an incredible weight from your shoulders.

3. Clear as much of your debt as possible

Debt is a considerable driver of financial anxiety, with a study from the Royal College of Psychiatrists revealing that half of all adults with debt problems also live with poor mental health. Whether it’s low moods or diagnosed conditions, debt is closely linked with your emotional wellbeing.

High-interest debt, such as that from credit cards or unsecured loans, can quickly snowball and become unmanageable, exacerbating your financial stress.

As such, you may want to consider employing some strategies for paying off your debt as soon as possible.

One effective method of doing so is by targeting your high-interest debt first, which can prevent it from spiralling out of control.

Remember that it’s vital you don’t bury your head in the sand regarding your debt, as ignoring your issues will likely only lead to more anxiety later down the line.

Then, once you’ve paid back what you owe, re-evaluate your spending habits to ensure you’re living within your means and don’t have to rely on debt in the future.

4. Bolster (or build) an emergency fund

Life is full of unexpected events, and even if your financial situation seems secure on the surface, emergencies can strike at any time.

Whether it’s sudden car repairs or a loss of income due to a period of illness, having a financial safety net to fall back on can prevent these unforeseen costs from contributing to your financial anxiety.

As such, it may be wise to bolster, or build, your emergency fund.

A good rule of thumb is to save between three and six months’ worth of essential household expenses in an easy access savings account. If you’re self-employed or have dependents, you may want to consider putting aside more.

What’s more, if you’re retired, you may want to bolster your emergency fund to cover between one and two years of necessary costs. This could ensure that you won’t have to sell any investments held within your pension during a period of market volatility when the value of your assets is temporarily lower.

Having this robust emergency fund in place can provide incredible peace of mind. You may find yourself safe in the knowledge that you won’t have to rely on expensive forms of borrowing when the unexpected arises.

This financial security is a vital step towards alleviating your long-term anxiety.

5. Work with a financial planner

Ultimately, one of the more effective ways to tackle your financial anxiety is simply by seeking professional guidance.

A financial planner can offer expert advice tailored to your specific circumstances, helping you develop a strategy that aligns with your goals and calms your concerns.

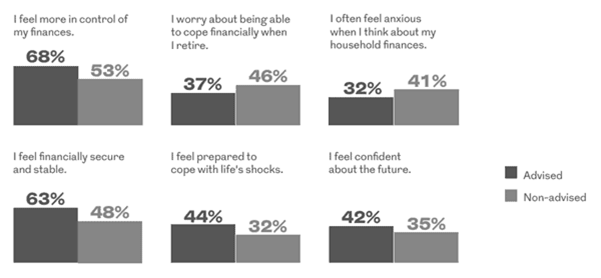

Research from Royal London highlights the positive effects of working with a planner, as shown by the graphic below.

Source: Royal London

As you can see, clients who worked with a planner felt more financially secure, more in control of their money, and less anxious about their household finances.

Having an expert in your corner provides some much-needed clarity and reassurance, helping you make informed decisions that benefit both your financial and mental wellbeing.

Get in touch

We can help you tackle your financial anxiety so you can feel more in control of your wealth.

Email enquiries@blackswanfp.co.uk or contact your adviser on 020 3828 8100 to find out more.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The post 5 practical ways to tackle financial anxiety on World Mental Health Day appeared first on Black Swan Financial Planning.

“Black Swan Financial Planning was established in 2000, and since then became one of the top independent financial adviser firms in the UK.”

Please visit the firm link to site