By Shadrack Kwasa | 15 Oct, 2024

For profesionnal investors

INTRODUCTION

Inflation has weighed heavily on investment markets for a prolonged period. Central Banks have waged a war against inflation and victory appears imminent as we have seen the most recent inflation readings signalling inflation is coming under control. This is an inflexion point for investment markets as we are now moving from a period where high interest rates have been used to control inflation to one where Central Banks have begun to cut rates. In this environment, the dynamics of investments in cash versus bonds change significantly, influencing how investors should position their portfolios. Understanding these impacts is crucial for maximizing returns and managing risks.

IMPACT ON CASH INVESTMENTS

Cash and cash-equivalent are highly sensitive to interest rate changes. When interest rates decline, the returns on these assets typically decrease as well. For holders of cash or very short-dated debt securities such as certificates of deposit (CD’s) the two major risks are:

- The erosion of return in real terms as rates fall and inflation remains steady. If the return on cash falls below the rate of inflation, then the return on cash in real terms becomes negative. This erosion of purchasing power makes cash less attractive as an investment option. Consequently, investors holding large cash positions may find their portfolios underperforming, particularly when inflation is factored in.

- The reinvestment risk once the short-dated instruments mature becomes material as the available rates in the market decline.

IMPACT ON BOND INVESTMENTS

Bonds, on the other hand, generally benefit from falling interest rates. The relationship between interest rates and bond prices is inverse; when interest rates fall, the prices of existing bonds with higher coupon rates increase. This is partly because new bonds are issued at the current lower rates, making the older bonds with higher rates more valuable in comparison.

Longer-duration bonds are particularly sensitive to interest rate changes. As rates fall, the prices of these bonds tend to rise more significantly than shorter-duration bonds. This occurs because the longer the bond’s maturity, the greater the impact of the rate change on its present value. Investors seeking higher returns in a declining interest rate environment may consider increasing their exposure to longer-duration bonds.

However, it’s important to note that while bonds generally perform better when interest rates fall, they are not without risks. Interest rates can fluctuate, and if rates rise, bond prices will decline. Additionally, bonds with longer durations are more volatile and susceptible to interest rate risks. Further as new bonds are issued at the lower interest rates investors in new issues will find bonds becoming more expensive as interest rates fall.

PORTFOLIO POSITIONING IN A FALLING INTEREST RATE ENVIRONMENT

Given the impact of falling interest rates on cash and bond investments, investors should consider rebalancing their portfolios to optimise returns while managing risk.

- Reduce Cash Holdings.

In a low-interest-rate environment, holding large amounts of cash can result in diminished returns, particularly when inflation is considered. While it’s important to maintain some liquidity for emergencies or short-term needs, excess cash may be better allocated to assets that offer higher potential returns.

- Increase Bond Exposure.

Bonds, especially those with longer durations, may offer more attractive returns in a declining rate environment. Investors might consider shifting a portion of their cash holdings into bonds to take advantage of the potential price appreciation. However, this strategy should be balanced against the risk of future interest rate increases and asset-liability matching requirements.

- Diversify Across Asset Classes.

While bonds can benefit from falling rates, a well-diversified portfolio remains essential. Investors should consider spreading their investments across different asset classes, including equities, which can also perform well in a low-rate environment due to cheaper borrowing costs for companies and the potential for higher dividend yields compared to bond interest rates.

- Consider Inflation-Protected Securities or securities that offer real returns.

To mitigate the risk of inflation eroding returns, investors might also look at inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), Inflation-linked Gilts or corporate bonds which offer protection against inflation while still providing income. Investors need to keep in mind that some of these instruments may be expensive due to a combination of demand for inflation protection and the pricing of these products in periods of high inflation. Alternatively, investors may consider assets that produce real returns such as equities, property or similar assets whose pricing is positively correlated with inflation.

INSTITUTIONAL INVESTOR: CASE STUDY

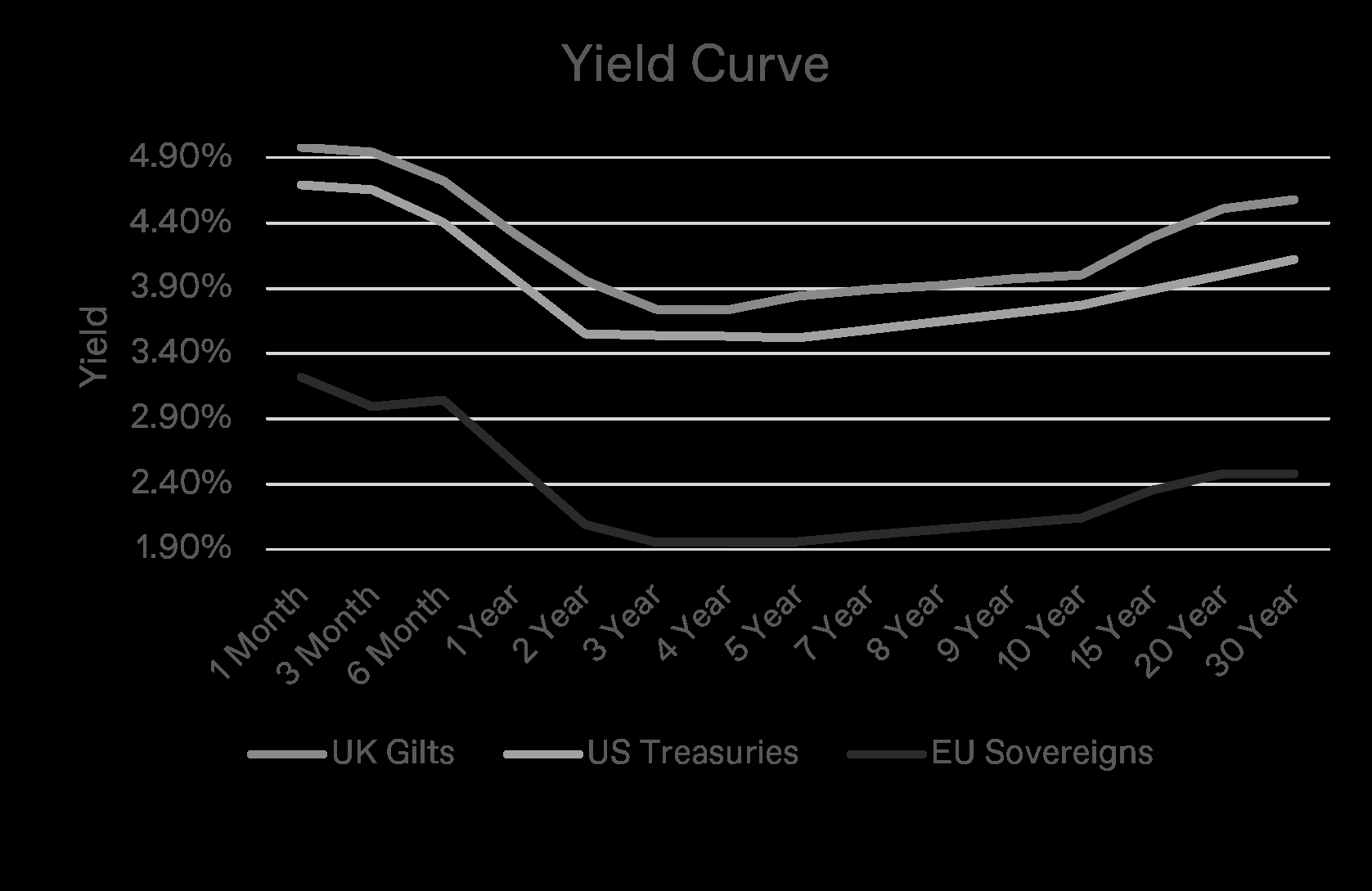

Insurance companies are particularly sensitive to interest rate movements due to the interaction between the valuation of their assets (mostly fixed income) and liabilities (often discounted at a rate that is linked to the “risk-free” interest rate). Insurers have also had a transition from a period of low to high interest rates hence for many of them locking in a favourable interest rate over a period of one or more years is attractive. The chart below shows the current yield curve for US, UK and EU government bonds.

The yield curve above is inverted which means yields for shorter dated treasuries are higher than longer dated treasuries. This is unusual as investors should demand higher yields for longer-dated bonds given the uncertainty of future outcomes. As Central Banks continue to cut rates we expect the yield curve to move lower and normalise. This means we will see shorter-dated yields fall faster than those on the long end.

Depending on the sensitivity of an insurer’s investment portfolio to changes in interest rates (variously described as duration and/or convexity); they should see an increase in the value of their bond portfolios but a reduction in expected returns going forward as yields move lower. What many insurers and institutional investors are doing in this situation is “locking in” yields by identifying a position along the yield curve and purchasing and holding these bonds. This allows the insurer to enjoy the benefit of the current yield before the curve begins to trend downward. This is especially relevant to holders of cash and assets with maturities less than 12 months as this is where most of the yield curve shift will happen (ie curve falling as well as normalising).

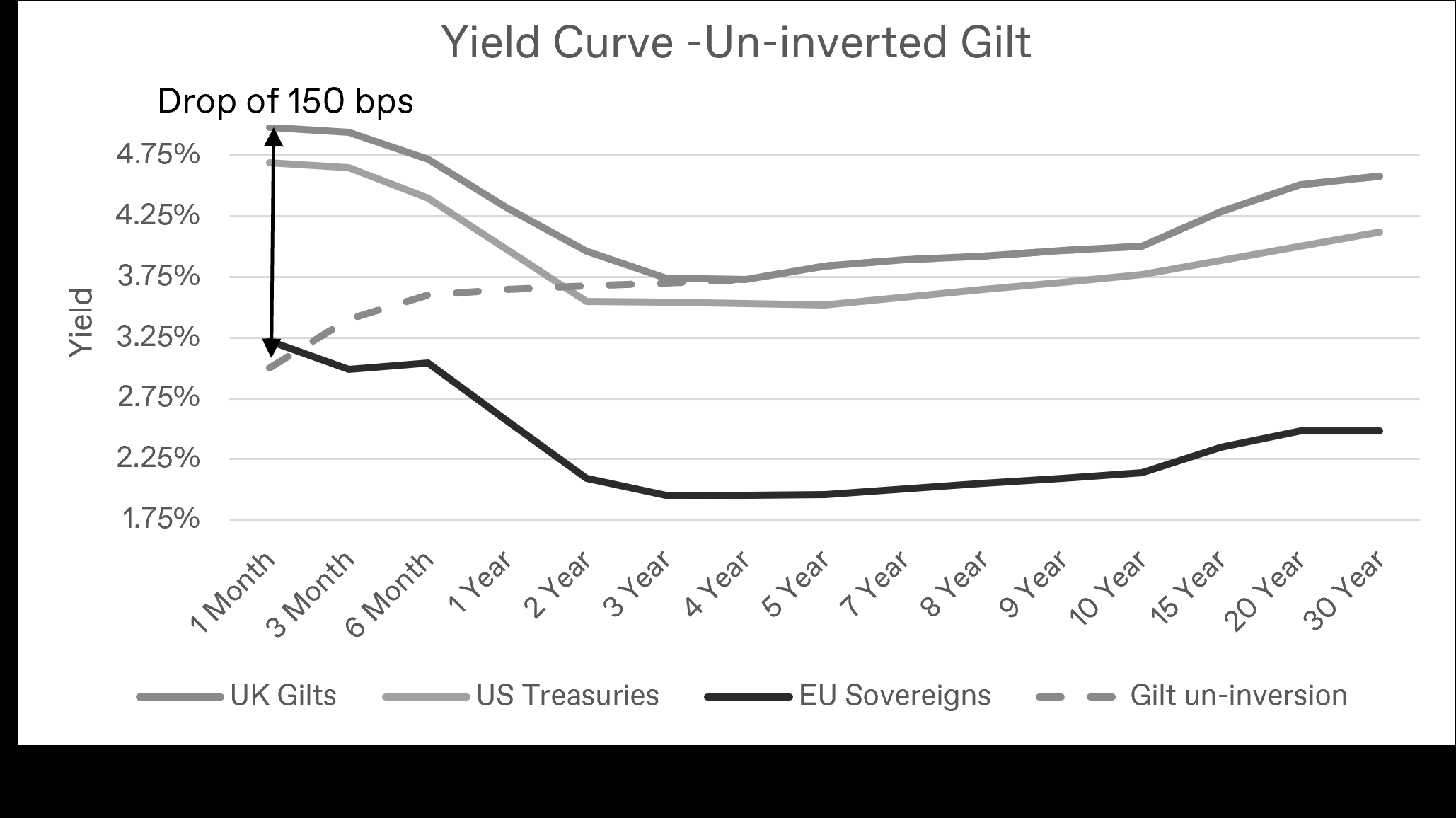

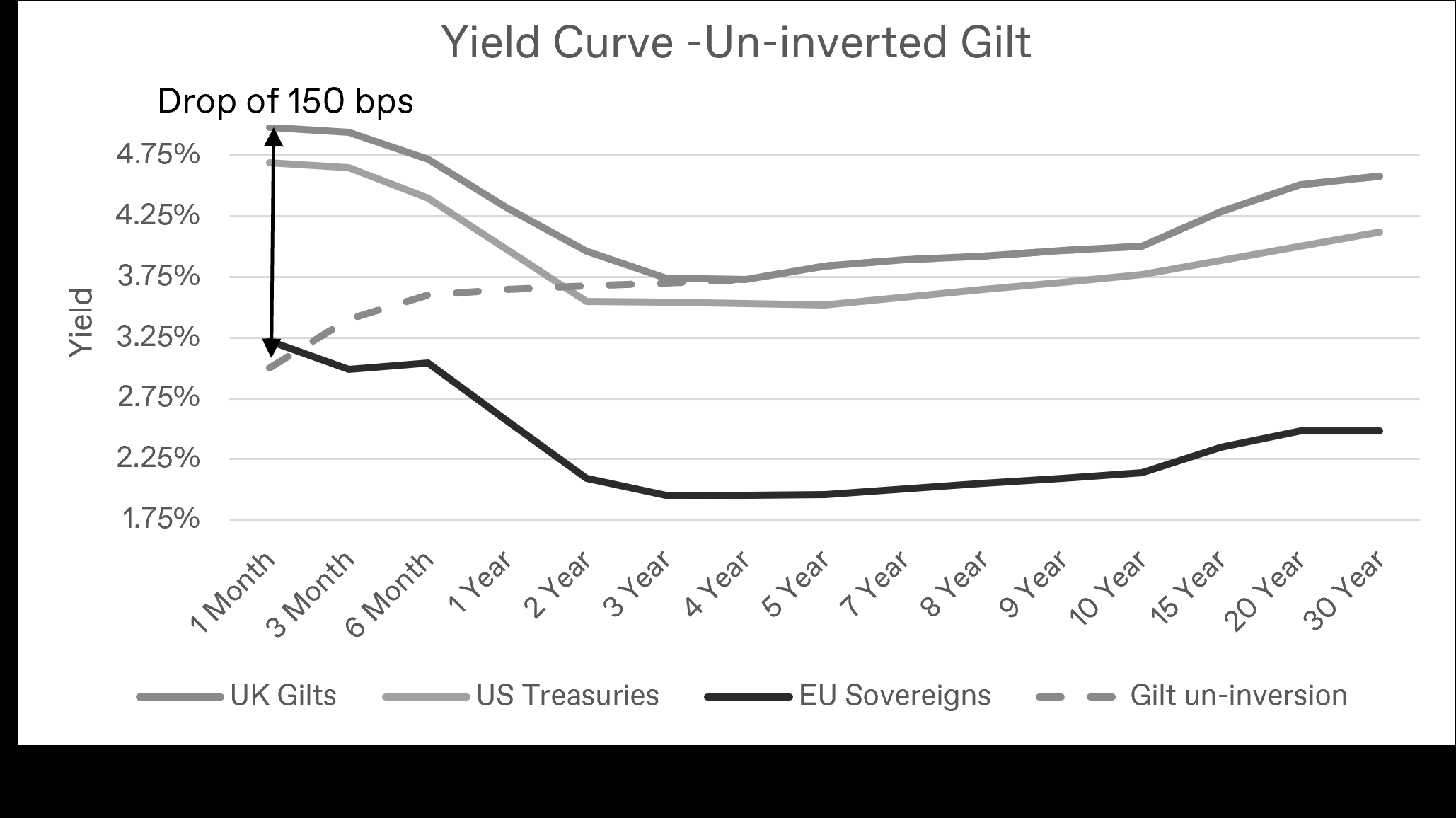

Assuming the equilibrium base interest rate for an is around inflation plus 1%. Given most Central Banks target a 2% inflation rate this implies that the base interest rate should move down to about 3.0%. In the case of the UK in order for the short-end of the yield curve to drop down to 3.0%, there would have to be cuts equating to 1.50% (150bps).

Assuming the equilibrium base interest rate for an is around inflation plus 1%. Given most Central Banks target a 2% inflation rate this implies that the base interest rate should move down to about 3.0%. In the case of the UK in order for the short-end of the yield curve to drop down to 3.0%, there would have to be cuts equating to 1.50% (150bps).

This would have a material impact on the return profile of anyone holding cash or short-dated debt (for example certificates of deposits or CDs). This poses a material reinvestment risk for these investors.

PRACTICAL EXAMPLE

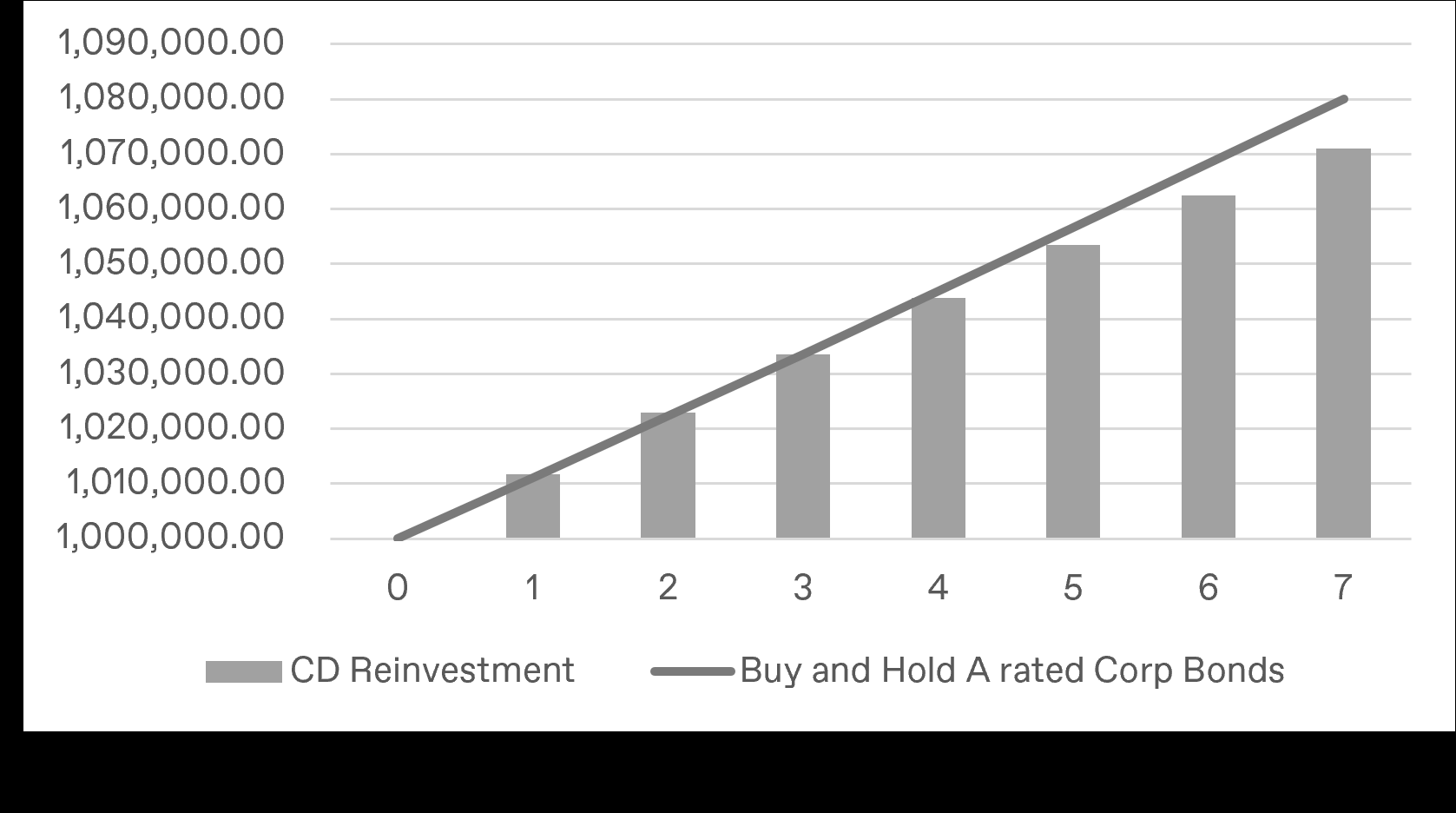

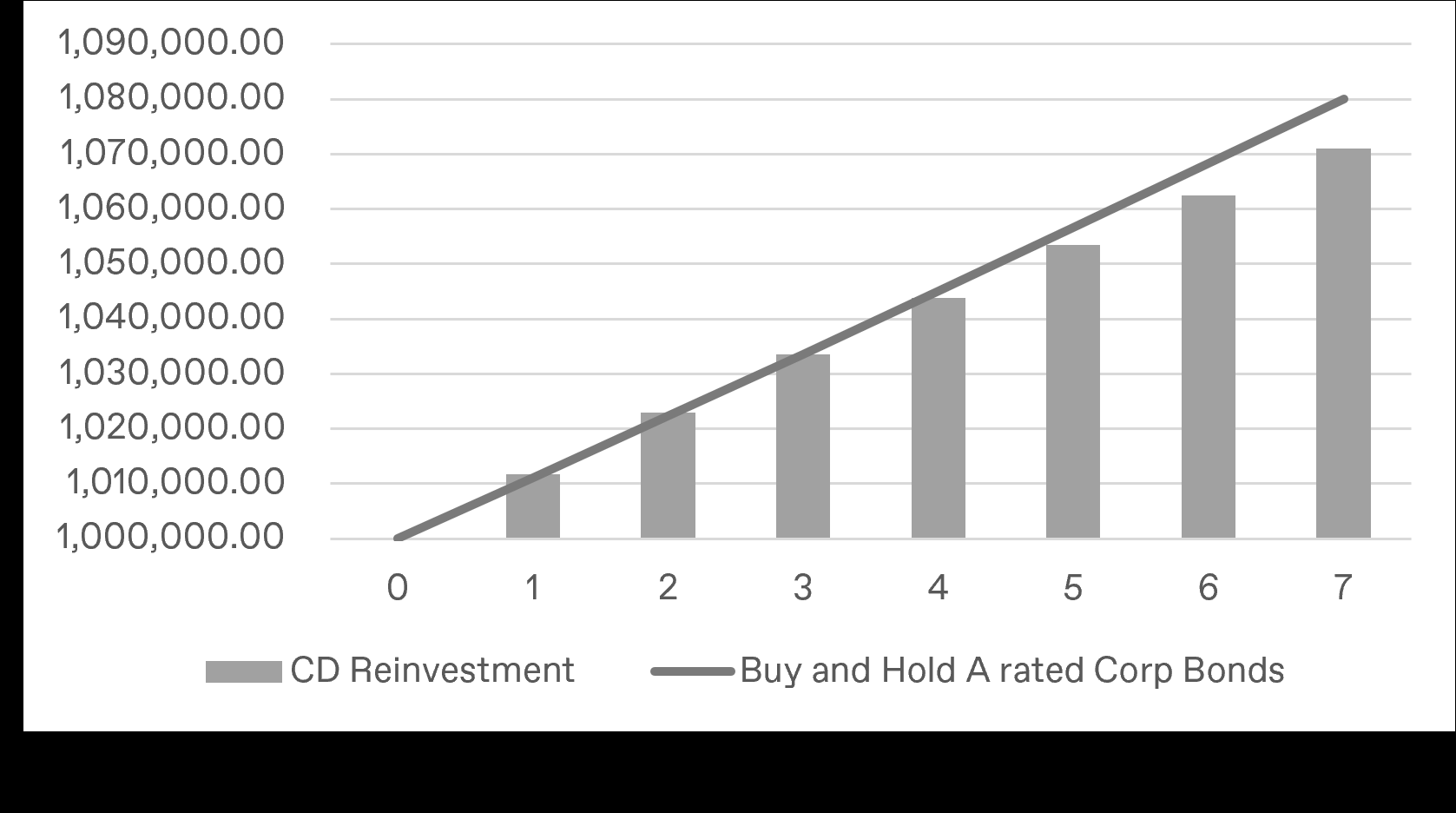

Consider the income profile of an investor holding 3-month CDs worth 1m and reinvesting at maturity, compared to a bond holder of A rated corporate debt. Assuming the 1.50% (150bps) reduction in the base interest rate happens at 0.25% (25bps) increments over 6 quarters and the corporate bond has a yield to maturity that is 0.50% (50bps) higher than that of an equivalent UK government bond. Then the amortised return profile (ignoring mark-to-market volatility) for a buy and hold investor over 7 quarters is as below.

In this scenario, the cumulative return for CDs over the period is 7.1% while the cumulative return on the bond is 8.0%.

In this scenario, the cumulative return for CDs over the period is 7.1% while the cumulative return on the bond is 8.0%.

In practice, the bond valuation will not be a smooth line as bonds will be subject to mark-to-market volatility and most bonds pay a coupon which will appear as a regular cash injection into the portfolio. However, for an insurance entity that has no need to call on the bond for cash the volatility is less of an issue and so long as the bond is held to maturity (and does not default) the investor will realise the full yield at maturity.

As active asset managers, we are proactively working with our clients to identify positions along the yield curve for which yields can be locked in.

CONCLUSION

Falling interest rates have a pronounced impact on both cash and bond investments. The lure of higher annual yields at the short end of the curve will not be realised as investors will be required to reinvest at lower yields for instruments with less than one year maturity. Cash and money market instruments becomes less attractive as returns decline, while bonds, particularly those with longer durations, may offer better opportunities for capital appreciation. However, investors should be cautious and avoid overexposure to any single asset class. By diversifying and rebalancing their portfolios in response to changing interest rates, investors can better position themselves to navigate a low-interest-rate environment while managing risk and optimising returns.

“London and Capital Group works with HNW and UHNW individuals to provide an integrated wealth management solution which includes financial planning, tailored investment management and multi-currency reporting.

With offices in London and Barcelona and a dedicated team who specialise in ex-pat Americans, they are positioned to provide a truly borderless wealth management solution.”

Please visit the firm link to site