By Robert Fernando CFA | 09 Sep, 2024

The usually quieter summer months for financial markets stirred to life with concerns over central bank policy, a slowing US economy and corporate earnings guidance.

The fall in equity markets during mid-July spilled into early August and by the 5th, the S&P 500 index was down 10% while the more global MSCI World equity index was down 8.5%.

However, markets recovered during the month of August and global equities – as measured by the MSCI world – finished up 2.5%.

Therefore, it was a seesaw month for equities floating towards correction territory mid-month and ending positively by month’s end.

It was no surprise the VIX index – a measure of volatility (or the increased movement up and down in prices) rose to 40 from 16 at the beginning of the month.

So, what spooked the markets?

Federal Reserve (Fed) policy. Markets were disappointed the Fed decided to keep rates on hold at their July meeting. Furthermore, employment data came in softer than expected, with the US economy adding 114,000 jobs – materially lower than expected – and the unemployment rate ticking up to 4.3% compared to 4.1% in June.

While other central banks including the Bank of England (BoE), European Central Bank (ECB) and the Canadian Imperial Bank of Commerce (CIBC) have begun to cut interest rates, the Fed have not, due in part to sticky inflation numbers at the beginning of the week and a tight labour market. Investors felt the economy was cooling at a pace worthy enough to begin reducing rates – which the Fed did not agree with.

In Japan, the Bank of Japan (BOJ) increased short term borrowing rates to 0.25% from 0.1% – only the second increase in 17 years as annual inflation approached their 2% target and wage inflation remained elevated. As Japan is primarily an exporting nation, the rate increase strengthened the yen, making exports for Japanese companies more expensive. Japanese equity markets sold-off aggressively with the Nikkei index down 10% on a single day. This sell-off spread to other markets.

Lastly, second quarter corporate earnings disappointed with some of the big tech firms falling short on analyst’s expectations on earning’s guidance.

China took a backward step during the month as deflation and sluggish growth continues to slow the economy.

Mid August recovery

Markets recovered as the Fed Chairman, Jerome Powell, looked to assuage markets in his speech at Jackson Hole, declaring victory in the battle to control inflation (with July’s Consumer Price Index (CPI) at 2.9%) and suggesting that rate cuts were imminent. Markets reacted positively.

Global Equities

Global equities were up 2.5% with the underlying market rotating from the strongest performing sectors into more defensive styles. Growth sectors like consumer discretionary (+0.6%) and IT (+1.4%) underperformed, while defensive sectors such as healthcare (+5.4%) and consumer staples (+4.3%) outperformed. Interestingly, real estate (+5.7%) was the strongest sector for the month outperforming due to expectations of a lower interest rate environment.

Fixed income

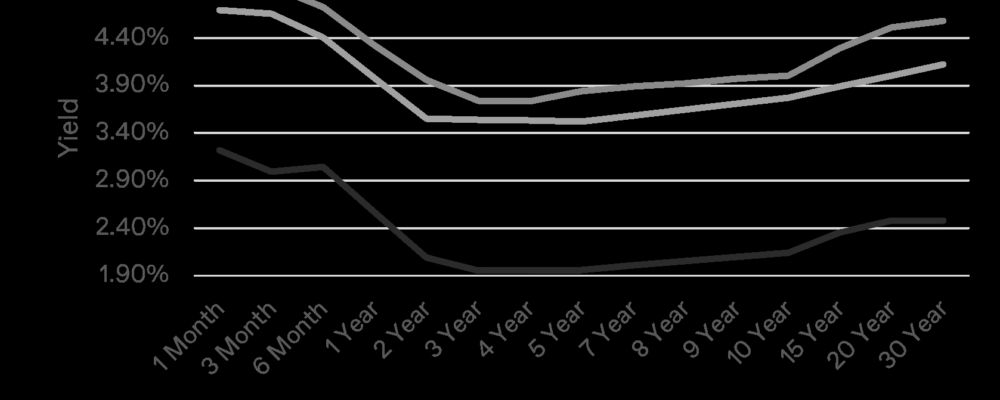

Global bonds as measured by the Bloomberg Barclays Global Aggregate index rose 2.4%. With inflation approaching the 2% target in most developed markets, government bond yields declined over the month with increasing probability of rate cuts at the Fed’s September meeting. The US 1-year interest rate dropped by 0.35% to 4.4%, while the 10-year interest rate/yield fell from 4% to 3.9%.

Corporate bond rates remained broadly flat for the month.

Commodities

Energy prices, particularly oil, were marginally lower over the month – down by around 2% due to concerns over global demand. Gold, which acts as a hedge against falling interest rates, was unsurprisingly up for the period as interest rate expectations declined.

Outlook

Our view for a soft landing remains, and we have maintained this perspective since the start of the year. Asset allocation is overweight in fixed income and underweight equities for balanced multi asset mandates. We remain positive on fixed income due to the attractive interest rate environment and duration – the average maturity of bonds – has increased throughout the year. Equities are tilted towards companies that are market leaders in their sector with a focus on high quality resilient earnings, stable dividends and low debt. Additionally, an allocation to growth equities via technology is merited too. A gold exposure is maintained to act as a hedge against falling interest rates and any unexpected periods of risk off sentiment in financial markets.

“London and Capital Group works with HNW and UHNW individuals to provide an integrated wealth management solution which includes financial planning, tailored investment management and multi-currency reporting.

With offices in London and Barcelona and a dedicated team who specialise in ex-pat Americans, they are positioned to provide a truly borderless wealth management solution.”

Please visit the firm link to site