By Investment Desk | 30 Oct, 2024

After a robust first half of the year, risk markets experienced heightened volatility in the third quarter. In part, this could have been due to the lingering disconnect between risk markets and economic growth trends in the West: markets are pricing in a soft landing, whereas economic indicators suggest a wider array of outcomes.

Additionally, the unwinding of the Japanese yen carry trade played a significant role (the Japanese yen had been heavily undervalued for an extended period, prompting investors to borrow in yen and invest in US dollars): in late July 2024, The Bank of Japan unexpectedly raised interest rates, and the US jobs report for July signalled a faster-than-anticipated slowdown in the US economy.

Overall, the economic landscape in the West is characterised by gradual GDP slowdown and some crosscurrents: areas like housing, manufacturing and lower-to-middle income retail spending are softening quickly, while government spending, defence spending, luxury retail sales and AI-related CAPEX remain strong.

Pandemic-era excess savings have now been depleted, with US consumer savings rates at a 17-year low, and both credit card delinquencies and corporate bankruptcies on the rise. This will put greater emphasis on what happens with the job market in the next few quarters: rising unemployment could turn a soft landing into a hard one and potential recession, although the latter is less likely. Indeed, it’s the soft landing that appears more probable. Inflation is easing, wage growth is slowing, and labour market pressures are subsiding. Crucially, the Federal Reserve (Fed) has begun easing monetary policy before widespread economic stress has fully emerged.

Markets

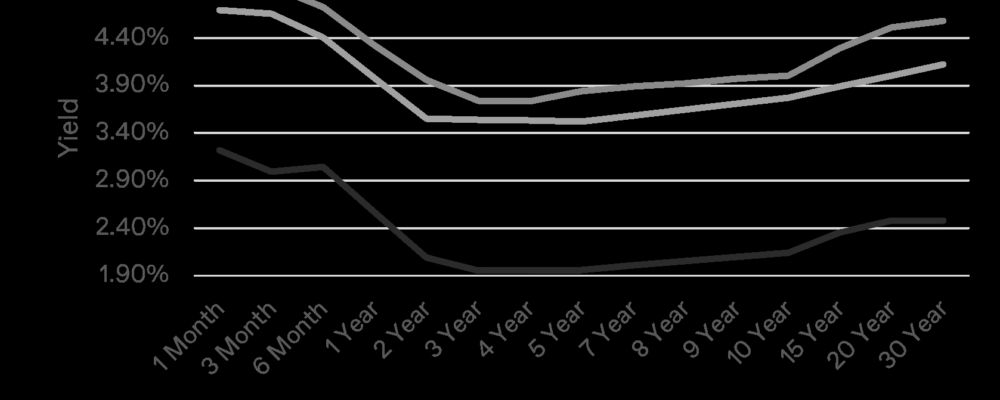

Global equities took a pause in Q3, showing less directional momentum. After the sharp volatility seen in late July and early August, tech and consumer discretionary sectors rebounded strongly, albeit with a degree of embedded caution not seen earlier in the year. When looking at the complete cycle from peak to trough and back to a new peak, defensive sectors (such as utilities, consumer staples and healthcare) have outperformed. In fixed income markets, performance has improved as inflation concerns have receded and the focus has shifted more to economic growth. Sovereign yields have declined for the year (with the US 10-year Treasury yield down by 0.7% since June), shorter-term bond yields have fallen even further (reflecting growing confidence that all major central banks will keep cutting rates), and spreads have continued to tighten.

To read the full AndPapers Q4 2024 click here.

“London and Capital Group works with HNW and UHNW individuals to provide an integrated wealth management solution which includes financial planning, tailored investment management and multi-currency reporting.

With offices in London and Barcelona and a dedicated team who specialise in ex-pat Americans, they are positioned to provide a truly borderless wealth management solution.”

Please visit the firm link to site