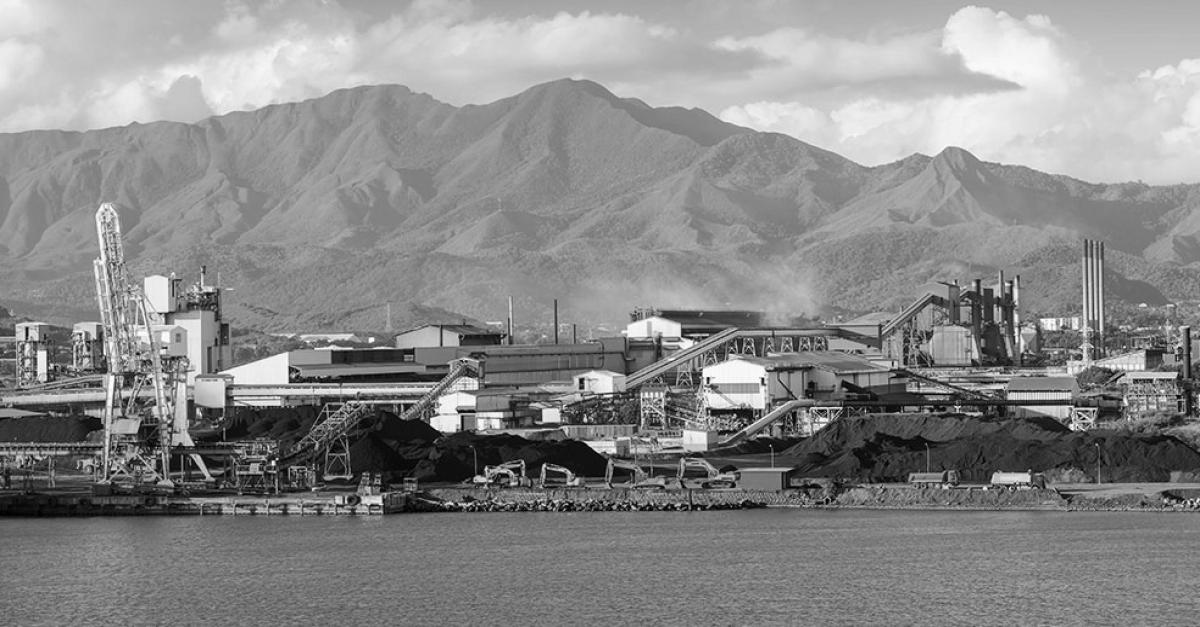

Yet the industry powers the New Caledonian economy, accounting for 20% of private sector jobs and 94% of exports.

A nickel giant…

Yet New Caledonia is one of the world’s top three producers of nickel, accounting for 6% of global production in 2023, albeit far behind Indonesia (50%) and the Philippines (11%). In 2023, the nearly 150-year-old New Caledonian nickel industry mined 230,000 metric tons of nickel to produce just over 100,000 metric tons of refined nickel, generating nearly €1.9 billion in export sales.

The island’s nickel sector is structured around three sites, each operated by a separate consortium, all supported by vertically integrated ore production. A handful of small-scale miners, producing crude ore for export, completes the picture.

Nickel refined on the island spans two types of product with differentiated markets. The Doniambo (SLN) and Koniambo (KNS) sites both produce ferronickel, an alloy of iron and nickel used in making stainless steel, mainly in Asia. Meanwhile, the Goro site (Prony Resources) produces MHP1, an intermediate product involved in the production of high-purity nickel for use in lithium-ion batteries, mainly for the automotive market.

…with feet of clay

Founded in 1880 and long owned by the Rothschild family, SLN2 is now a joint venture between mining group Eramet, Société Territoriale Calédonienne de Participation Industrielle (STCPI, an entity spanning New Caledonia’s three provinces) and Japanese steelmaker Nisshin Steel. Based around Doniambo near Nouméa, SLN’s pyrometallurgy plant3 sells ferronickel made from ore mined at its four mining centres. In 2023, SLN accounted for approximately 15%4 of global ferronickel production, producing around 6 million metric tons of ore, half of which is exported. In the past, it has experimented with producing nickel matte, an intermediate product used in producing battery-grade nickel, which was refined in Sandouville (in France’s Nord département). This activity was shut down after failing to make a profit, and the Sandouville plant was sold to Sibanye-Stillwater in 2022. Eramet is no longer refinancing SLN, which has not turned a profit in ten years; only government aid is keeping the company and its 2,300 employees afloat.

Another producer of ferronickel for the steelmaking industry is the Koniambo Nickel SAS (KNS) plant, opened in 2014 and known as the “Northern plant”. KNS is a joint venture between Société Minière du Sud Pacifique (51%), a New Caledonian company in which the island’s Northern Province is a shareholder, and Swiss metals giant Glencore (49%). Glencore acquired its stake in 2013 following its takeover of Xstrata. Despite having invested some $9 billion in the site, it announced that it was pulling out at the beginning of this year following substantial recurring financial losses. Keen to keep the wheels turning, the French government offered to help save the plant on condition that part of the site was refocused on the battery market. This offer was rejected and the plant was mothballed in March; with no buyer to be found, it was closed on 31 August, resulting in 1,200 layoffs and wiping out 9% of the global supply of ferronickel. Although the possibility of a last-minute takeover cannot be entirely ruled out, the clock is ticking as facilities fall into disrepair and the economic appeal of resuming activity fades.

Meanwhile, the hydrometallurgy plant5 at Goro, on the island’s southernmost tip, has been focused on the market for high-purity nickel for use in batteries ever since it opened in 2008. After being sold by Brazilian mining firm Vale in 2020, it is now operated by Prony Resources, a joint venture between Société de Participation Minière du Sud Calédonien (SPMSC), commodity trading giant Trafigura and local players. However, like its counterparts, the site has been loss-making for the last ten years and is heavily in debt, prompting Trafigura to publicly voice its desire to pull out. Once again, only French government intervention has kept it afloat; the search for a buyer continues in hopes of securing the future of its 1,350 employees. It is an irony of history that the site’s salvation could involve the Sandouville plant, whose buyer Sibanye-Stillwater says it is interested in using Goro’s output as an input into its new site.

Indonesia and New Caledonia: similar ambitions, radically different results

Indonesia now accounts for over half the world’s production of nickel. The rapid growth of the country’s nickel industry is the result of a strategic decision: exports of crude ore, partially banned since 2014, have been completely banned since January 2020. Galvanised by huge amounts of investment, mainly by Chinese companies keen to develop a robust low-cost value chain on China’s doorstep, Indonesian production has quadrupled in the space of ten years. Alongside this rapid expansion, the availability of surplus metal is keeping a lid on nickel prices, putting foreign producers’ margins under pressure. This success in creating a vertically integrated value chain is underpinned by four key factors: strong political will; attractive energy prices supported by power stations fired by locally produced coal; cheap labour; and operational excellence that keeps the rate of production high.

It is precisely in the latter three areas that New Caledonian nickel refining falls down. Despite both SLN and KNS having installed captive power plants (the former powered by fuel oil and the latter by coal), electricity prices for New Caledonia’s industrial sites range from two to three times their equivalent in mainland France, accounting for 40% of fixed and variable costs at the Doniambo and Koniambo sites. This price differential is similar to that with Indonesia, the island’s main competitor. It should also be noted that these three players between them account for around 70% of total local electricity consumption.

On the operational front, neither Prony Resources nor KNS have ever managed to operate at full capacity since they began production in 2010 and 2013 respectively, achieving average production rates of less than 50% of nominal capacity, far short of breakeven.

To further exacerbate the crisis, the May 2024 riots also affected the sites’ productivity, forcing SLN to cut production to the bone for lack of access to ore. Meanwhile, in late August Prony Resources said a lack of access to raw water and electricity meant its plant remained at a standstill. In early September, production of ore and refined nickel were already more than 40% and 30% short of their levels at the same point in 2023. Furthermore, the slowdown in global demand for steel – the sole purpose for which New Caledonian ferronickel is used – and the potential return towards the end of this year of the La Niña weather phenomenon, responsible for torrential rain affecting Pacific mining sites, round out an annus horribilis for the industry.

Before the KNS site closed down in August, these three sites employed nearly 5,000 people – more than 7% of New Caledonia’s private sector workforce. In a 2023 report, the Inspectorate-General of Finances, France’s public sector audit department, estimated that a further 8,300 jobs depended on the plants, which means all in all they account for 20% of jobs in New Caledonia. That same report also pointed out that if all three plants were to shut down at the same time, unemployment on the island would increase by 50% – a shock described as “intolerable” by Caisse d’Allocations Familiales et des Accidents du Travail de Nouvelle-Calédonie (CAFAT), which manages family allowance and occupational injury payments, and which would be unable to meet its commitments. Lastly, the impact on the island’s GDP is estimated at 4 percentage points in the first year (€325 million). One might say the nickel industry is, in many ways, too big to fail.

Possible ways out of the crisis

In thinking about how to secure the industry’s future, the question of whether to shift away from refining and instead focus solely on mining appears central. Like Indonesia, exports of crude ore from New Caledonia are heavily regulated. Exports of the richest ores, and those from the ore reserves that supply the KNS and Prony Resources plants, are banned, which means these ores can only be refined locally. Yet mining and exporting ore is considered a profitable activity, as demonstrated by SLN and the island’s small-scale mining companies. In fact, by moving away from a vertically integrated model, it would be possible to protect local industry while limiting its scale. Such an initiative would, however, interfere with the desire for sovereignty at a time when nickel and its refining appear to be of strategic importance in all relevant classifications, notably in Europe through the Critical Raw Materials Act.

In light of this aspect, the government is keen to incentivise efforts to convert New Caledonian ferronickel into nickel matte, an intermediate product used in batteries and produced by SLN until 2016. This conversion process would give firms a choice of whether to produce nickel for the steel or battery markets, depending on their respective outlooks. However, this option involves an additional processing step, the economic benefit of which remains to be demonstrated: New Caledonian nickel matte would be in competition with a robust, low-cost Indonesian product that has the advantage of being located close to Chinese customers in the battery value chain. It should be noted that news from Australia is also symptomatic of an industry in dire straits, with BHP mothballing its Nickel West operation – even though it mainly produces nickel for the battery market – until 2027.

Lastly, there appears to be no way around the need to upgrade New Caledonia’s power grid if local production is to be secured for the long term. However, the time required for such an undertaking appears incompatible with the urgent need to make the sites in question profitable. Although far from negligible, the associated costs would be lower if the KNS site were to remain inactive, since this would significantly reduce the underlying electricity demand.

Amid a severe market downturn but with a potentially viable market in the long term, it’s hard to imagine how New Caledonia’s nickel crisis can be resolved painlessly. The industry’s short-term resilience looks set to remain contingent on support from the government, which is torn between budget constraints on the one hand and the intolerable consequences of the wholesale failure of the sector on the other. Meanwhile, the long-term future of the island’s nickel industry appears wholly dependent on a structural overhaul of the value chain.

“Crédit Agricole Group, sometimes called La banque verte due to its historical ties to farming, is a French international banking group and the world’s largest cooperative financial institution. It is France’s second-largest bank, after BNP Paribas, as well as the third largest in Europe and tenth largest in the world.”

Please visit the firm link to site