19 November 2024

Meeting the EU’s climate neutrality targets calls for deep structural changes and significant private funding, requiring a healthy financial system. That’s why we’ve tested how resilient banks, investment funds and insurers are to stresses arising during the green transition. ECB Vice-President Luis de Guindos explains the findings.

Achieving a carbon-neutral European Union by 2050 will require a resilient financial sector to provide the funding for the necessary investment. In other words, the financial system needs to be strong enough to finance the green transformation of our economy. The path is expected to be bumpy and there’ll be transition risks along the way. These come about when companies and financial institutions have to adapt their business models and operations to changes in regulations, consumer behaviour or investor preferences – sometimes quite rapidly. To make sure our financial system can cope, the European Commission asked the ECB and the European Supervisory Authorities to use their stress test models to assess the impact of the green transition on the entire euro area financial system.

Our assessment looked at how banks, investment funds, institutions for occupational retirement provision (IORPs) and insurers across the European Union would fare under three different scenarios. The scenario narratives were set by the European Commission and developed by the European Systemic Risk Board. All three assumed the full implementation of the EU’s “Fit-for-55” package, a set of measures that includes the goal of cutting carbon emissions in half by 2030 and becoming carbon neutral by 2050. We also checked the potential for contagion and amplification effects, giving us a truly comprehensive view of what the impact across the financial system might be.[1]

So, what did our analysis tell us?

Transition risks and the financial system

The three scenarios of our stress test looked at transition risks and macroeconomic variables over an eight-year horizon. Under the baseline scenario, the package is implemented in an economic environment as projected to evolve in the June 2023 Eurosystem staff macroeconomic projections. But, of course, things might turn out to be more difficult. So a first adverse scenario imagines and models investors abruptly shifting away from “brown” companies – those with environmentally unfriendly business models – leading to a significant fall in the value of their assets. This is known as a “run on brown”. And to make things even more challenging, a second adverse scenario introduces a recession characterised by the standard macroeconomic stress factors such as sharp falls in GDP and real estate prices – on top of the run on brown.

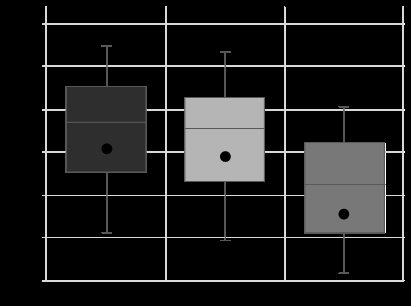

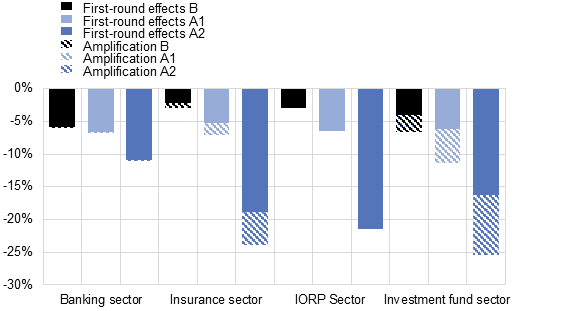

Under the baseline scenario, excluding the mitigating effect of earnings, financial institutions across all sectors suffer moderate losses (Chart 1). These losses come from the increased risk of default by firms that urgently need to invest in reducing their carbon emissions and, as a result, have smaller profits and greater debt. Adding a run on brown to the baseline scenario brings a small increase in losses. This means that shifts in perceived climate risks alone are not a threat to financial stability during the green transition. But the picture worsens considerably when the run on brown coincides with a recession. In this case, losses increase significantly. However, the impact on financial institutions’ capital is expected to be mitigated by factors such as banks’ income, insurers’ liabilities and funds’ cash flows and holdings, which were not included in this assessment.

The good news is that the findings show that the overall stability of the financial system is not at risk under these specific adverse scenarios. However, the substantial losses under the second adverse scenario highlight the need for financial institutions to properly manage climate-related risks. Moreover, a coordinated policy approach to financing the green transition is essential.

Chart 1

Financial sector losses under the three scenarios

(aggregate losses over the period 2023-30 as a share of exposures in scope, by financial sector and scenario)

Sources: European Banking Authority, European Insurance and Occupational Pensions Authority, European Securities and Markets Authority and ECB calculations.

Notes: “Exposures in scope” refers to the assets covered for each sector in this exercise. These are 35% of total credit risk exposures and 26% of total market risk exposures for banks, 81% of total investments for insurers, 76% of total investments for IORPs and 77% of total assets for investment funds. IORPs are not included in the model used to assess cross-sectoral amplification. “B” refers to the baseline scenario, “A1” to the first adverse (run-on-brown) scenario and “A2” to the second adverse (run-on-brown plus recession) scenario.

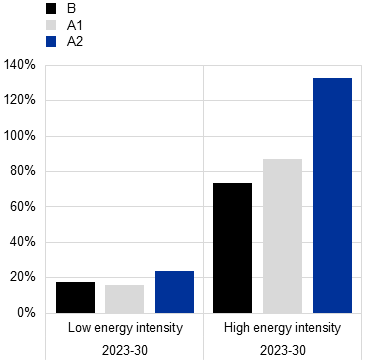

Zooming in on the banking sector, the findings show that banks should be able to continue financing companies during the green transition. That holds for both the baseline scenario and the first adverse run-on-brown scenario (Chart 2, panel a). However, when severely adverse economic conditions are combined with climate-related risks – as modelled by the second adverse scenario – our analysis indicates that loans to these companies could fall by as much as 11% over the eight-year period.[2] This would result from banks trying to restore their solvency position after their balance sheets had taken a hit from bigger losses as well as the recession.

Banks are affected differently in each scenario, with those more exposed to energy-intensive sectors seeing bigger drops in loan volumes because of the run-on-brown effect. Under the two adverse scenarios, banks may need to increase lending to energy-intensive sectors more than to less energy-intensive sectors, so that their corporate customers can meet their green investment needs (Chart 2, panel b).

So, how can public policy help companies going through the green transition get sufficient funding? In our view, policy should take an all-encompassing perspective on how to support firms and sectors. This would be based on where they are in their green innovation cycle and what transition goals they have. It should also involve all financial intermediaries and markets to ensure the funding needs of our economy are met. Financial market segments outside the banking sector, such as venture capital, can be particularly effective when it comes to financing innovative start-up firms and supporting green technology projects.

Chart 2

Banks’ financing capacity is resilient but would benefit from targeted policy measures

|

Panel a) Change in banks’ total outstanding loans to NFCs between 2023 and 2030 |

Panel b) Green investment needs as a share of new lending to NFCs between 2023 and 2030 |

|

|

|

Sources: ECB calculations, Banking Euro Area Stress Test (BEAST) projections and the EBA stress test 2023 starting points.

Notes: NFCs stands for non-financial corporations. The box plot shows the 10th, 25th, 50th, 75th and 90th percentiles. The point on the box plot represents the weighted average. “B” refers to the baseline scenario, “A1” to the first adverse (“run-on-brown”) scenario and “A2” to the second adverse (run-on-brown plus recession) scenario.

A cross-sectoral assessment to complete the analysis

Since the different financial sectors are interlinked, the ECB and the European Supervisory Authorities have worked together to complement the sectoral results with a cross-sectoral assessment.[3] This additional analysis considers the possibility that each financial institution’s reaction to the financial stress might trigger contagion and amplify the stress on other financial institutions and sectors. Here, liquidity risks and the reactions they trigger play a significant role.

Under the baseline scenario the amplification effects are contained, but these can lead to losses that are up to 50% greater when the run-on-brown scenario triggers liquidity stress (Chart 1). Amplification effects vary both within and across sectors. Investment funds face greater liquidity stress as a result of redemptions, which could force them into fire sales of assets. This means that investment funds might become the main driver of subsequent losses for all sectors. Insurers are more exposed to this through their holdings of fund shares and depreciated securities, while banks are less exposed on account of their smaller exposures and hedging strategies.

It is crucial to continue monitoring the financing of the green transition in the EU and, more broadly, to keep making further system-wide assessments of financial risks. This work benefits from collaboration between EU institutions. The findings can help shape policies that seek to prevent risks from spreading across the financial system and ensure funding reaches activities that support the green transition.

Coordinated efforts are essential to unlock the capital we need for the green transition in Europe. Policymakers should facilitate this process, and supervisors should watch out for the potential risks that could undermine the EU’s ability to meet its climate change objectives.

Check out The ECB Blog and subscribe for future posts.

For topics relating to banking supervision, why not have a look at The Supervision Blog?

“The European Central Bank is the prime component of the Eurosystem and the European System of Central Banks as well as one of seven institutions of the European Union. It is one of the world’s most important central banks.”

Please visit the firm link to site