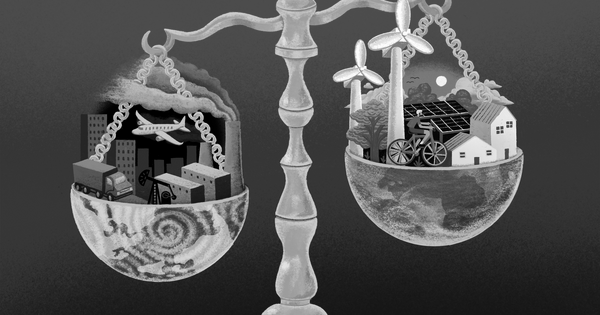

Can green investors help contribute to climate-change solutions and simultaneously earn a higher return? While roughly 60% of asset managers who responded to a 2019 survey expected their environmentally and socially aligned investment portfolios to outperform the market over the following five years, academics report starkly divergent findings when it comes to whether investors are right to hold this expectation.

Yale SOM’s Theis Jensen was drawn to this thorny question in part because of a broader fascination with how subjective expectations impact asset pricing. As he dug into the reams of research literature seeking to clear up the confusion about how a stock’s greenness is linked to its returns, he found himself even more baffled: “Roughly half of the papers said that you got a higher return from investing in green assets,” he says, “and half of the papers said you got a higher return from investing in brown assets.”

In a new study, Jensen, alongside co-authors Marc Eskildsen, Markus Ibert, and Lasse Heje Pedersen of Copenhagen Business School, replicated several papers from the green finance literature based on different measures of an asset’s “greenness,” testing their methodology with realized stock returns—that is, the actual profit or loss from stock sales—in multiple markets around the world. But they found that the results were sensitive to the specific measure of greenness and varied substantially from market to market. So the researchers instead proposed their own methodology for constructing a more comprehensive—and useful—green score, and moved from using backward-looking realized returns to forward-looking expected returns.

The researchers found that their own green score, which they constructed by averaging key greenness measures from leading data providers, revealed a small cost of investing in climate-friendly stocks, meaning that investors is expected to get 0.50% less in returns each year when investing greenest tercile of stocks relative to the brownest. Corporate bonds and sovereign bonds displayed similar patterns as their greenness increased.

If you really care about the environment, then you should hope for a lower return on green assets than on brown assets. We want to make it cheaper for green firms to finance their projects, and more expensive for brown firms to finance theirs.

“There has been this idea in the asset management industry that you can ‘do well by doing good,’” Jensen says, referring to the belief that investing in green assets should deliver higher returns over time than will investments in brown assets. “Our estimates imply that’s not true.”

While this may at first read as a blow to champions of green investing, Jensen doesn’t see it that way.

“If you, as an investor, really care about the environment, then you should hope for a lower return on green assets than on brown assets,” he says. “We want to make it cheaper for green firms to finance their projects, and we want to make it more expensive for brown firms to finance theirs.”

“The Yale School of Management is the graduate business school of Yale University, a private research university in New Haven, Connecticut.”

Please visit the firm link to site