18 December 2024

The growth of negotiated wages is expected to ease in 2025. This is the information emerging from the ECB wage tracker, which we will publish on a regular basis from now on. The ECB Blog explains the tool and how it can help monitor wage pressures in the euro area.

Wages are an important driver of domestic goods and services inflation. Most wages are negotiated in advance as trade unions and employer associations agree on contracts for one, two or even three years. The ECB and the national central banks of the Eurosystem developed a measurement tool to benefit from this situation. The “wage tracker” – as we call it – allows us to analyse current and future wage pressures in the labour market. It currently covers developments in Germany, France, Italy, Spain, the Netherlands, Greece and Austria.[1] From now on we will publish the results every six to eight weeks, just after the monetary policy decisions of the Governing Council. Here we explain the tracker and how it informs us about upcoming wage pressures.

What is the ECB wage tracker?

The ECB wage tracker uses granular data from collective bargaining agreements – that means it collects and aggregates information from thousands of these agreements between trade unions and employer associations, contract by contract.[2] The set of tracker indicators provides information on negotiated wages, with and without one-off payments, and on the share of employees covered by the tracker at each point in time.[3]

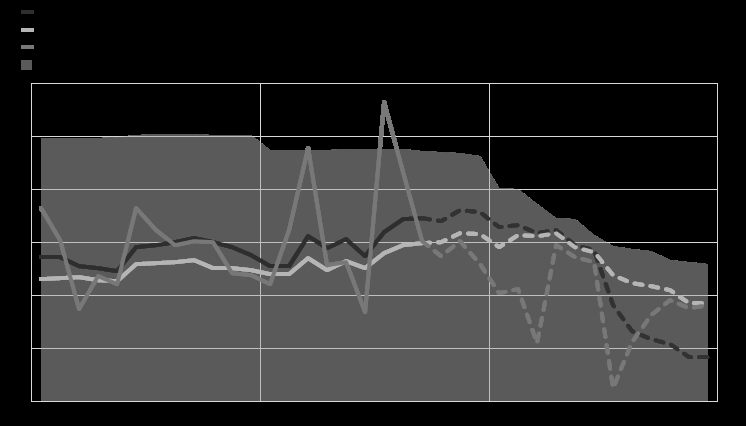

The novelty of the tracker is that it is based on agreements that are already in place.[4] That means that it already provides insights into wage increases that may only take effect in the future. The tracker is not a forecast tool, however, as future wage growth also depends on future wage agreements. But it does complement other sources used to monitor and anticipate wage pressures, which are affected by changes in economic growth, labour market conditions and inflation. Therefore, Eurosystem and ECB staff macroeconomic projection exercises still provide the best forecast for wage developments.

Another benefit of the wage tracker is that it is timelier than other wage growth indicators. Other wage pressure indicators, like compensation per employee or the ECB indicator of negotiated wages, are usually available only with a delay of more than two months. In contrast, the wage tracker data are available within a few days, thanks to the very short processing time. This allows for an almost immediate update. In addition, the forward-looking aspect of the tracker helps to anticipate trends and potential turning points.

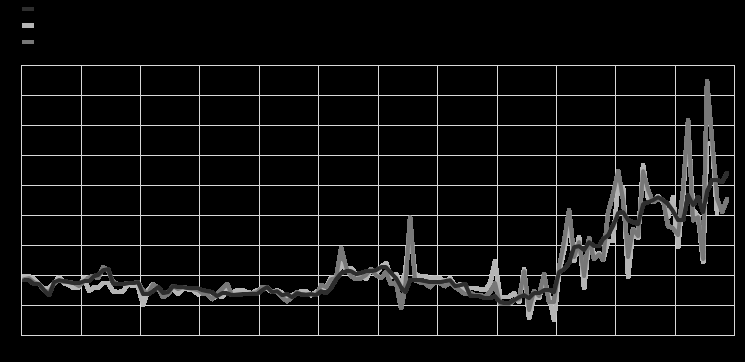

Let us put the forward-looking feature aside for a moment and focus on how well the wage tracker captures past developments in other aggregate negotiated wage series. To do so we have constructed monthly indicators of negotiated wages using national sources, either including or excluding one-off payments, for the aggregate of countries.[5] Chart 1 shows that the tracker series (lines in blue and red), though not identical, closely follow the corresponding indicator of negotiated wages (in yellow).[6] That holds true both with or without one-off payments, and adds to the confidence that the wage tracker is a robust measure of wage pressures.

Negotiated wage pressures started increasing in 2022

From 2013 until the end of 2019, all wage tracker indicators suggested mild negotiated wage growth of 1.7% per year on average for the seven countries covered. The subdued wage growth during this period was a pervasive feature of the euro area, thoroughly analysed.[7] The low wage inflation in the euro area was also assessed as part of the last ECB Strategy Review.[8] In a nutshell, the relatively weak wage pressures coincided with low consumer price inflation and strong job creation, with these countries recording 10 million new employees during this period.[9]

The pandemic-related economic shutdown and job retention schemes kept negotiated wage pressures weak in 2020 and 2021.[10] During this time negotiated wage growth averaged 1.4% per year. The subsequent inflation surge gave rise to a gradual increase and a stronger prevalence of one-off payments used to compensate employees for the effects of high inflation. During this period, the ECB tracker suggested accelerated wage growth, to 2.9% in 2022 and 4.2% in 2023, and is currently suggesting wage growth of around 4.7% on average in 2024 so far.[11]

Chart 1

ECB wage tracker: backward looking information and comparison with the indicator of negotiated wages

Including one-off payments

Yearly growth rates, in percentages

Excluding one-off payments

Yearly growth rates, in percentages

Sources: ECB calculations based on data provided by the Deutsche Bundesbank, Banco de España , Ministerio de Empleo y Seguridad Social, Dutch employers’ organization AWVN, Centraal Bureau voor de Statistiek, Osterreichische Nationalbank, Statistik Austria, Bank of Greece, Banca d’Italia, Istituto Nazionale di Statistica (ISTAT), Banque de France, Eurostat, and Haver Analytics. Notes: The ECB wage tracker is based on micro-level data on wage agreements since 2013 for Germany, France, Italy, Spain, and the Netherlands, since 2016 for Greece, and since 2020 for Austria. The indicator of negotiated wages uses national sources since 2013 for Germany, France, Italy, Spain, the Netherlands, and Austria. There is no negotiated wages data available for Greece during this period. Aggregation across countries is based on compensation of employees’ weights for the ECB wage tracker and for the indicator of negotiated wage growth among the available wage tracker countries. Latest observations: November 2024 for the wage tracker indicators (blue and red lines), and September 2024 for the indicators of negotiated wages constructed using national sources (yellow lines).

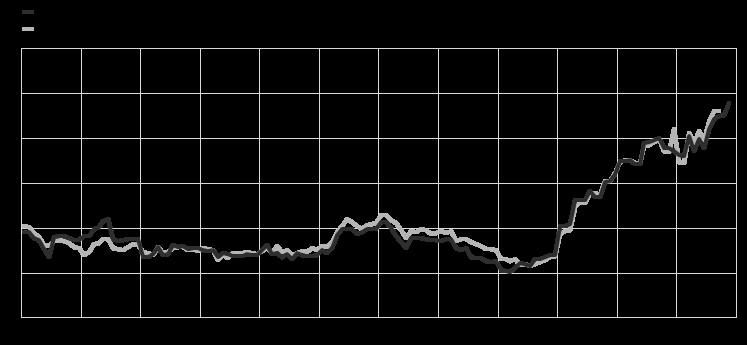

Negotiated wage pressures expected to gradually ease

Now let’s look at what the wage tracker signals for the near future. The data currently cover agreements signed up to November 2024. Chart 2 shows the forward-looking information on negotiated wage growth in active agreements until December 2025.[12] All series are expected to ease over the course of 2025. That holds especially true for those series that include base effects stemming from one-off payments that were paid in 2024 and that will not be paid again in 2025. The headline ECB wage tracker is currently anticipated to peak at around 5.4% at the end of 2024 before gradually easing to an average of 3.2% during 2025. The tracker with unsmoothed one-off payments is currently averaging 4.8% in 2024 and implies a decrease to 2.7% in 2025.[13] The tracker excluding one-off payments stands at 4.2% in 2024 and gradually eases to 3.8% in 2025.

The differences between the sub-indicators with and without one-off payments result from more frequent one-off payments to compensate for inflation following the recent inflation surge. These differences are expected to eventually narrow as wage negotiations adapt to lower inflation.

The tracker’s coverage shows the share of employees that are covered by the collective bargaining agreements in the database. That ratio is crucial for understanding how representative the wage signals in the data are. Coverage averaged 47.4% of the total number of employees in the participating countries between 2013 and 2023. The forward-looking coverage decreases as the active agreements followed by the tracker expire over time, from an average of 50.2% in 2023, to 47.4% in 2024, and then to 32% in 2025. As coverage drops, so does the reliability of the wage signals provided by the tracker. This waning reliability is a structural feature and can be quite heterogeneous by country, depending on the contract durations and the timing of wage negotiations.[14]

Chart 2

ECB wage tracker: forward looking information and employees’ coverage

Left hand side: Yearly growth rates, in percentages. Right hand side: share of employees among the participating countries, in percentages.

Sources: ECB calculations based on data provided by the Deutsche Bundesbank, Bank of Greece, Banco de España, Banca d’Italia, Banque de France, Dutch employers’ organization AWVN, Osterreichische Nationalbank, and Eurostat. Notes: The euro area aggregate for the wage tracker is based on micro data on wage agreements since 2013 for Germany, France, Italy, Spain, and the Netherlands, since 2016 for Greece, and since 2020 for Austria. Aggregation across countries is based on compensation of employees’ weights. The coverage series uses the number of employees covered in the wage tracker countries, as a ratio to the total number of employees in these countries. The solid lines correspond to the period for which there is information for both the ECB wage tracker and the indicator of negotiated wages (until September 2024). Dashed lines denote periods in which only the ECB wage tracker is available, including its forward-looking part spanning from December 2024 until December 2025. Latest observations: November 2024.

Overall, the ECB wage tracker is a valuable tool for understanding negotiated wage dynamics in the euro area, which have reached an all-time high following the post-pandemic reopening and inflation surge but are expected to ease in 2025. The information from the wage tracker informs monetary policy discussions about negotiated wages and their future trajectory. The ECB wage tracker is not a forecast and should be interpreted with caution depending on the employee coverage over time and across countries. While the wage pressures indicated by the forward-looking wage tracker will change as more contracts are agreed and the coverage increases, they still provide a good indication of the direction of wage pressures and confirm the profile in the ESCB staff projections, which foresee easing wage pressures in 2025.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Check out The ECB Blog and subscribe for future posts.

For topics relating to banking supervision, why not have a look at The Supervision Blog?

“The European Central Bank is the prime component of the Eurosystem and the European System of Central Banks as well as one of seven institutions of the European Union. It is one of the world’s most important central banks.”

Please visit the firm link to site