After agreeing to turn himself in to avoid “bloodshed”, the president was remanded in custody for 48 hours – a first in South Korean political history, and is still detiained. Tension has ratcheted up between two broad groupings: on the one hand, a presidential security service determined to protect Yoon at all costs, together with Yoon’s supporters, who see him as a hero who has fallen victim to North Korean “communists” attempting to destabilise their southern neighbour; and on the other, opponents from the Democratic camp and civil society (particularly women) alarmed by the chaos unleashed by President Yoon.

A tense winter

Yoon’s arrest concludes a tumultuous first chapter in which the shock declaration of martial law on 3 December triggered a series of cascading events. In the space of a month and a half, the country’s National Assembly instigated impeachment proceedings against Yoon and appointed a first acting president (Han Duck-soo), who in turn faced impeachment proceedings for his part in the attempted coup and for obstructing the investigation, followed by a second acting president (former finance minister Choi Sang-mok).

All this unfolded amid a very tense social climate characterised by a number of pro- and anti-Yoon demonstrations, with protesters braving the winter cold to either support the president or call for his removal. The pro-Yoon movement, dominated by South Korea’s powerful evangelical churches, drew some of its inspiration from the Trumpist camp, going as far as taking up the “Stop the steal” slogan used after Trump’s defeat in 2020. Yoon contends that the 2024 parliamentary elections, comfortably won by the opposition Democrats, were rigged as a result of hacking masterminded from North Korea.

For the time being, the Trump camp is paying very little attention to what is happening in South Korea. Nevertheless, Trump’s successful re-election despite the raft of legal proceedings brought against him is galvanising Yoon’s supporters and fuelling their rhetoric. Yoon’s refusal to hand himself in has also boosted his image among his clan, so much so that his popularity rating has risen over the past few weeks, with his supporters praising his tenacity.

While Yoon’s arrest should put paid to daily protests, it has failed to dispel uncertainty as to what comes next. South Korea’s Constitutional Court has until June to confirm the president’s impeachment, which would then trigger an early election, to be held within two months of the Court’s decision. In any event, political instability is likely to continue to reign until at least the middle of the year.

A resilient institutional framework

One thing that stands out is the robustness of South Korea’s institutions and, in particular, the role of the National Assembly, which has stood firm throughout the crisis. Many leaders, notably in the army and the police, also refused to obey President Yoon when he ordered them, for example, to fire on the assembled crowd and members of parliament who were trying to get back inside the parliament building on the night martial law was declared.

While debates over the powers of the acting president (does he have the authority to appoint a judge to the Constitutional Court?) may have delayed decisions and sometimes have been used by the presidential camp to stop investigations proceeding, they are testament to the vitality of political debate in this still young democracy. Similarly, the large-scale mobilisation of civil society underscores just how committed people are to a democratic regime.

However, this episode serves as a reminder that South Korea’s political class remains very weak: out of eight presidents elected to office since 1987, four have been found guilty of – and served prison time for – corruption and embezzlement. But the allegations levelled against Yoon are unprecedented in their seriousness.

Impact on South Korea’s economy

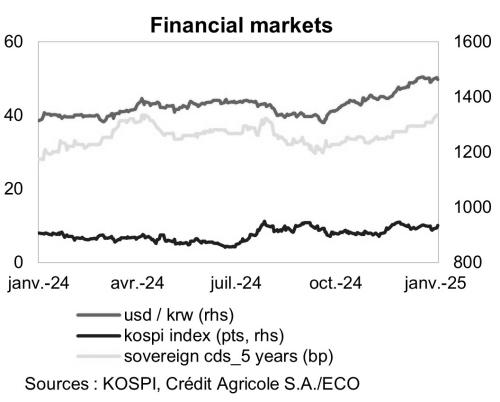

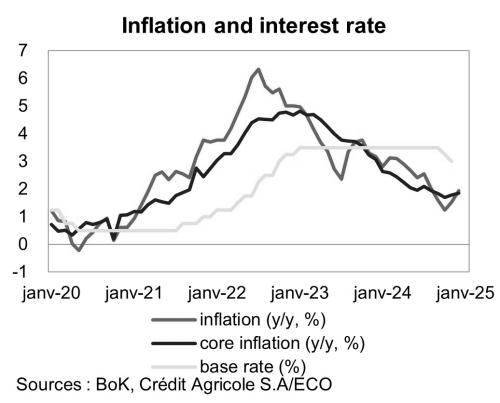

Political weakness is not a good thing for the South Korean currency, already under pressure from the strong dollar. It makes the job of the central bank – which had hoped to be able to continue with its cycle of monetary easing and bring some relief to slowing economic activity – more complicated. On Thursday 16 January, the Bank of Korea (BoK) decided, in a divided vote, to keep its base rate at 3%.

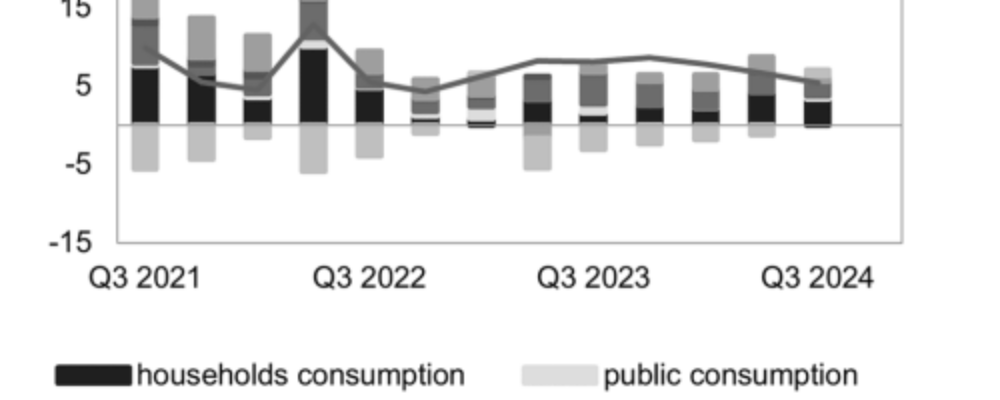

The BoK has to reckon with a slowdown in economic activity, particularly domestically (consumption and investment), and exchange rate pressures aggravated by political instability, all in an environment where inflation is more or less under control (below 2%), which could allow for slightly more expansionary monetary policy.

The Korean won, which this week approached an all-time high of KRW 1,500 to the dollar, is known for its volatile tendencies. It has lost just over 10% against the dollar in the last year and more than 30% over the past three years, making it one of the region’s worst-performing currencies. On a positive note, capital outflows have, for the moment, been restrained, with investors not reacting strongly to either the won’s depreciation or political turbulence.

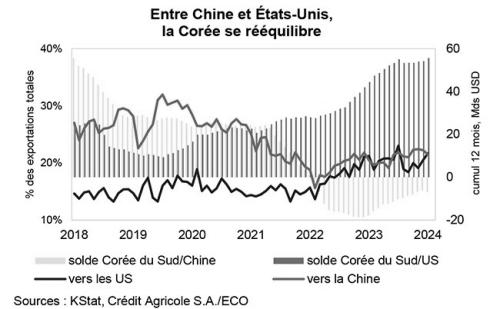

There is also the prospect of US import tariffs at a time when the US is now the number one market for South Korean exports, notably because of the upturn in the semiconductor cycle. At the same time, though, South Korea’s bilateral trade surplus with the United States has more than doubled over the past three years to exceed $50 billion, potentially putting the country in the incoming Trump administration’s firing line.

And this is true despite the fact that South Korea exports high value-added goods, is not a “backdoor” country like Mexico or Vietnam, which sometimes export goods with little local content and a lot of Chinese content, and has significantly stepped up foreign direct investment into the United States, particularly in the field of semiconductors. Keen to show off its credentials, South Korea hopes its efforts mean it will continue to enjoy a privileged partnership with the United States, with which it has, for the time being, a free trade agreement.

Keeping exports high becomes even more important as the domestic economy slows. Although economic activity data for December has yet to be released, the consumer confidence index is already showing serious signs of weakness (at 88.4, down from 100.7 in November), which could translate into a slowdown in retail sales and thus in consumer spending. The trajectory of inflation, which fell back below 2% in the middle of 2024 and has remained there ever since, reflects this decline in demand.

However, the course of the Korean won and rising import prices – particularly for energy, with oil and gas accounting for around 25% of the South Korea’s total imports – could put renewed upward pressure on inflation. This explains the BoK’s conservative stance: the central bank would no doubt like to wait a few months to see whether the currency has stabilised and what is happening in the United States before embarking on further monetary easing.

Since 3 December, South Korea has been in the grip of a profound political crisis, the outcome of which remains unknown, just at a time when Donald Trump’s return to power is liable to weigh on its currency and export volumes. Against this backdrop, a united political front would be preferable: everyone knows that negotiations with the US administration will be tough in a world where each country wants to stay ahead of the game and hang on to what it has.

“Crédit Agricole Group, sometimes called La banque verte due to its historical ties to farming, is a French international banking group and the world’s largest cooperative financial institution. It is France’s second-largest bank, after BNP Paribas, as well as the third largest in Europe and tenth largest in the world.”

Please visit the firm link to site