Why the slowdown?

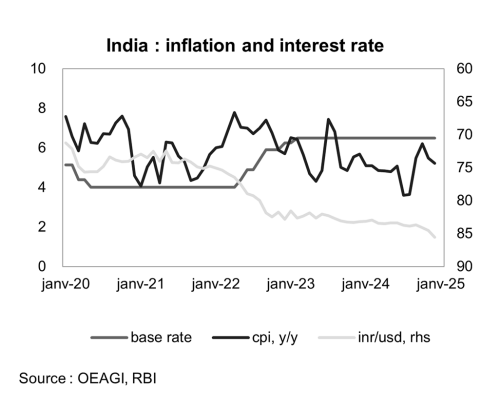

The answer lies in inflation, which is extremely volatile in India. Driven by food prices, it has been oscillating between 5% and 6% for the past few months. Prices are putting pressure on wages, which are stagnating or even falling slightly, and thereby on household consumption, the traditional driver of India’s growth. Against this backdrop, the lack of momentum in the labour market is not helping: employees are not in a strong position to negotiate pay rises in what is also still a highly informal environment.

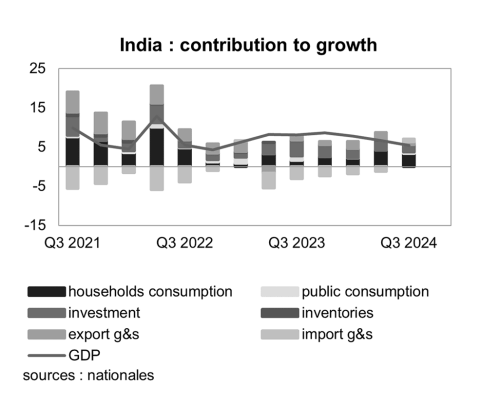

The decline in consumption – of durable goods (cars, motorbikes and household goods) in particular – is directly affecting major Indian groups. Still relatively uncompetitive in export markets, in a country that remains very protectionist and has not entered into many free trade agreements, large Indian companies are mainly reliant on the huge domestic market to absorb what they produce. The contribution of net imports to growth has swung back into positive territory, signalling a sharp slowdown in imports, even as prices have risen sharply as a result of the weak rupee. These various factors all reflect sluggish domestic demand.

In reality, the Indian economy is beset by far-reaching questions, notably over its ability to fuel the emergence of a true middle class that could drive endogenous growth, underpinned by the convergence – slow but at least linear – of annual incomes. These questions, combined with persistent inflation and relatively pessimistic expectations, also explain the slowdown in private investment and foreign direct investment, which fell to a record low of $28 billion in 2023.

What policy mix?

Inflation is also being fuelled by the fall in the value of the rupee, which is currently depreciating unusually sharply. Given India’s structural current account deficit, downward pressure on its currency is nothing new and tends to complicate monetary policy decisions, which must always strike a balance between controlling inflation, managing the exchange rate and supporting economic activity.

The task facing the new Governor of the Reserve Bank of India (RBI) – Sanjay Malhotra, appointed last December – looks set to be a complex one. A former secretary for revenue at India’s Ministry of Finance, Malhotra was chosen for the line he defends: clearer support for growth, which means more accommodative monetary policy, to make up for tighter fiscal discipline.

Although the RBI has, for the time being, kept interest rates unchanged at 6.5%, an initial cut could follow its next monetary policy meeting in February, even if that means sacrificing the rupee by using accumulated currency reserves to defend it if necessary, as it has already been doing over the past few months – reserves fell from $616 billion in September to $534 billion in January. The exchange rate is therefore likely to fall below 90 rupees to the dollar in the next few months, equating to depreciation of around 30% from its pre-pandemic level.

This happens to also be the line defended by Narendra Modi and his team, who are lobbying the RBI to provide more support to the domestic economy. Even before the committee meets, the RBI has already announced fresh injections of liquidity into the interbank market.

Another looming debate is over the budget, the examination of which is due to begin in February. After rising during election year, public spending has slowed sharply, with the government still pursuing fiscal consolidation. Finance Minister Nirmala Sithamaran is set to announce new tax cuts (corporate tax was already cut during Modi’s second term) and infrastructure spending.

The central government budget deficit should fall back below 5% of GDP before the end of the fiscal year (the consolidated deficit is still in excess of 8% of GDP), but this consolidation is also explained by the difficulty of implementing the budget: some projects are falling behind and the quality of infrastructure already built is questionable, all of which is delaying the start of other projects.

Narendra Modi’s image as a development-oriented prime minister, already dented by his poor performance in the June 2024 elections and the loss of his parliamentary majority, continues to fade even as the Bharatiya Janata Party (BJP) faces fresh elections this year, notably in Delhi and the state of Bihar.

Unpredictable Trump

Lastly, like the rest of the world, India looks on at the United States with fear. The US is its number one customer by far, absorbing around 18% of its total exports. Over the first ten months of the year, India generated a trade surplus of around $35 billion with the US. This is not enough to put India atop Donald Trump’s list of targets – first there is China, of course, but also Canada, Mexico, South Korea and Vietnam – but it is enough to raise concerns about potential restrictions on international trade.

Donald Trump and Narendra Modi have already spoken by telephone, and the Indian prime minister might make an official visit to Washington as early as February to discuss his concerns and priorities: import tariffs, of course, but also visas for Indian workers as America tightens the screws on its migration policy. Meanwhile, the US president has suggested that his Indian counterpart buy more American weapons. This “advice” feels like a threat, hinting at future negotiations in which India, still hopeful of positioning itself as an industrial alternative to China, will have much at stake.

“Crédit Agricole Group, sometimes called La banque verte due to its historical ties to farming, is a French international banking group and the world’s largest cooperative financial institution. It is France’s second-largest bank, after BNP Paribas, as well as the third largest in Europe and tenth largest in the world.”

Please visit the firm link to site