Championed by some as a route to universal access to mobile services, single wholesale networks (SWN) have failed to deliver. Lee Sanders, Managing Partner at Aetha Consulting, wonders whether Malaysia abandoning its SWN means the concept has run its course.

Governments around the world are increasingly attuned to the importance of infrastructure to economic growth and societal well-being. Hence their interest in telecoms; the services provided, and their reach and quality.

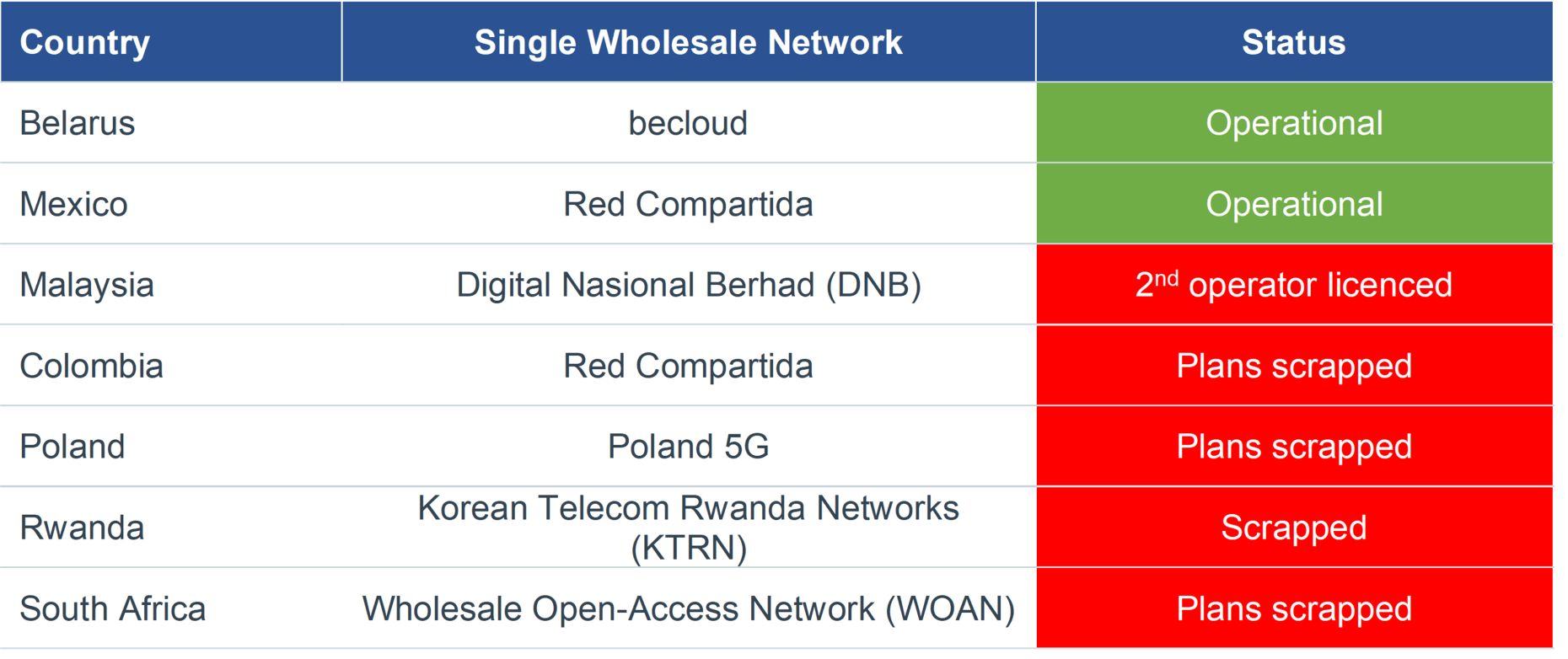

In recent years, the single wholesale network (SWN) – also known as the wholesale-only access network (WOAN) – has been touted by some as a model to promote competition at the retail level and ensure access to mobile services in underserved regions such as rural areas. They have been proposed in several countries. However just three have made it to fruition, and the Malaysian government’s recent decision to end the monopoly of its SWN leaves just two in operation; in Mexico and Belarus (see figure below).

Figure 1: Status of planned / deployed SWNs worldwide [Source: PolicyTracker. Aetha]

Under the SWN model, a government or a designated entity such as a regulatory authority builds and operates the physical network infrastructure, such as the towers, antennas, and backhaul connections. This network is then opened up on a wholesale basis to multiple mobile operators, who can lease capacity and provide services to end-users using the shared infrastructure. Mobile operators may or may not be permitted to deploy their own networks. A central tenet of a SWN, at least in theory, is that it avoids duplication of infrastructure, thus improving the economics of deployment in difficult-to-serve regions.

Laudable though these aims are, the reality of SWNs is different. SWNs lack the agility and innovation engendered by a competitive market. State-run entities are often inefficient and this can lead to delays in deployment and high costs. Because multiple operators share the same network infrastructure, this can limit their ability to differentiate themselves and innovate in terms of services or network technologies. Additionally, being state-run, SWNs suffer from all too frequent shifts in political weather and government priorities.

The Malaysian experiment has been particularly short-lived. Its SWN, Digital Nasional Berhad (DNB), was launched commercially only last year as the state-run monopoly provider of 5G infrastructure. Its mandate was to fill gaps in digital connectivity, improve internet speeds, and promote digital inclusion. However, with some operators unwilling to invest in or buy wholesale services from DNB, the Malaysian government will now license a second 5G network at the end of this year, thus terminating DNB’s monopoly.

The governments of Colombia, Poland, Rwanda and South Africa have all abandoned their SWN plans. The single wholesale networks in Mexico and Belarus have not exactly been flushed with success.

Mexico’s 4G SWN, Red Compartida, has struggled to meet its rollout targets. Consequently, most mobile network operators have rolled out their own networks rather than use Red Compartida. Ultimately, Altán Redes, the company behind Red Compartida, filed for bankruptcy in July 2021, and a state bailout was needed to save it.

Belarus, where beCloud is the single wholesale network provider, has the slowest average LTE speeds in Europe – at just 12.4Mbps (according to the Speedtest Global Index).

Australia’s experience with NBN, a fixed rather than mobile SWN, is little more encouraging. Costs skyrocketed while at the same time the technological specification was diluted. Originally conceived as a state-of-the-art mainly fibre-to-the-premises (FTTP) network, its scope was substantially downgraded to a mix of technologies, becoming less fibre-to-the-premises and more fibre-to-the-node. The estimated cost was AUD29.5 billion but ultimately over AUD50 billion was required to complete it.

So, is the demise of DNB in Malaysia the nail in the coffin for the SWN experiment? Given the number of nations that have ended their exploration of the concept, the answer is probably ‘yes’. The liberalisation of telecoms markets globally was done for good reason. While noting that competitive markets are far from perfect, and at times need guidance and regulation, a move back to the old days would be a regressive step.

Aetha supports leading players in the telecom industry to make major strategic and regulatory decisions.

“Our commitment is to provide high-quality advice, supported by rigorous quantitative analysis, to help our clients solve their most pressing issues. With our strong track record in both developed and emerging markets, our footprint is global.

Our senior team collectively has over 150 person-years of experience advising telecom operators and regulators, as well as financial and legal institutions. They are supported by a team of specialist telecoms consultants and, together, we have established Aetha as a global leader within the telecoms industry.”

Please visit the firm link to site